Understanding Roth IRAs: Contribution Limits, Income Restrictions, and Benefits for 2025

Roth Individual Retirement Accounts (IRAs) are a popular choice for retirement savings due to their tax-free growth and withdrawal benefits. Here are some key points to consider for 2025.

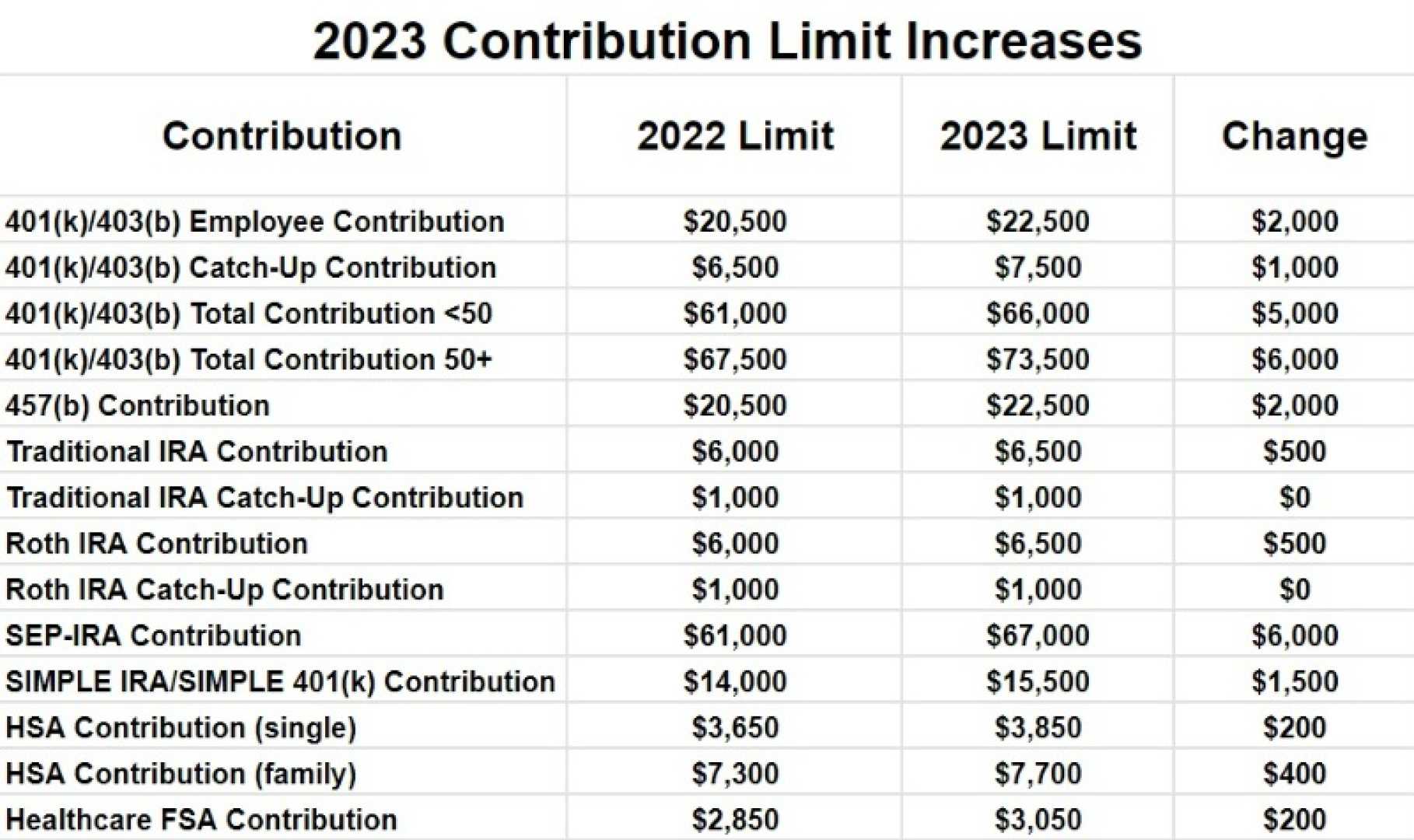

For the tax year 2025, the contribution limit for Roth IRAs remains at $7,000, with an additional $1,000 catch-up contribution available for those aged 50 and older. It is important to note that you can contribute to a Roth IRA at any age, as long as you have earned income and do not exceed the income limits set by the IRS.

The IRS has established income limits for Roth IRA contributions. For single tax filers, contributions are phased out between $150,000 and $165,000, and for married couples filing jointly, the phase-out range is $236,000 to $246,000. If your income exceeds these limits, you may not be eligible to contribute to a Roth IRA or your contributions may be reduced.

Roth IRAs offer significant tax benefits. Contributions are made with after-tax dollars, so there is no upfront tax deduction, but the earnings and withdrawals are tax-free if certain conditions are met. Specifically, withdrawals of earnings are tax-free if you are at least 59½ years old and have had a Roth IRA for at least five years. Additionally, there are no required minimum distributions (RMDs) during your lifetime, making Roth IRAs ideal for wealth transfer.

Another advantage of Roth IRAs is their flexibility in withdrawals. You can withdraw your contributions at any time without penalty or taxes. For earnings, withdrawals are tax-free if they meet the qualified distribution criteria, such as being taken after age 59½ or for a first-time home purchase.

For those considering a Roth IRA, it is also worth noting the potential for significant long-term growth. Over 30 years, investing the annual maximum into a Roth IRA could result in substantial tax-free growth, assuming historical market returns.