Business

Super Micro Computer Shares Surge Ahead of Key Report Amid Recovery Hopes

SAN JOSE, Calif. — Shares of Super Micro Computer Inc. surged over 4% to $35.30 in intraday trading on Friday, marking a significant rebound for the server manufacturer known for its partnership with Nvidia. The gains come as the company prepares to release its fiscal second-quarter report on February 11, raising investor optimism following recent turmoil surrounding its accounting practices.

Investors have responded positively after Super Micro announced it has ramped up production availability of its artificial intelligence data center solutions, now powered by Nvidia’s latest Blackwell platform. The company’s stock has increased approximately 31% since the update about its production capabilities was released on Monday.

“Supermicro’s Nvidia in plug-and-play scalable units with advanced liquid cooling and air cooling are empowering customers to deploy an infrastructure that supports increasingly complex AI workloads while maintaining exceptional efficiency,” stated CEO Charles Liang.

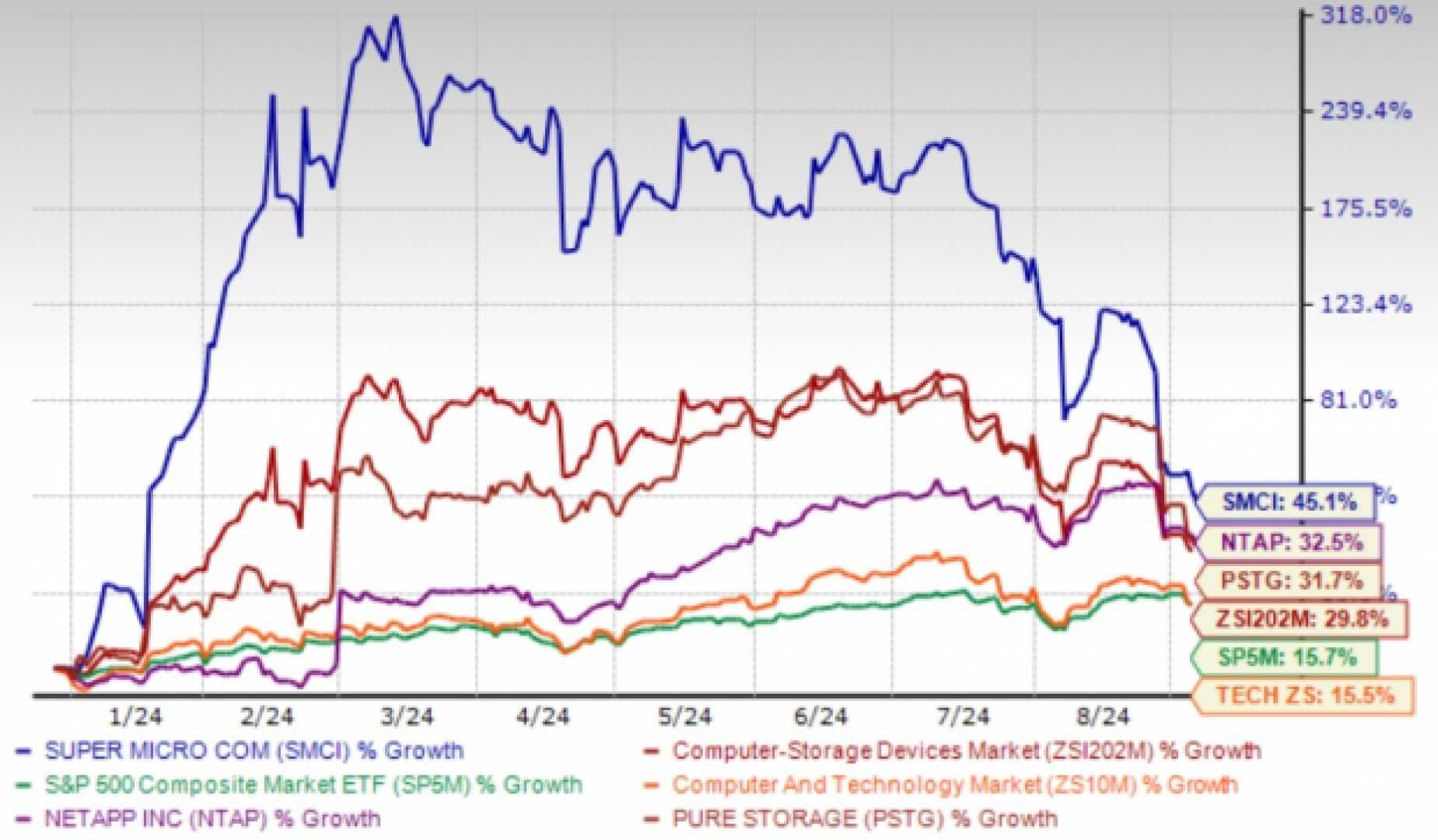

Despite the recent upswing, Super Micro’s shares have suffered a dramatic decline over the last year, losing more than half their value due to ongoing concerns over its accounting practices and pending regulatory disclosures. The company must submit its overdue annual report to the Securities and Exchange Commission by February 25, or it risks being delisted from the Nasdaq stock exchange.

Super Micro has faced scrutiny since its accounting firm resigned last October, raising alarms about the company’s financial reporting and governance. In response to these challenges, the firm established an independent special committee to address these issues, which concluded in December that it “did not raise any substantial concerns about the integrity of Supermicro’s senior management.”

The upcoming earnings report has the potential to significantly influence Super Micro’s stock price. If the report includes a successful resolution of its regulatory obligations and approval from its new auditor, analysts predict shares could see sharp increases. Conversely, further adverse findings could lead to additional declines.

As investors await the February 11 report, Wednesday’s announcement has stirred optimism, indicating that Super Micro is making strides forward in its business operations.