Business

U.S. Treasury Yields Drop Amid Economic Fears and Trade Wars

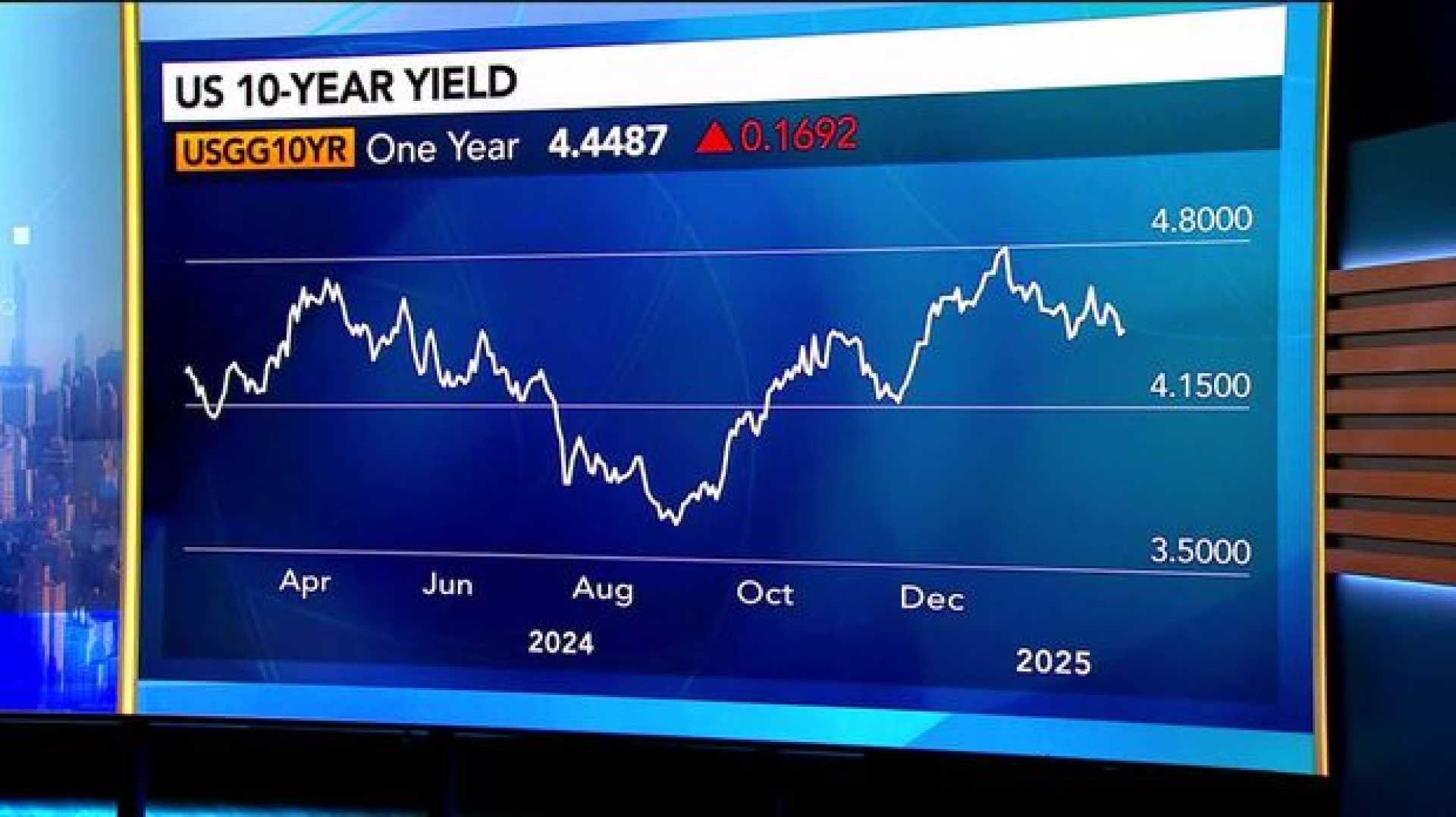

NEW YORK, March 10, 2025 – U.S. Treasury yields fell significantly as investors brace for a week filled with crucial economic updates following remarks by former President Donald Trump regarding the state of the economy. The yield on the benchmark 10-year Treasury note decreased by 7 basis points, bringing it to 4.251% amid increasing concerns about a possible recession.

The yield on the two-year Treasury bond fell below 4% during overnight trading in Asia after Trump indicated that the economy is undergoing “a period of transition.” This sentiment echoed that of Treasury Secretary Scott Bessent, who stated on Friday that the economy may be slowing.

Investor attention this week is heavily focused on upcoming economic data, including the New York Fed‘s survey of consumer expectations, which is slated for release on Monday at 10 a.m. ET. The Consumer Price Index (CPI), a key measure of inflation, will be published on Wednesday at 7:30 a.m. ET, alongside the Producer Price Index on Thursday. Analysts believe the CPI likely saw moderate growth in February after a surge in January.

“Inflation data will dominate the economic calendar this week,” said Bill Adams, chief economist at Comerica Bank. He added that overall and core CPI figures are expected to reflect steady annual increases despite a less aggressive month compared to January.

The backdrop of these economic releases was intensified by Trump’s comments over the weekend hinting at the possibility of recession, stating that the economy is transitioning. Bessent also suggested that the market has become dependent on governmental spending, indicating a potential adjustment as the economy shifts toward private-sector spending.

“Could we be seeing that this economy that we inherited starting to roll a bit? Sure,” Bessent remarked during an interview on CNBC. “There’s going to be a natural adjustment as we move away from public spending to private spending.”

The uncertainty surrounding Trump’s tariff policies is also weighing heavily on market sentiment. As 25% tariffs on imports from Mexico and Canada and increased duties on Chinese goods took effect on Tuesday, concerns arose regarding the potential impact on consumer prices and economic growth.

Jake Dollarhide, CEO of Longbow Asset Management, expressed concerns about the implications of these tariffs, stating, “This economy has been driven by the consumer and saved by the consumer.”

As tensions escalate, the stock market reflected a negative response, with major indexes falling. The Dow Jones Industrial Average dropped 670.25 points to 42,520.99, a decline of 1.55%. Similarly, the S&P 500 and Nasdaq Composite fell by 1.22% and 0.35%, respectively.

Investors’ flight to safety saw gold prices rise, with spot gold increasing by 0.6% to $2,911.88 an ounce amid heightened safe-haven demand.

“Trump’s tit-for-tat approach has heightened fears of a global trade war,” stated Uto Shinohara, senior investment strategist at Mesirow in Chicago. “It is pressuring risk assets while boosting safe havens.”

Meanwhile, the euro rose to a three-month peak against the U.S. dollar, fueled by news of a €500 billion infrastructure fund proposed by German political parties, which aims to boost defense spending.