Business

U.S. Treasury Yields Drop Amid Stock Market Sell-Off, Fed Decision Looms

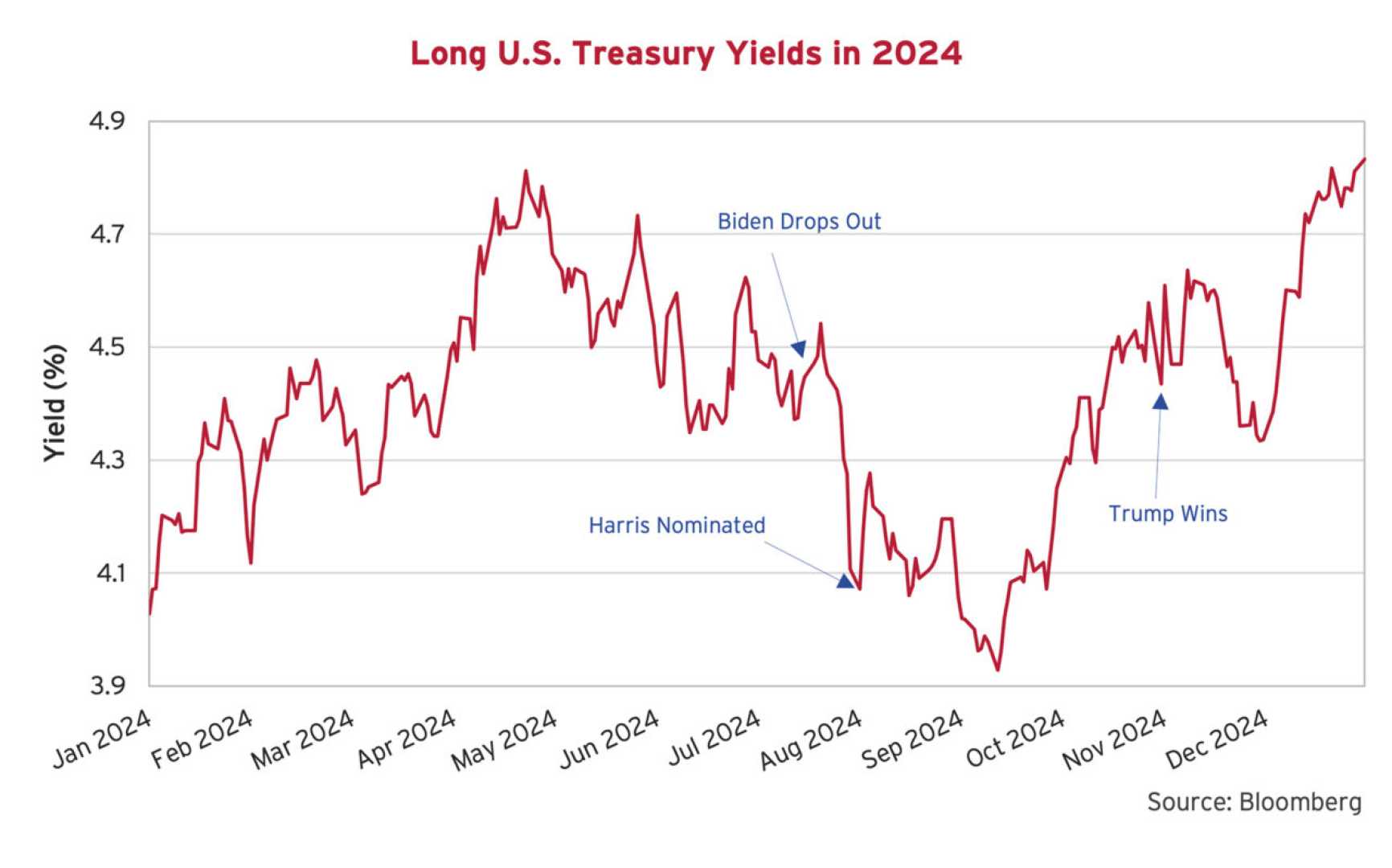

NEW YORK — U.S. Treasury yields fell sharply on Monday as investors flocked to safe-haven assets amid a significant stock market sell-off, particularly in the technology sector. The yield on the 10-year Treasury note dropped eight basis points to 4.54%, while the 2-year Treasury yield fell more than six basis points to 4.208%. Yields move inversely to prices, and one basis point equals 0.01%.

The sell-off comes as investors brace for a pivotal week, with the Federal Reserve set to announce its next monetary policy decision on Wednesday. Traders are pricing in a more than 99% chance that the Fed will leave interest rates unchanged, according to the CME Group’s FedWatch Tool. At its December meeting, the Fed projected only two interest rate cuts in 2025.

Adding to market uncertainty, former President Donald Trump, speaking at the World Economic Forum in Davos, Switzerland, last week, called for immediate interest rate cuts. “I’ll demand that interest rates drop immediately,” Trump said. “And likewise, they should be dropping all over the world. Interest rates should follow us all over.”

Investors are also awaiting the release of the personal consumption expenditures (PCE) price index for December on Friday. The PCE index, the Fed’s preferred inflation gauge, will provide fresh insights into the health of the U.S. economy.

Meanwhile, the technology sector faced significant pressure following news that Chinese AI startup DeepSeek released an open-source AI model in December that reportedly outperformed OpenAI’s models in several tests. This development has raised questions among investors about the billions of dollars spent globally to build and train AI models.

U.S. stock futures tumbled on Monday, reflecting broader market unease. The Dow Jones Industrial Average futures fell by 0.8%, while S&P 500 and Nasdaq futures dropped 1.2% and 1.6%, respectively.

As the week progresses, market participants will closely monitor the Fed’s decision and economic data for clues about the future trajectory of interest rates and inflation. The combination of geopolitical tensions, technological disruptions, and economic uncertainty has created a volatile environment for investors.