Business

Texas Instruments Set to Report Earnings Tomorrow Amid Market Challenges

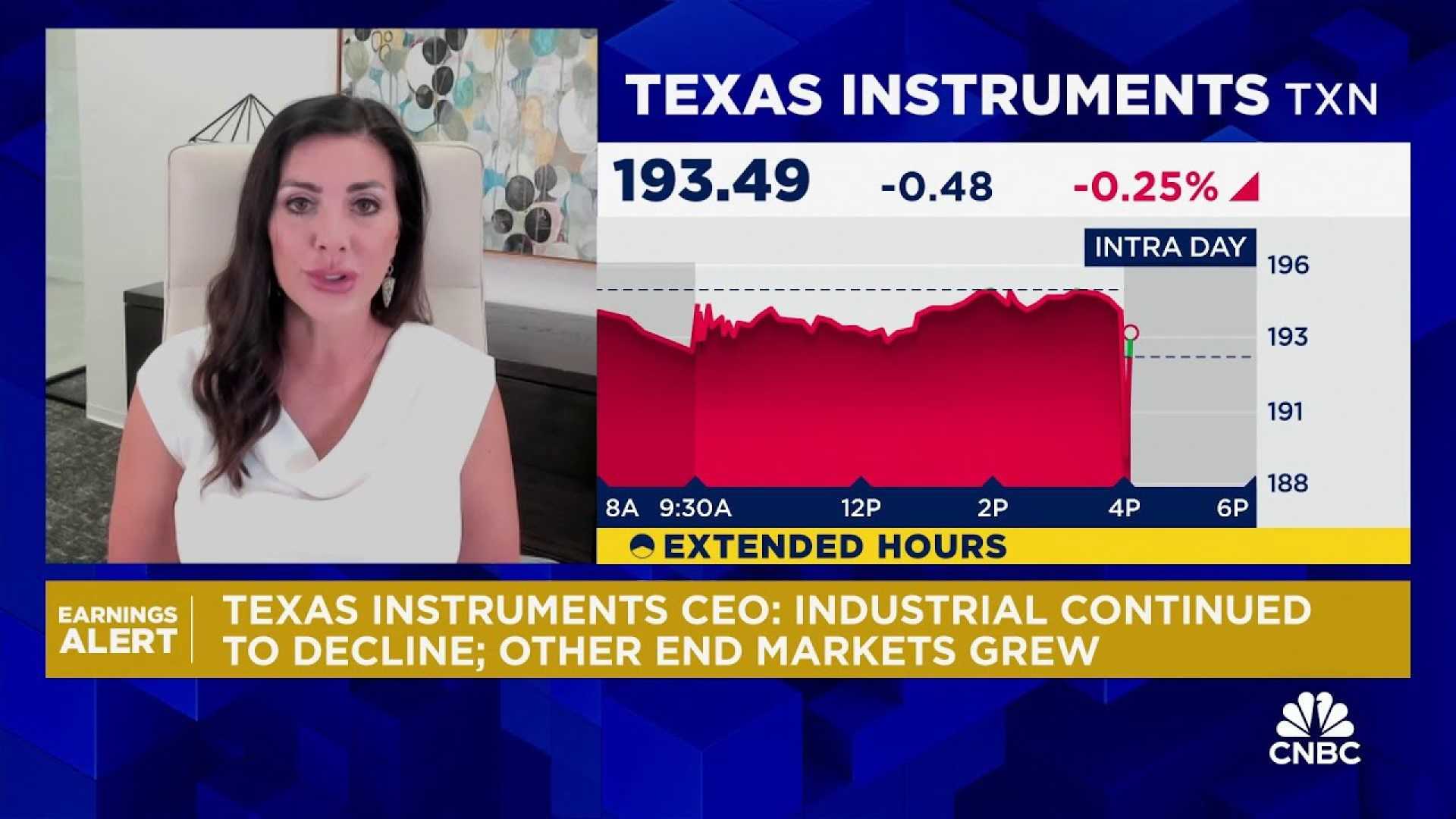

DALLAS, Texas – Texas Instruments (NASDAQ: TXN) is scheduled to report its earnings tomorrow afternoon, following strong performance in the previous quarter. Analysts noted the company beat revenue expectations by 3.3%, recording $4.01 billion in revenue, although this figure represents a 1.7% decline year over year.

This upcoming earnings report will reveal if Texas Instruments can maintain its current trajectory, as analysts predict a 6.8% revenue growth this quarter, raising expectations to $3.91 billion. This marks a promising turnaround from the 16.4% decrease reported in the same quarter last year. Additionally, adjusted earnings are anticipated at $1.10 per share.

Over the last month, analysts have generally reaffirmed their estimates, indicating confidence in the company’s performance heading into earnings. However, Texas Instruments has missed Wall Street’s revenue estimates three times within the last two years, adding uncertainty to the upcoming figures.

In comparison with its peers in the semiconductor sector, only Micron has released earnings so far, surpassing revenue estimates by 1.9% and achieving year-on-year sales growth of 38.3%, although its stock fell 7.9% on the news.

This year’s stock market performance has been mixed, as broader economic conditions improve. The Federal Reserve has successfully combated high inflation while avoiding a recession, and recent rate cuts have contributed to market growth. However, semiconductor stocks have lagged, with an average decline of 22.6% in the past month. Texas Instruments specifically has dropped 22.1% during this period and is currently trading at $143.48, near an average analyst price target of $197.18.

As the company approaches its earnings date, investors are watching closely to determine whether it can capitalize on its past successes amidst a fluctuating stock landscape.