Business

Trump Announces New 25% Tariffs on Steel and Aluminum Imports

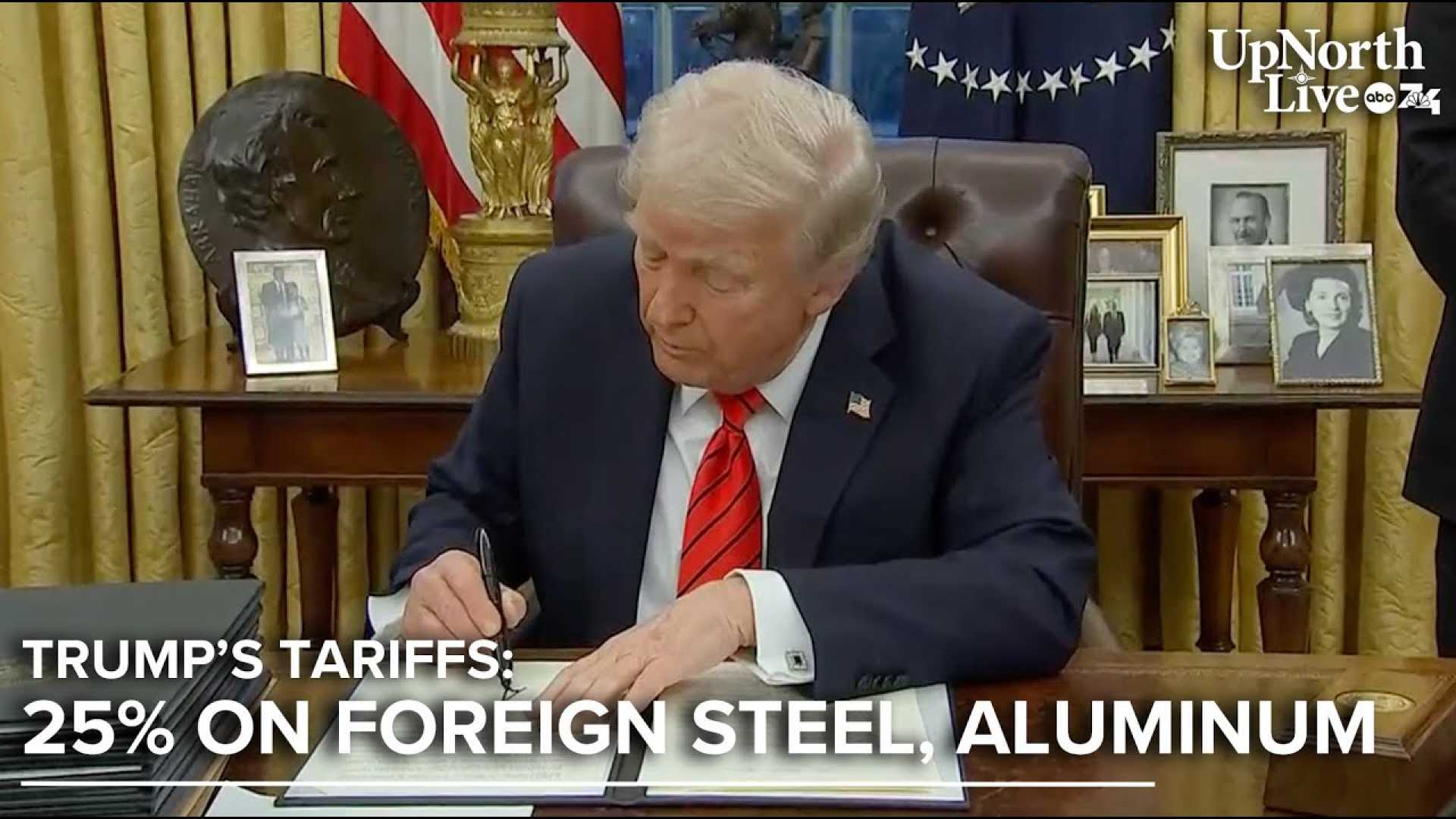

WASHINGTON, D.C. — President Donald Trump unveiled plans to impose a new 25% tariff on all steel and aluminum imports during a signing ceremony at the Oval Office on February 11, 2025. This decision comes as part of an effort to protect U.S. industries and curb trade imbalances with foreign nations. The tariffs, described by Trump as necessary for national security, are set to take effect on March 12, 2025.

“We are taking these actions without exceptions or exemptions,” Trump stated, emphasizing the need to defend American manufacturing against what he termed unfair trade practices. With nearly 25% of steel utilized in the U.S. being imported, the new tariffs may have significant implications for various sectors, including construction and automotive, which heavily rely on these materials.

The announcement drew attention to the critical role of imported steel, with Canada, Brazil, and Mexico being the top suppliers. Between March 2024 and January 2025, data indicated that these three countries contributed nearly half of the steel imports into the U.S. Canada alone accounted for 22%, supplying over 5 million tonnes, while Brazil and Mexico contributed approximately 15% and 12%, respectively.

The aluminum sector similarly relies on imports, with Canada providing 40% of total U.S. aluminum imports. The lightweight metal is essential for industries ranging from automotive to packaging. Trump cited a keenness to bolster U.S. production and create jobs, reiterating that previous tariff exemptions for key partners like Canada and Mexico would not be available this time.

A tariff is a government-imposed tax intended to protect domestic industries by making foreign goods more expensive, which can lead to increased costs for consumers as businesses often pass on these higher expenses. In 2018, Trump enacted a 25% tariff on steel and a 10% tariff on aluminum, which initially resulted in a surge in U.S. steel prices and a drop in imports. However, by the end of 2019, domestic steel prices plummeted over 40% due to retaliatory tariffs from trading partners and declining consumption.

Deborah Idowu, a Metals Research Specialist at the London Stock Exchange Group, remarked, “Increased domestic production led to an oversupply in the market. We may see a similar trend as industries shift to domestic producers with the new tariffs. However, this might drive costs higher across various sectors.”

Concerns have been raised about possible retaliatory measures from other countries. Saida Litosh, lead metals analyst at LSEG, commented on the risks involved, stating, “These proposed tariffs could trigger significant disruptions in established supply chains and may provoke counteractions from key trade partners, affecting the North American aluminum market and leading to higher input costs for U.S. manufacturers.”

The manufacturing sector’s heavy reliance on imported materials sparks questions about the broader economic impact. Financial analysts predict that the tariffs could increase the cost of goods ranging from automobiles to food packaging, potentially straining consumers already facing rising prices due to inflation.

Industry leaders, such as Robert Budway of the Can Manufacturers Institute, voiced apprehensions over the tariffs, indicating that they could undermine food security and consequently lead to increased grocery prices. “Without exemptions for can manufacturers to import steel tariff-free, grocery prices for canned foods made in the U.S. are likely to rise,” he warned.

In a related area, analysts have projected that if these tariffs lead to significant price increases, they could dampen overall demand in an already unstable market. The National Association of Home Builders (NAHB) echoed these concerns, asserting that the tariffs contradict efforts aimed at making housing more affordable.

As the March deadline approaches, trade experts are closely monitoring the reaction of international markets and the rippling effects throughout the global economy. The potential for ongoing negotiation remains, but the path appears set toward increased tariffs and heightened tensions in U.S. trade relations.