Business

Trump’s Tariffs: What They Mean for U.S. Trade and Global Markets

NEW YORK, March 4, 2025 — Since President Donald Trump‘s re-election, new tariffs have been imposed on various imported goods, impacting trade relations with countries including China, Mexico, and Canada. These tariffs aim to protect U.S. jobs and manufacturing while addressing issues like illegal drug trafficking. However, they have sparked considerable global debate and reactions.

In response to a question from a constituent about executive power, Natalie Sherman, a business reporter in New York, noted that while Congress remains in session, much authority regarding trade has been delegated to the President since the 1930s. “Though there have been discussions about reclaiming power, the Republican-controlled legislature currently supports Trump’s trade actions,” she explained, emphasizing the role of national security in justifying these tariffs.

Clarifying the specifics of tariffs on solar panels from China, Laura Bicker, China correspondent in Beijing, stated that tariffs on solar cells have doubled under the Biden administration from 25% to 50%. “This move aims to bolster U.S. solar manufacturing as global demand, particularly from China, continues to dominate,” she commented.

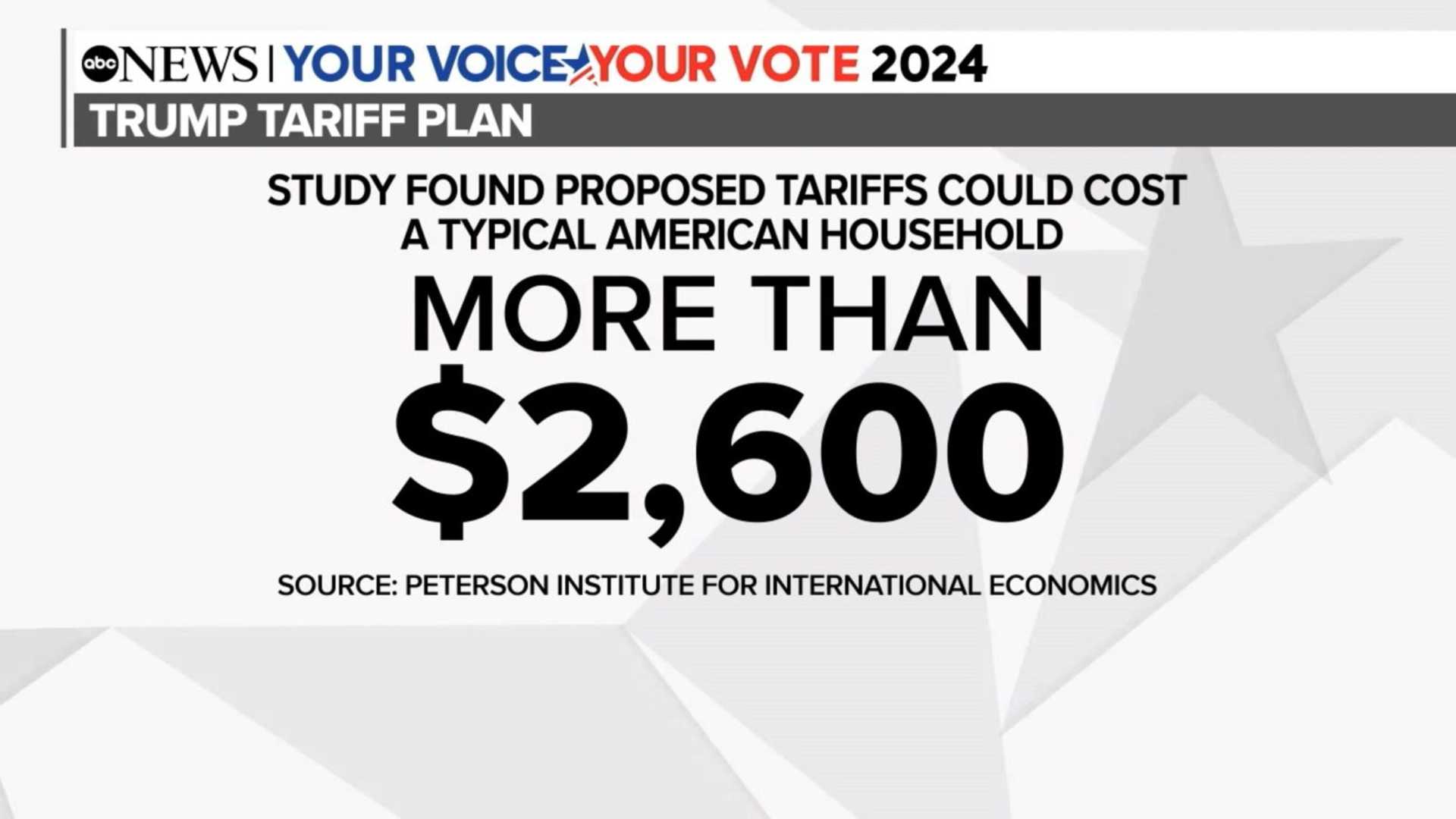

On the domestic front, questions arose regarding price inflation. Sherman reported findings from the U.S. International Trade Commission indicating that past tariffs on steel and aluminum led to an average price increase of 2.4% and 1.6%, respectively. Senator Elizabeth Warren voiced concerns that families might face higher prices from domestic producers capitalizing on increased demand due to tariffs.

In assessing impacts on emerging markets, Chief Economics Correspondent Dharshini David addressed the potential for countries like Vietnam and Malaysia to gain manufacturing advantages as American firms reassess their supply chains in response to tariffs targeting China.

Responding to inquiries about the public perception of tariffs among Republicans, Sherman revealed survey results indicating strong support among conservatives for such measures, despite apprehensions about resultant price hikes. “More than 80% of conservatives back tariffs on China, showcasing a divide in economic philosophy within the party,” she stated.

As companies adapt to the shifting trade landscape, some firms are considering relocating production away from China. “The trend of companies moving operations to countries like Vietnam has increased since tariffs were implemented,” noted Laura Bicker, signaling ongoing shifts in global trade practices.

Regarding global economic repercussions, economic correspondent Nikhil Inamdar shared uncertainties about the long-term effects of tariffs on international markets, highlighting that no definitive estimates are available for anticipated GDP impacts yet. He pointed out that historical data suggests trade wars typically inflate prices and suppress overall economic growth.

Reflecting on public sentiment about the administration’s tariffs, responses to questions from consumers raised concerns over the immediate effect on prices. “Retailer Target indicated potential increases in the prices of items within days due to tariffs, particularly on imports with shorter lead times,” Sherman reported, emphasizing consumer conditions amid the fluctuating marketplace.

In conclusion, as Trump’s administration leverages tariffs as a tool for economic policy, the broader implications for domestic consumers and international relations remain to be fully understood. With ongoing dialogues across various platforms, the months ahead could deliver critical insights into the efficacy of these measures.