Business

U.S. Treasury Yields Mixed as Investors Weigh Trump Tariffs

WASHINGTON, D.C. — U.S. Treasury yields were mixed on Monday as investors assessed the economic implications of new tariffs imposed by former President Donald Trump on key trade partners, including Mexico, Canada, and China.

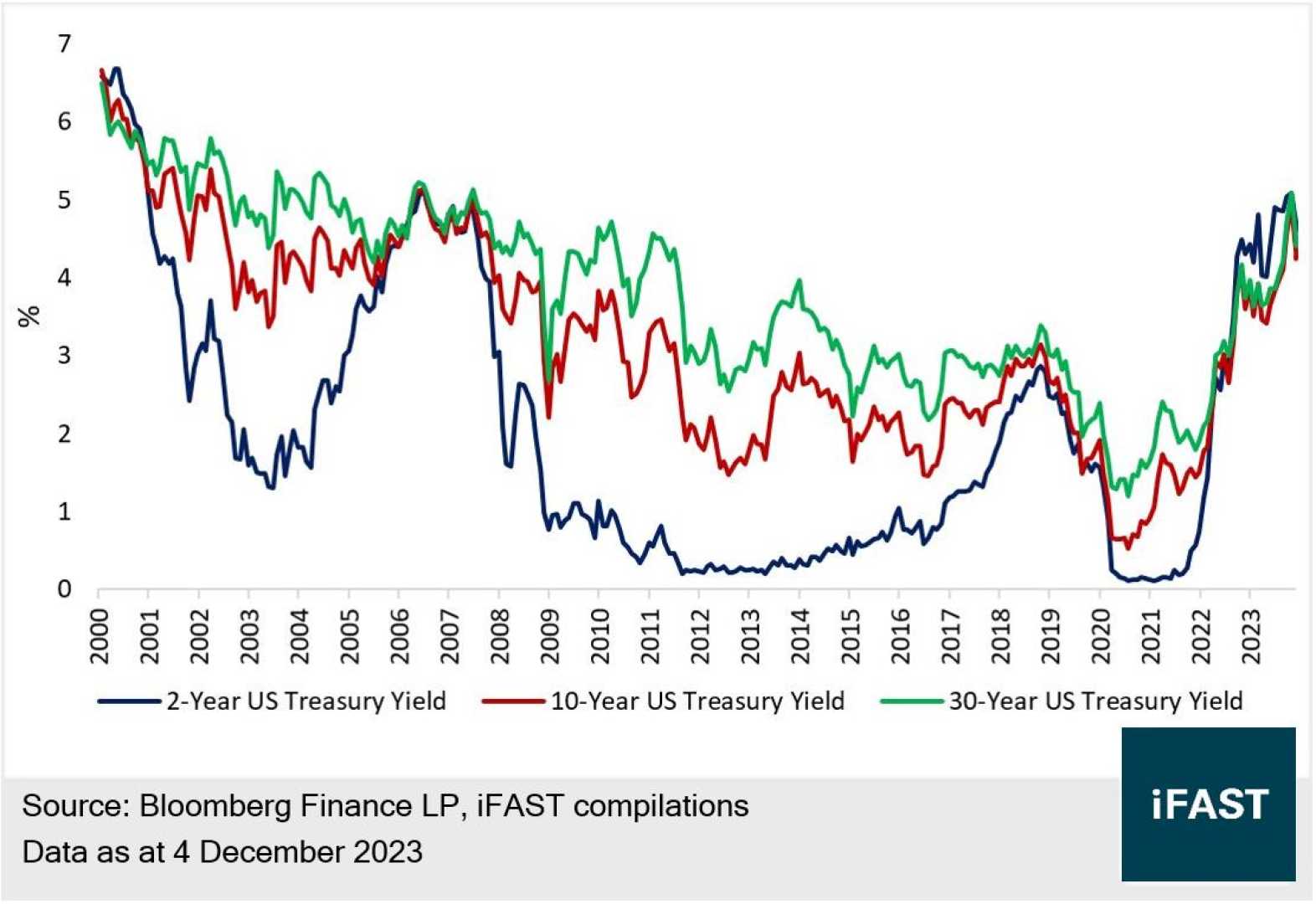

The yield on the 10-year Treasury note fell about 6 basis points to 4.508%, while the 2-year Treasury yield rose less than 1 basis point to 4.245%. Yields and prices move inversely, with one basis point equaling 0.01%.

Trump signed an executive order on Saturday imposing a 25% tariff on imports from Mexico and Canada and a 10% duty on Chinese goods. The U.S. conducts approximately $1.6 trillion in trade annually with these three nations. The move has sparked retaliatory threats, with Canada vowing to impose its own tariffs on U.S. goods, Mexico considering levies, and China filing a lawsuit with the World Trade Organization.

Investors are also bracing for a week of critical economic data. On Monday, the S&P Global US Manufacturing PMI and the Manufacturing ISM report will provide insights into the health of the manufacturing sector. Tuesday will see the release of the Job Openings and Labor Turnover Survey, which tracks open positions at the end of each month.

Federal Reserve officials, including Atlanta Fed President Raphael Bostic and San Francisco Fed President Mary Daly, are scheduled to deliver speeches this week, offering potential clues on monetary policy. The week will culminate with the January nonfarm payrolls report on Friday, which economists predict will show 175,000 jobs added and an unchanged unemployment rate of 4.1%, according to a Dow Jones poll.