Business

Super Micro Computer Faces Market Struggles Amid Weak Guidance

San Jose, California — Super Micro Computer‘s stock experienced another decline on Wednesday after the company reported disappointing fiscal third-quarter results, leading to further investor concern. The stock price fell by 6.7%, dropping significantly from earlier highs this year.

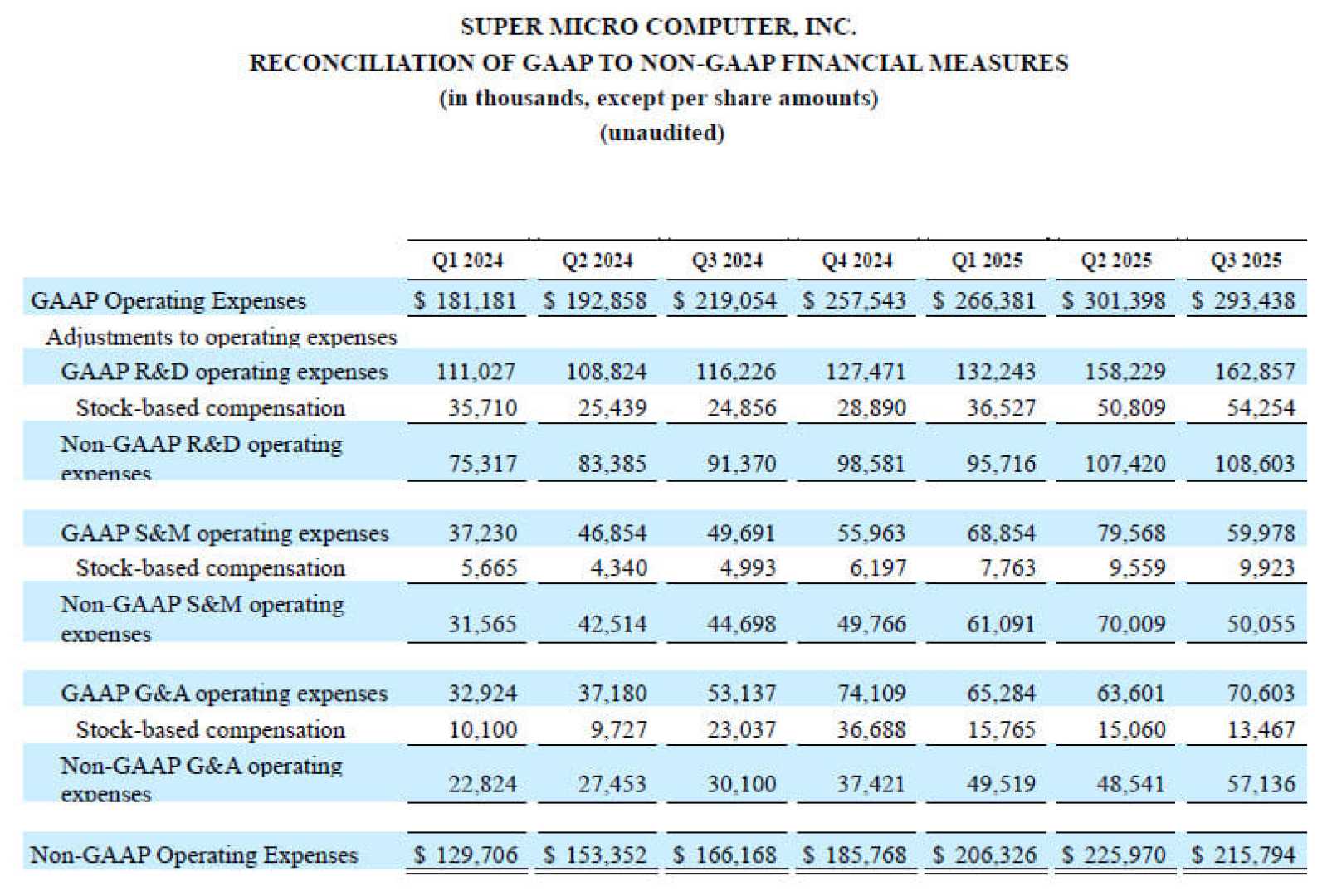

In its latest report, Supermicro announced a revenue increase of 19% to $4.6 billion, but this fell short of expectations. Analysts had projected revenue between $5 billion and $6 billion for the quarter. The company’s net income also plummeted from $402 million in Q3 2024 to just $109 million in Q3 2025.

CEO Charles Liang acknowledged that customers were delaying decisions concerning new server platforms, causing revenue to be pushed into future quarters. The uncertainty surrounding upcoming sales has contributed to a grim outlook, with the company projecting fiscal fourth-quarter sales of only $5.6 billion to $6.4 billion, again below analyst expectations.

In an effort to adapt, Supermicro has been lowering prices to secure new design wins, which has subsequently hurt its gross margins. These fell from 15.5% to 9.6% over the same period, making it difficult for the company to convert revenue into profits.

Additionally, the financial turmoil has been exacerbated by Supermicro’s tarnished reputation stemming from past accounting issues. The Securities and Exchange Commission previously fined the company for accounting irregularities, a situation that has continued to impact investor sentiment.

Supermicro now faces competition from industry giants like Nvidia, which has significantly higher gross margins and market presence. Observers note that the company operates in a low-margin environment, causing concerns over its long-term viability and investor confidence.

The company did not provide guidance for fiscal year 2026, citing uncertainties related to tariffs and the broader economic environment, compounding the apprehension felt by investors.

Despite the challenges, the company remains hopeful for future infrastructure spending, although skepticism about its current business model remains prevalent among market analysts.