Business

Tax Returns Drop as Deadline Approaches Amid Uncertainties

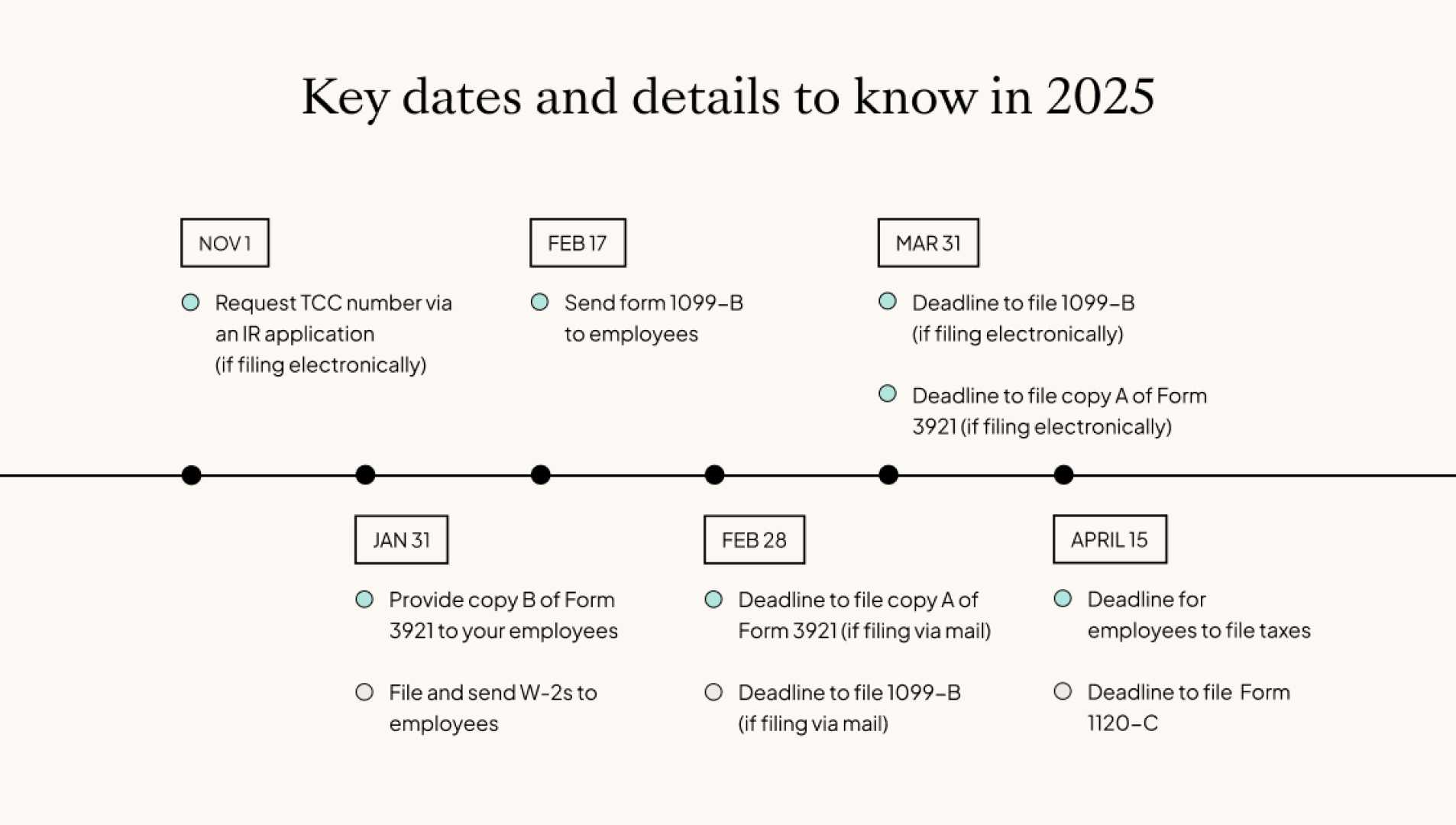

WASHINGTON, D.C. — As the April 15 tax filing deadline approaches, the Internal Revenue Service (IRS) reports a significant drop in tax returns this year compared to last. As of March 21, nearly 1 million fewer Americans had filed their federal taxes, marking a 1.1% decrease from the same period in 2024, according to recent data from the IRS and external sources.

Experts indicate that the decline is not uncommon for this time of year, but it raises concerns about potential revenue collection shortfalls. Factors contributing to this year’s decreased filings are still under investigation, with speculation surrounding the current turmoil within the IRS.

Some tax professionals have suggested that the chaos within the IRS may lead taxpayers to believe they could evade responsibilities this year. “There’s a working theory that some individuals might be rolling the dice and taking their chances,” a source involved in discussions with IRS officials disclosed to CNN.

Additionally, fears surrounding deportation among undocumented immigrants have led some to pause their tax filing. Nina Olson, former National Taxpayer Advocate, noted that her organization is in contact with undocumented individuals who are hesitant to file taxes amidst the current political climate. “Some are requesting extensions, and won’t need to file until October,” Olson explained.

Other external factors, such as natural disasters affecting access to financial records, could also play a role in the filing decline. January’s wildfires in Los Angeles displaced many residents, complicating their tax obligations. The IRS typically provides tax relief to those in federally declared disaster areas.

Despite concerns, long wait times for IRS customer service have improved, averaging three minutes this year compared to 28 minutes a few years ago, likely influencing taxpayers’ behavior. “People feel like they can wait until the last minute,” said R. William Snyder, an accounting professor at George Mason University.

The IRS has processed roughly $179.5 billion in refunds so far, reflecting a $10 billion increase compared to last year, with the average refund at $3,221. However, the timing of returns also seems to align with the evolving financial situation of taxpayers. “That’s the only big delta I see,” said Jim Buttonow, a CPA from North Carolina.

Another contributing factor may be political discontent, as some have openly resisted taxation for various reasons, including dissatisfaction with government policies. Olson mentioned that her organization recently received an irate letter from a taxpayer expressing grievances about alleged breaches in taxpayer confidentiality.

As the April 15 deadline looms, uncertainty pervades the atmosphere. The potential for a 10% drop in revenue collection is making headlines, posing significant implications for federal finances. However, recent data indicate that revenue may be pacing ahead of estimates, as the Treasury reported a 4.5% increase in total dollars collected year over year as of the week ending March 21.

Amid these developments, the IRS is also launching its Direct File program to facilitate simpler tax filing for eligible taxpayers, with 135,000 users engaged by March 21.