Business

Tesla Shares Plunge Amid Dramatic Sales Decline in China

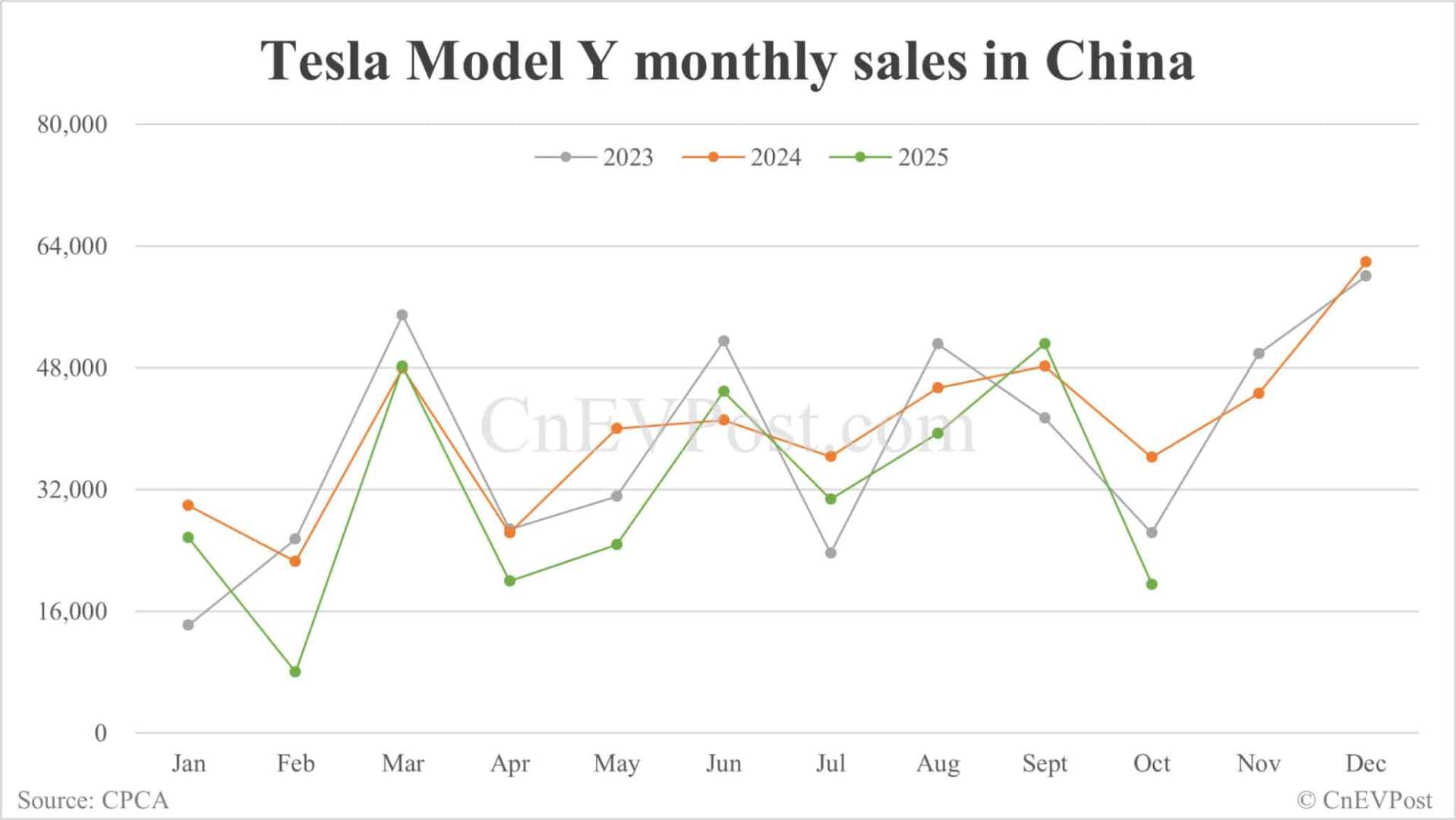

SHANGHAI, China — Shares of electric vehicle maker Tesla Inc. (NASDAQ: TSLA) fell 5.5% on November 13, 2025, following reports of a severe drop in October sales in China. The company’s sales plummeted to 26,006 vehicles, marking a three-year low and representing a 36% decline from the same month last year.

This downturn is particularly concerning as it reflects a 63.6% decrease from September figures, causing Tesla’s market share in China to shrink from 8.7% to just 3.2%. Reports indicate that competitor Xiaomi outperformed Tesla in vehicle sales for the month, selling more units than Tesla’s combined figures of the Model Y and Model 3.

The broader U.S. stock market also experienced a decline amid investor caution, especially within technology stocks. Investors appear to be taking profits after a strong growth period in tech. This trend, known as ‘market rotation,’ suggests a shift of funds from high-performing technology sectors to other areas perceived as more stable.

A contributing factor to the cautious market climate came with the conclusion of a long government shutdown. While this may seem like positive news, it also signals an influx of delayed economic reports, which might influence future decisions by the Federal Reserve regarding interest rate cuts.

Tesla has exhibited volatility, with 45 instances of stock price movements greater than 5% in the past year. The latest decline reflects a significant concern among investors but is not expected to alter the long-term perception of the business. Notably, just nine days prior, Tesla shares fell 3.3% after news that Norway‘s sovereign wealth fund planned to oppose CEO Elon Musk‘s $1 trillion compensation package, citing worries about shareholder dilution.

Additionally, Tesla faced hurdles with two separate recalls for its Cybertruck, affecting nearly 70,000 units due to lighting issues. The company is also dealing with a lawsuit related to a fatal crash involving a Model S, where it was alleged that the vehicle’s doors failed to open properly.

Despite current challenges, Tesla’s shares have increased by 6.4% since the beginning of the year. However, trading at $403.44 per share, the stock remains 15.9% below its 52-week high of $479.86 from December 2024.