Business

How to Test Your Retirement Portfolio Against Financial Storms

CHICAGO, IL — As financial security becomes more critical for retirees, testing the resilience of retirement plans is gaining attention. Financial stress tests, similar to those conducted on banks after the 2008 financial crisis, assess how well a retirement portfolio can withstand economic shocks.

A retirement plan is only as reliable as its ability to endure unexpected financial upheavals. Market volatility, job loss, or healthcare expenses can threaten a retiree’s stability. Cassandra Rupp, a senior wealth advisor, explains that stress testing a portfolio helps identify potential risks and ensures that retirees can maintain their lifestyle and savings throughout their retirement.

Ryan Viktorin, a certified financial planner, emphasizes the importance of modeling various market conditions. “We consider average returns, below-average returns, and bullish scenarios to see how well a portfolio can endure challenging times,” said Viktorin. This approach helps retirees avoid being blindsided by economic downturns.

Renee Young, a thought leadership director at T. Rowe Price, identifies three main uncertainties retirees must prepare for: market volatility, longevity, and spending habits. Market volatility can drastically affect retirement savings if investments decline when portfolios are most vulnerable. Moreover, retirees may spend more during unanticipated healthcare crises as their needs fluctuate over time.

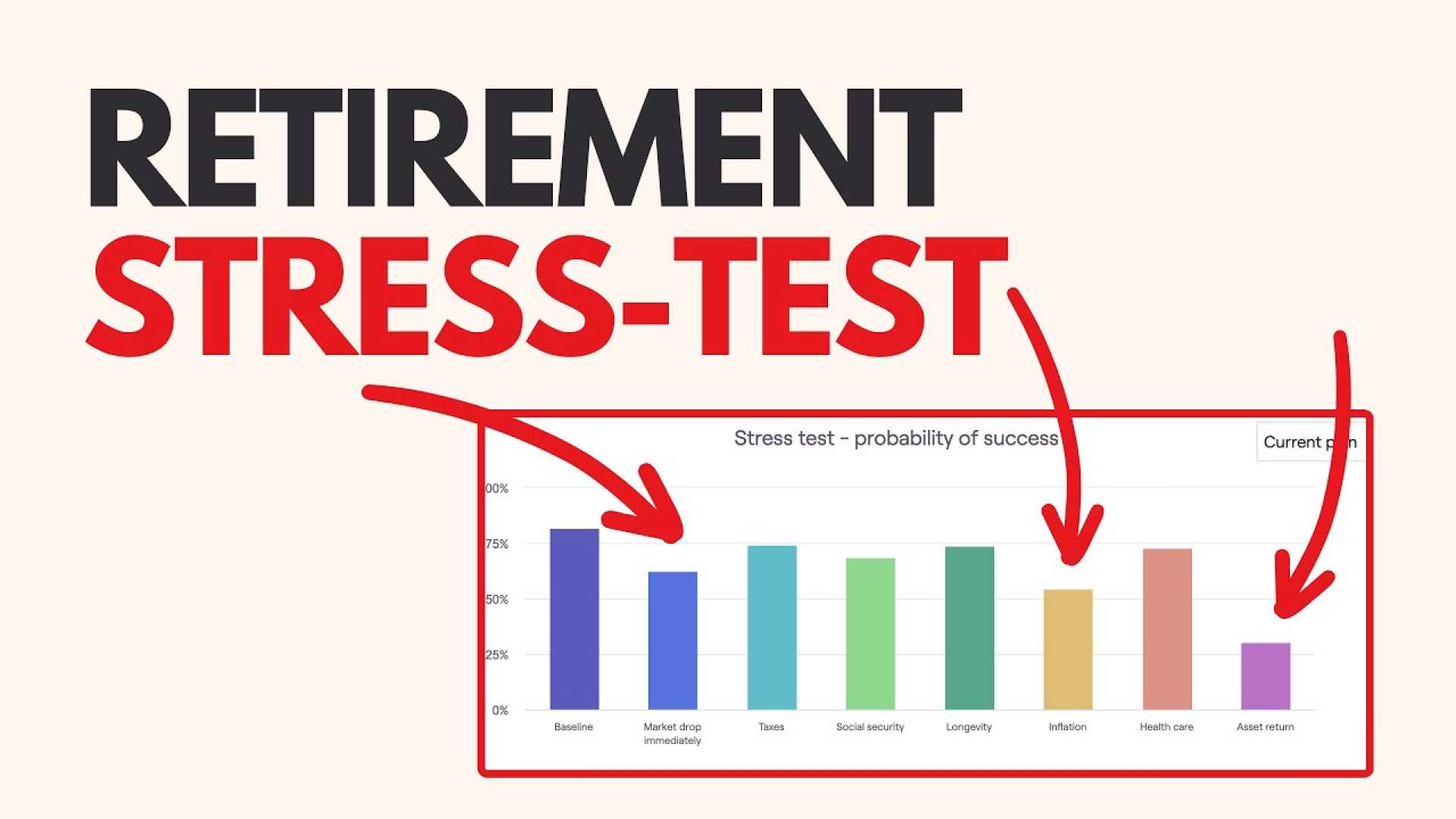

Financial experts like Young utilize Monte Carlo simulations to project retirement success rates, running thousands of scenarios to evaluate how individual circumstances affect outcomes. These simulations account for various factors, including investment returns and longevity, to provide a clearer picture of a retiree’s chances of ensuring a stable financial future.

While a Monte Carlo analysis offers greater insight than basic projections, it requires a current financial adviser familiar with modeling and forecasting techniques. Collaboration with professionals is essential for enhancing the reliability of retirement strategies.

If a stress test reveals a low confidence score in relation to financial goals, retirees may need to adjust their savings or spending habits. Increasing contributions, minimizing expenses, or diversifying investments could help enhance the likelihood of a successful retirement.

Ultimately, ensuring financial stability in retirement requires diligent planning and monitoring. Regular assessments and updates to retirement strategies can significantly improve the odds of achieving comfort and security during retirement years.