Business

Trump Signs Executive Order for Strategic Bitcoin Reserve to Shift U.S. Crypto Policy

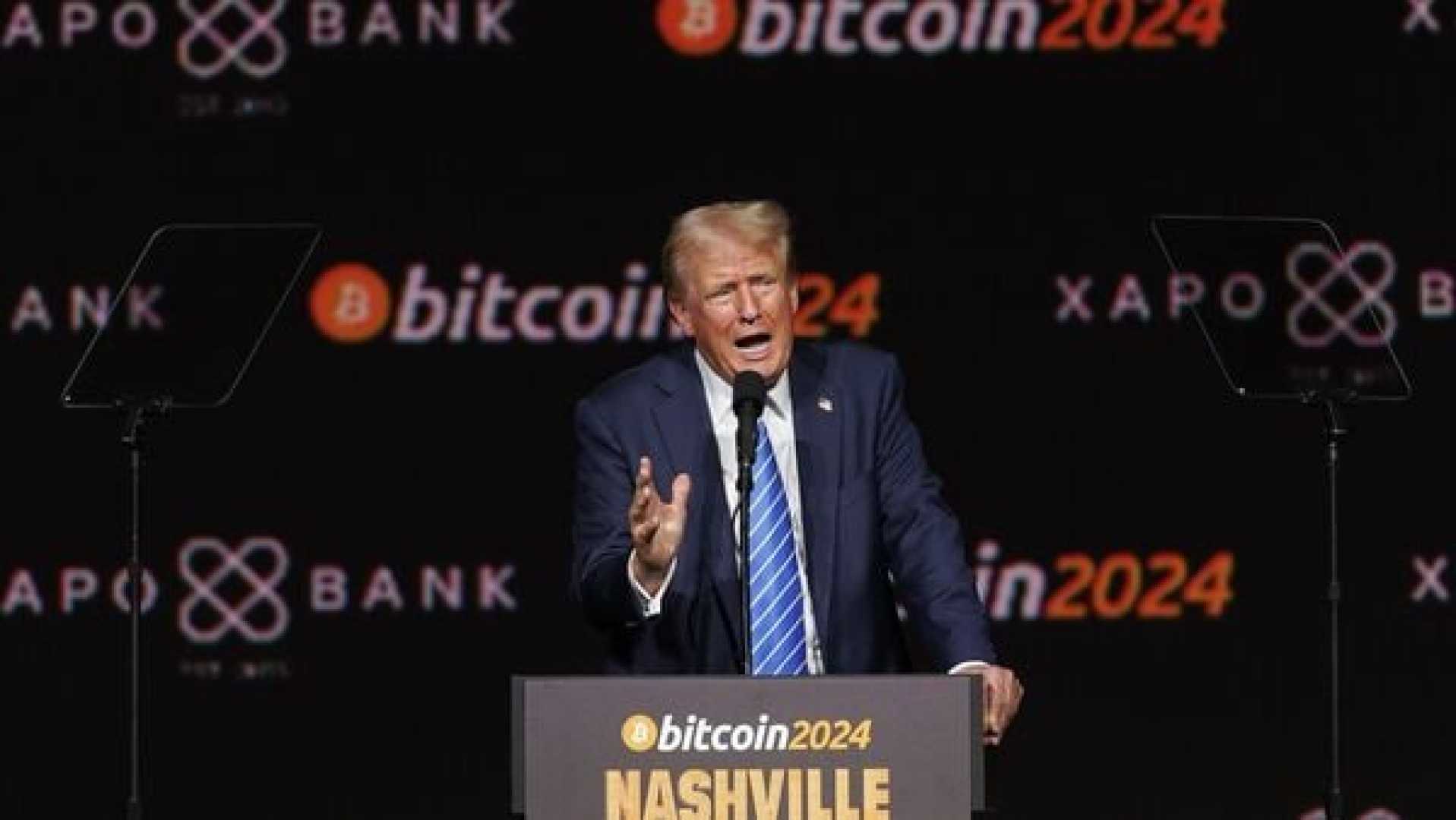

WASHINGTON, D.C. — President Donald Trump signed an executive order on March 6, 2025, creating a Strategic Bitcoin Reserve, marking a significant pivot in the United States’ digital asset policy. This new initiative is intended to stockpile cryptocurrency seized through criminal and civil forfeiture, with the goal of providing financial security without taxing American citizens.

The order specifies that the reserve will exclusively use approximately 200,000 bitcoins currently controlled by the U.S. government, ensuring that taxpayers will not incur costs associated with the reserve. According to David Sacks, the White House Crypto Czar and a Silicon Valley venture capitalist, the reserve will act as a permanent store of value.

“The U.S. will not sell any bitcoin deposited into the Reserve,” Sacks stated, emphasizing a commitment to treating it as a digital equivalent of Fort Knox. This aligns with previous criticisms regarding the government’s sale of seized bitcoin, which is estimated to have cost taxpayers approximately $17 billion in unrealized value.

In addition to bitcoin, Trump’s order also designated a U.S. Digital Asset Stockpile, managed by the Treasury Department, to hold additional cryptocurrencies confiscated through legal actions. Notably, this initiative follows Trump’s announcement that other cryptocurrencies, including ether, XRP, Solana, and Cardano, may also be included in future plans.

This announcement has generated varied responses within the cryptocurrency community. Tyler Winklevoss, a prominent bitcoin investor, voiced support for a bitcoin-only reserve, stating, “Only one digital asset in the world right now meets the bar, and that digital asset is bitcoin.”

Critics, including Nic Carter from Castle Island Ventures, argue that a bitcoin-only strategy would legitimize bitcoin as a significant global asset. “The U.S. is clearly the most important nation in the world, and so their stamp of approval really does a lot for bitcoin,” said Carter.

Conversely, Ryan Gilbert, a fintech investor, concerns linger regarding the government’s management of the reserve. “What we don’t want to see is the U.S. actively trading bitcoin,” he cautioned. “A reserve should be a long-term store of value, not something that introduces market-moving speculation.”

The executive order comes as Trump prepares to meet with industry leaders at the White House for a crypto summit. This forum is expected to showcase discussions aimed at outlining a broader strategy for U.S. digital assets, including potential policies for managing both the bitcoin reserve and other cryptocurrencies.

While the executive order attempts to advance the United States’ position as a leader in the digital asset space, reactions from various stakeholders highlight ongoing tensions between innovation and regulation. Some advocates believe that the reserve could offer taxpayers a stake in crypto market growth, while skeptics warn of the potential volatility associated with cryptocurrencies.

Amid all these developments, the cryptocurrency market has exhibited reactions to the news, with fluctuations observed in the prices of the mentioned digital assets. Each of the five cryptocurrencies that Trump indicated as potential reserve assets saw a spike in value following the initial announcement.

This initiative represents a crucial moment in U.S. cryptocurrency policy, with the administration aiming to position the nation as the “crypto capital of the world.” As discussions progress, the delicate balance between leveraging digital assets for governmental benefits and ensuring fiscal responsibility will remain at the forefront of legislative considerations.