Business

TJX Companies Inc. Beats Q3 Expectations with Strong Earnings and Revenue Growth

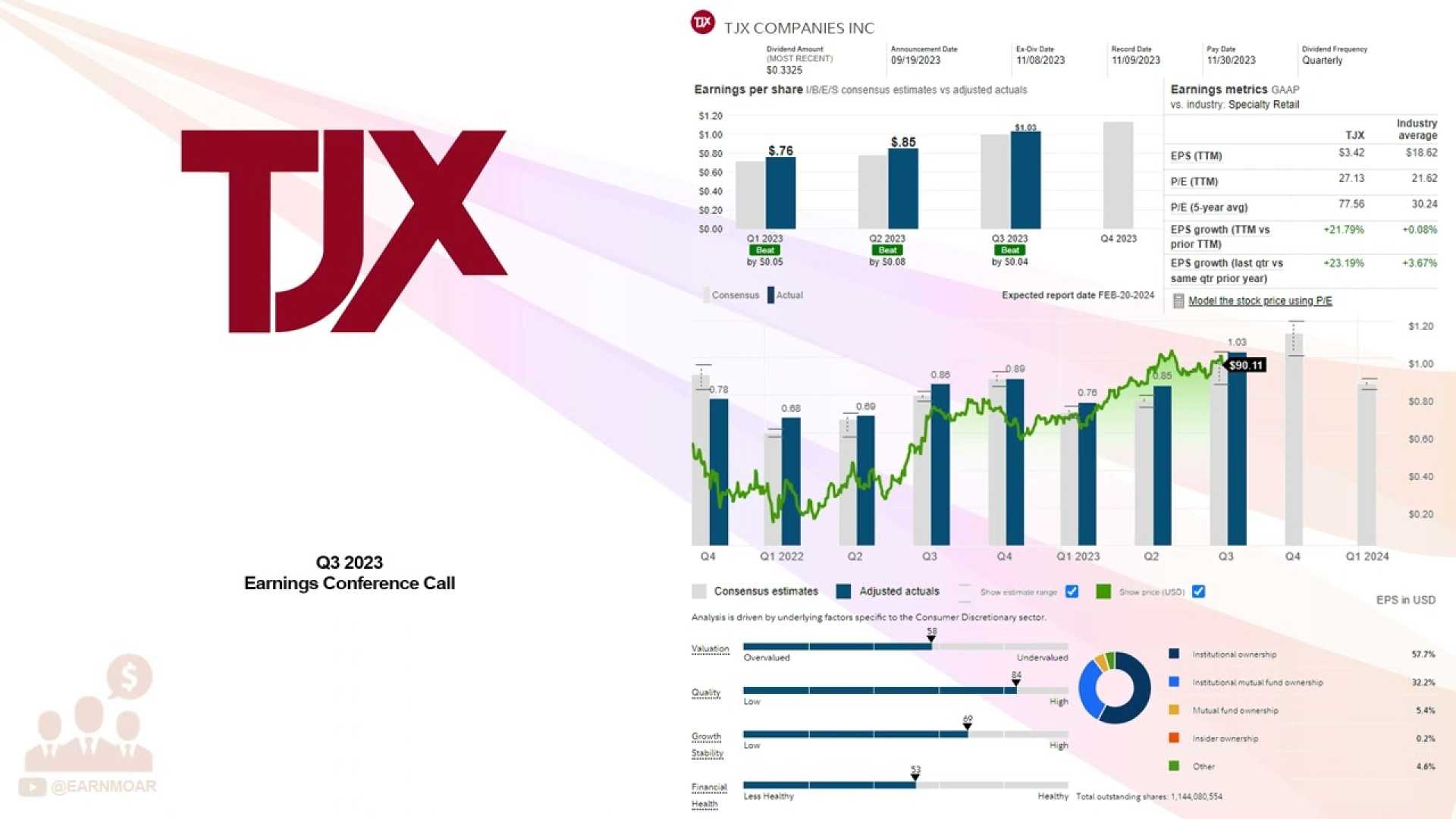

The TJX Companies, Inc. (NYSE: TJX) has reported impressive financial results for the third quarter of Fiscal Year 2025, exceeding market expectations. The company’s earnings for the quarter came in at $1.297 billion, or $1.14 per share, which is an 11% increase from the $1.03 per share reported in the same period last year.

Revenue for the quarter rose 6% to $14.063 billion, up from $13.265 billion in the previous year. This growth was driven by a 3% rise in consolidated comparable store sales, which was at the high end of the company’s plan. The increase was attributed to a surge in customer transactions, indicating a positive reception to TJX’s off-price business model.

The company’s pretax profit margin for the third quarter stood at 12.3%, a 0.3 percentage point improvement over the previous year. This margin was well above TJX’s internal expectations, demonstrating effective cost management and operational efficiency.

TJX also provided guidance for the upcoming quarters. For the fourth quarter of FY2025, the company expects consolidated comparable store sales to rise by 2% to 3%, with a pretax profit margin between 10.8% and 10.9%, and diluted EPS ranging from $1.12 to $1.14. The full-year EPS outlook has been increased to a range of $4.15 to $4.17.

In addition to strong financial performance, TJX continued to expand its global footprint. The company completed its investment in a joint venture with Grupo Axo, enhancing its presence in Mexico and South America, and plans to enter the Spanish market with its TK Maxx banner by early 2026.

TJX maintained a solid cash position, ending the quarter with $4.7 billion in cash and returning $997 million to shareholders through share repurchases and dividends. The company also plans to repurchase $2.25 to $2.5 billion of its stock during the fiscal year).