Business

Tempus AI Insiders Cash Out Amid Record Stock Peaks

CHICAGO, Ill. — Insiders at Tempus AI sold significant portions of their stock last week as shares of the medical technology firm reached record highs, continuing a remarkable rise in 2025.

Tempus AI (TEM) has surged by 161% this year, distinguishing itself in the turbulent AI sector, which is reacting to recent developments such as China’s DeepSeek models and major investments by tech giants.

CEO Eric Lefkofsky was among the notable insiders offloading stock, selling 243,545 shares valued at nearly $19 million between Wednesday and Friday to fulfill tax obligations related to vested restricted stock units. Other insiders, including director Jennifer Doudna and chief accounting officer Ryan Bartolucci, also participated in the selling.

Lefkofsky’s recent sale leaves him with approximately 48.27 million shares of TEM, in addition to holdings of 3.95 million shares in Groupon and over two million in Echo Global Logistics (ECHO). Despite recent sales being characterized as “uninformative,” Tempus AI still holds a “Very Negative” rating, with corporate insiders executing informative sells worth $146.4 million over the past three months.

The excitement surrounding TEM stock was boosted earlier this year when American politician Nancy Pelosi acquired 50 call options. The stock experienced another rally on February 14, after the announcement of a project aimed at developing treatments for follicular lymphoma, a slow-growing cancer.

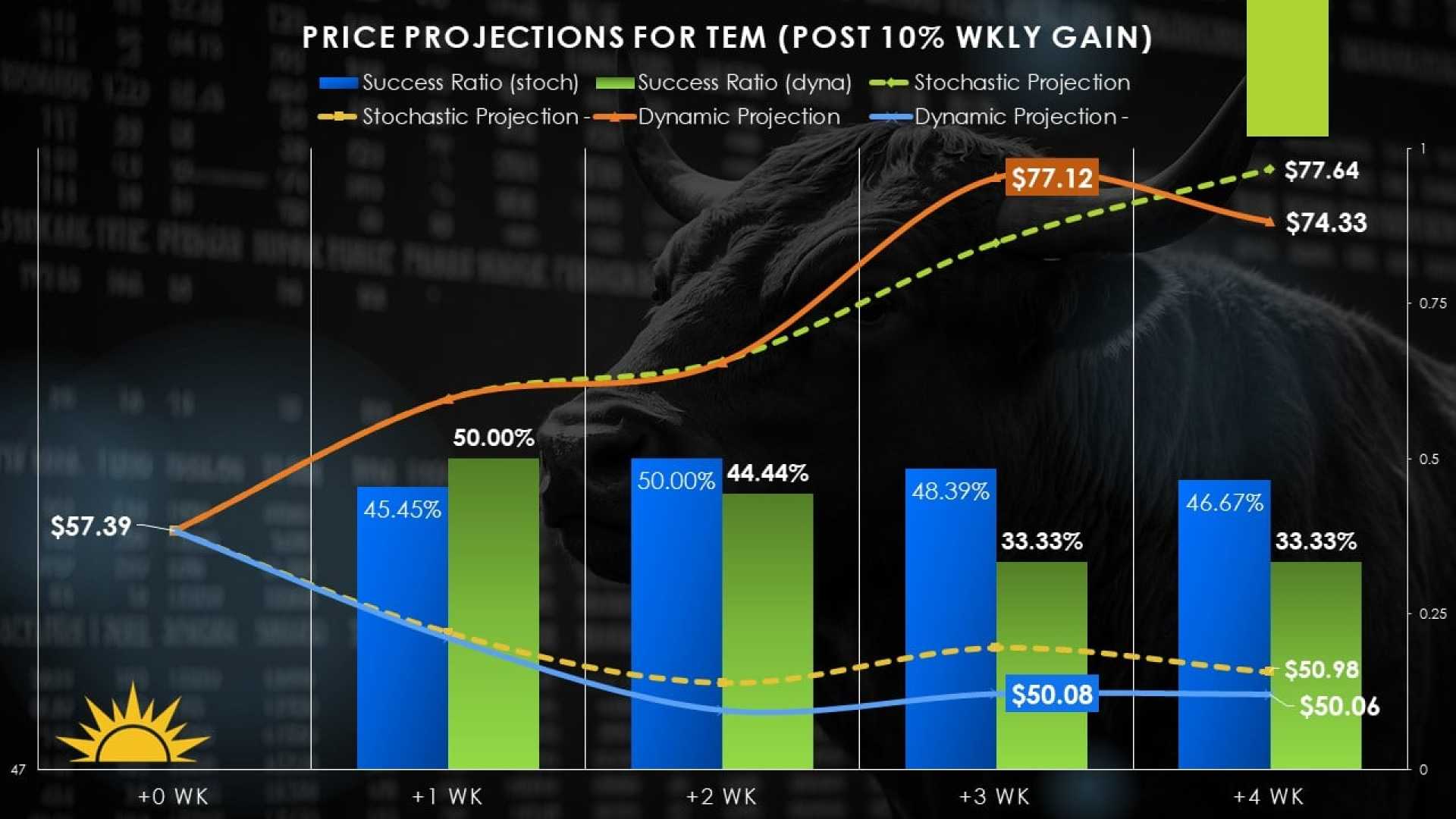

Investment sentiment around Tempus continues to be robust, with Wall Street analysts providing a Moderate Buy consensus rating based on five Buys and two Holds assigned over the past three months. However, current pricing at $61.67 indicates a potential downside of approximately 31% according to analysts’ assessments.

As the AI market remains volatile, Tempus AI’s future appears highly contingent on the ongoing development of its innovative treatments and the response of investors to insider selling activities.