Business

Super Micro Computer Inc. Faces Multiple Legal Challenges Amid Financial Allegations

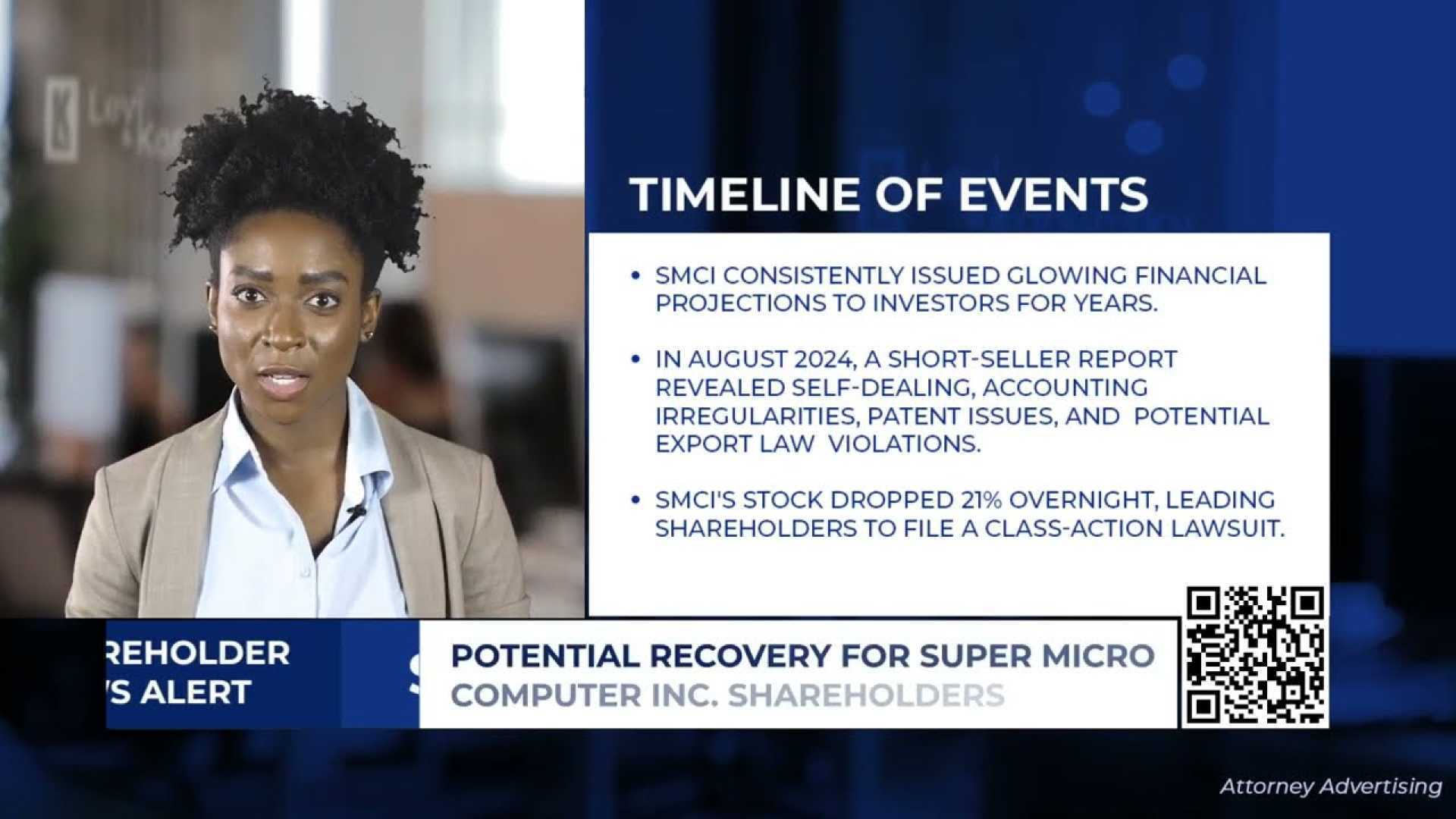

Super Micro Computer, Inc. (SMCI), a leading manufacturer of high-performance server and storage solutions, is currently embroiled in several legal battles stemming from allegations of financial misconduct. The company, headquartered in San Jose, California, has been the subject of multiple class action lawsuits filed by various shareholder rights litigation firms.

The lawsuits allege that Super Micro Computer made false and misleading statements to the market, including overreporting sales and underreporting expenses. Additionally, the company is accused of having a closer relationship with related parties than it disclosed and failing to cease exporting products to areas restricted by the U.S. government due to the Russia-Ukraine war. These actions are claimed to have led to significant financial losses for investors when the truth about the company’s practices was revealed.

Firms such as the Schall Law Firm and Hagens Berman are urging investors who suffered losses to participate in the class action lawsuits. These firms specialize in securities class action lawsuits and shareholder rights litigation, and they are actively seeking to represent affected shareholders.

Despite these legal challenges, Super Micro Computer has shown significant financial growth in 2024, with revenue increasing by 109.77% to $14.94 billion and earnings rising by 88.77% to $1.21 billion compared to the previous year. However, the ongoing legal issues could impact the company’s future financial performance and investor confidence.

Analysts have maintained a “Buy” rating for SMCI stock, with a 12-month stock price forecast of $74.53, representing a potential increase of 61.22% from the current price. However, the legal uncertainties may influence investor decisions and the stock’s performance in the near term.