Business

Tesla Offers Insurance Subsidy Amid Slumping Sales in China

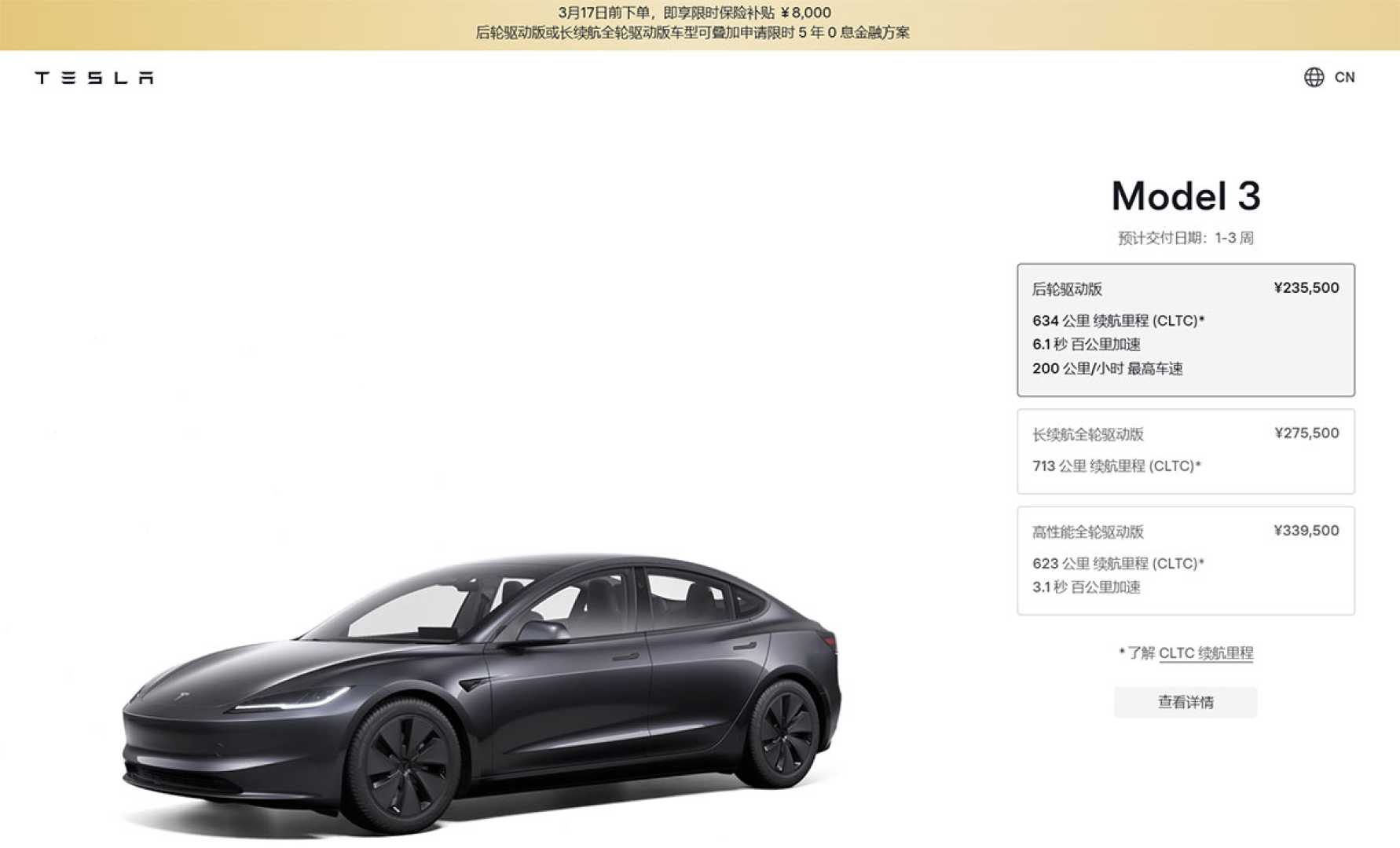

BEIJING, China — Tesla has unveiled an 8,000 yuan ($1,101.90) insurance subsidy for Model 3 purchases in China, effective until March 17, as the company grapples with declining global sales and increasing competition.

This incentive is part of Tesla’s strategy to bolster sales in a challenging market environment, especially after a striking 76% sales drop in Germany last month, reflecting mounting consumer resistance. The initiative aims to mitigate operational hurdles and attract purchasers in one of Tesla’s most significant markets.

“We are committed to making our vehicles more affordable and accessible to customers,” a Tesla spokesperson said. “By addressing the cost of insurance, we hope to encourage more people to consider owning a Model 3.”

In Europe, Tesla has experienced substantial sales declines, with a reported 71% drop in Germany and 44% in France year-to-date. Conversely, the UK market noted an 11% increase in Tesla registrations during the first two months of 2025, indicating some regional resilience amid broader downward trends.

In response to various market pressures, including fierce competition from local manufacturers, Tesla is enhancing its insurance partnerships to reduce costs for customers. Despite the introduction of in-house insurance options in selected regions, the company has not yet achieved profitability within its insurance division.

Tesla initiated its insurance program in California in 2019 but has since evolved, incorporating its safety score system that evaluates driver behavior. This system aims to reduce premiums for safe drivers but has faced criticism for what some customers deem fluctuating scoring criteria due to the vehicles’ performance capabilities.

Additionally, production halts at its plants, particularly in Grünheide, Germany, have complicated operations. Tesla is refitting assembly lines to introduce updated Model Y variants, causing temporary slowdowns in output and aggravating supply chain challenges.

The recent attacks on railway infrastructure near Tesla’s Berlin facility have also created logistical issues, with environmental activist groups claiming responsibility for these actions, expressing concerns over the company’s growth strategies.

Financially, Tesla has seen its stock value decline by 27.45% since January 2025 and more than 40% from its peak in December 2024. Concerns regarding the automaker’s elevated forward price-to-earnings ratio in contrast to competitors have heighted investor unease regarding Tesla’s market position.

The introduction of the insurance subsidy is viewed as a strategic effort to enhance demand for the Model 3 within the competitive Chinese market. While Tesla has adjusted prices downward, additional costs like insurance remain formidable barriers for prospective buyers, prompting the latest subsidy initiative.

Despite the short-term benefits of such incentives, industry experts caution that Tesla must navigate broader industry challenges. Factors like intensifying competition from affordable domestic brands and Elon Musk‘s controversial public presence may further impact the brand’s global standing.

As of now, Tesla has not communicated plans to extend similar subsidy offers outside of China, suggesting that further adjustments might be necessary for the company to regain momentum and reassure stakeholders about its long-term viability.