Business

Tesla Shares Plummet Amid Brand Struggles and Competition

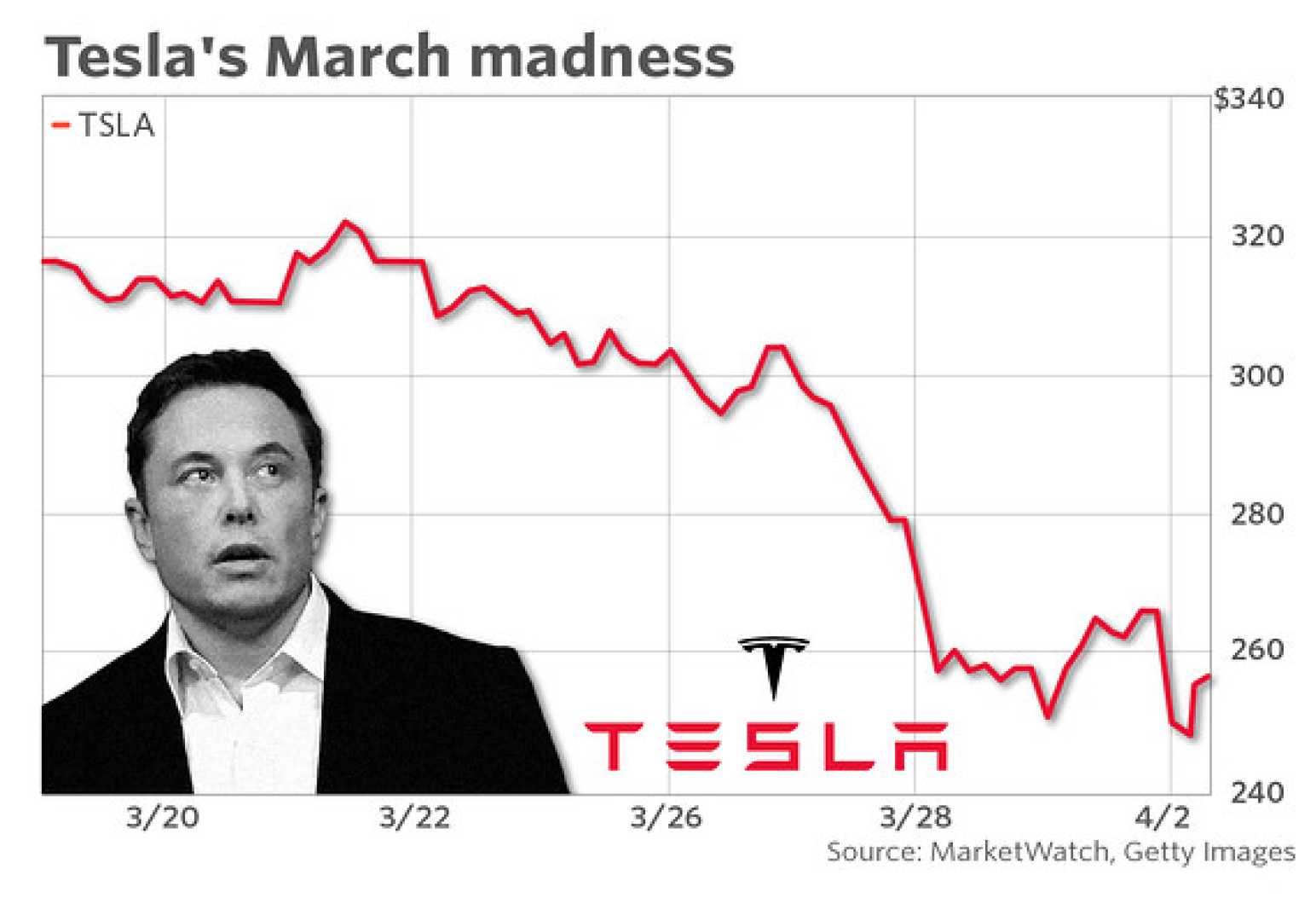

WASHINGTON, D.C. — Tesla‘s stock is facing significant pressure this week as shares of the electric vehicle manufacturer led by CEO Elon Musk dropped 5% to $225.31, compounding a similar decline from the previous day. The downturn raises concerns over the company’s market position, especially in China, and the impact of Musk’s political entanglements.

Market analysts have cautioned investors about Tesla’s performance, predicting a potential ninth consecutive week of decline. RBC Capital Markets analyst Tom Narayan lowered his price target for the company, reducing it by $120 to $320 while still maintaining an outperform rating, citing intensifying competition in the Chinese market. Narayan noted that approximately 21% of Tesla’s projected sales in 2024 will come from China, where local car manufacturers are expected to dominate.

In conjunction with RBC’s report, Mizuho Securities also adjusted its forecasts, cutting Tesla’s price target by $85 to $430 and reducing its 2025 vehicle delivery estimate from 2.3 million to 1.8 million—a reduction exceeding 20%, which falls below the consensus of 2 million deliveries. These adjustments reflect weakening brand perception and increasing competition from Chinese EV firms.

According to Mizuho, Tesla’s U.S. sales decreased by 2% year-over-year last month, while the broader EV market grew by 16%. Meanwhile, in China, Tesla’s sales plummeted by 49%, in stark contrast to a growth rate of 85% in the local electric vehicle market, highlighting significant challenges for the company as it looks to maintain its position.

<p"BYD and Zeekr, two of Tesla’s prominent competitors in China, made headlines this week with new technology announcements, including a fast-charging system that significantly reduces charging times and a self-driving offer that will be available for free in the region. Analysts have suggested that these advancements may further hinder Tesla’s standing in the competitive market.

As Tesla’s stock has faced turbulence, Musk’s personal wealth, estimated at $321 billion, has also taken a hit, plummeting from a peak of $464 billion in December. Despite the challenges, employees reportedly remain optimistic about the company’s trajectory, buoyed by significant stock grants provided last year.

Musk’s ties to the Trump administration have also drawn scrutiny as analysts have cited potential impacts of Musk’s political affiliations on Tesla’s brand image. In a recent statement, JPMorgan analysts noted that the company’s brand perception has waned dramatically, particularly in markets where Musk has publicly intervened in divisive political matters.

Polling data reveals a growing negativity toward Musk, with a CNN poll indicating that nearly 51% of respondents possess unfavorable views of the billionaire, illustrating a stark shift in public sentiment. In contrast, around 35% express a favorable opinion.

As Tesla navigates these hurdles, it ranks poorly among S&P 500 stocks with a 44% year-to-date decline, prompting several financial institutions to adjust their predictions and raise concerns regarding sustained brand strength and market share.