Politics

Trump’s Economy Approval Plummets as 100 Days Approaches

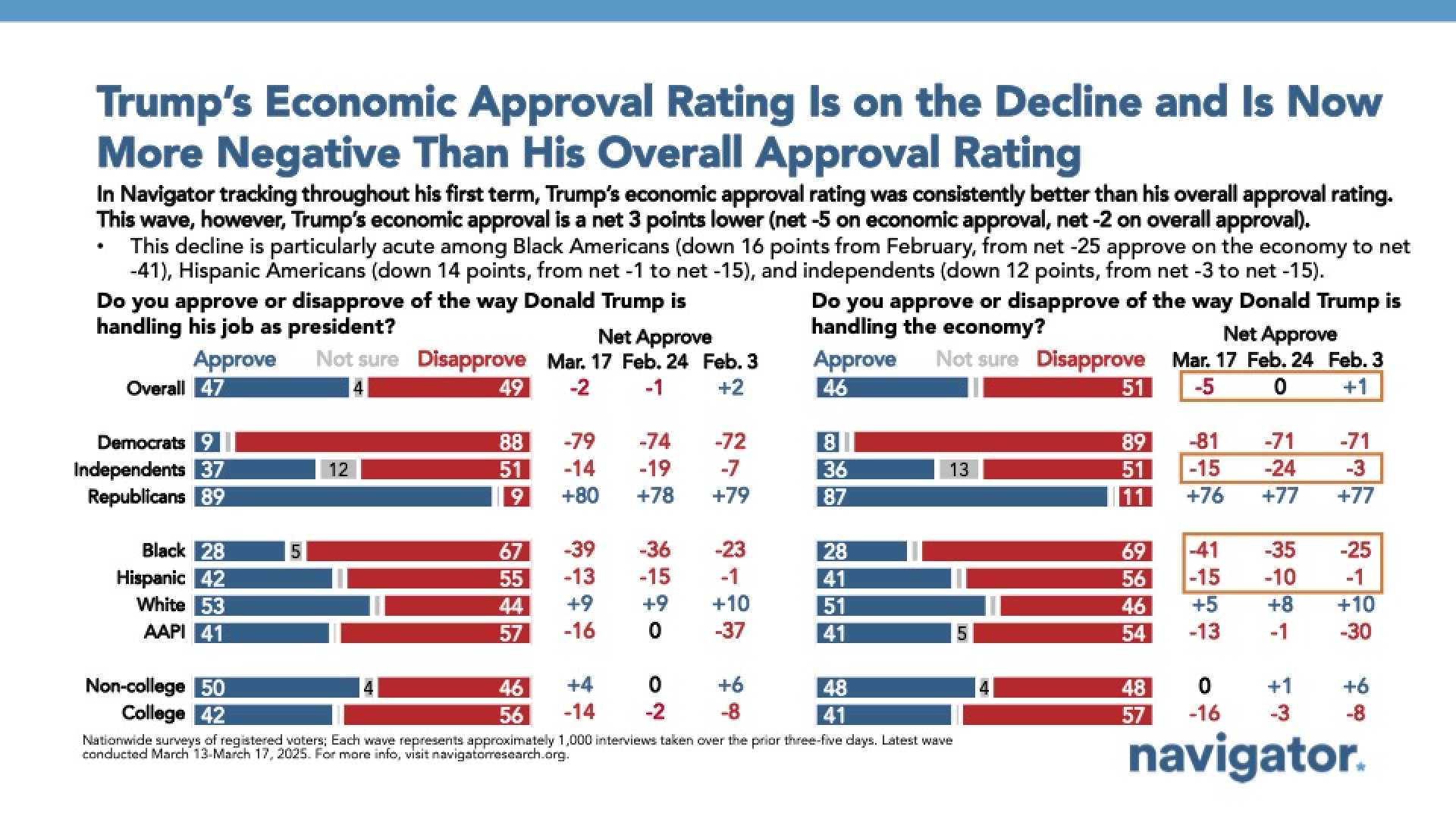

WASHINGTON, April 23 (Reuters) – As President Donald Trump nears the 100-day mark of his second term in office, criticism of his management of the U.S. economy continues to grow. A recent poll shows only 37% of Americans approve of the president’s economic handling, down from 42% at his inauguration on January 20.

Since taking office, Trump has pursued a bold economic agenda, introducing tariffs on key trading partners aimed at reshaping trade relations. These actions have led to increased tensions and significant declines in financial markets, marking the worst selloff since the early days of the COVID pandemic.

James Pethokoukis, a senior fellow at the American Enterprise Institute, expressed concern over the president’s policies, stating, “You have a president who promised a golden age, but everything that’s supposed to be up is down, everything that’s supposed to be down is up.”

Public sentiment reflects a bleak outlook; three-quarters of respondents in the latest poll worry about a looming recession, with many citing Trump’s tariff policies as a potential cause. Nearly 56% of Americans consider his economic maneuvers “too erratic,” including one in four Republicans.

The benchmark S&P 500 index is currently about 14% lower than its February peak, contributing to public anxiety about future investments and stability. Consumer prices have surged 2.5% in the year through February, exceeding the Federal Reserve‘s target.

Despite the mounting criticism, Trump’s overall approval rating remains at 42%, supported largely by 81% of self-identified Republicans. The president’s immigration policies have also retained a solid backing among his base.

However, even within his party, concerns are rising; about a third of Republicans feel their cost of living is on the wrong track. Moreover, the reliability of the Social Security system is another significant concern, with 75% of respondents fearing its stability amid potential government cuts.

Banking giant JP Morgan anticipates a recession this year, largely attributing it to Trump’s tariffs, which have prompted retaliatory measures from other countries. This has raised eyebrows within the White House, especially as Trump has suggested the economy could slow further without rate cuts from Federal Reserve Chair Jerome Powell.

As the nation approaches the milestone of 100 days in Trump’s presidency, the economic landscape looks increasingly turbulent. With surveys revealing widespread discontent and a significant portion of the public expressing skepticism about future stability, questions arise about the impact on his presidency and the Republican Party’s strategy moving forward.