Business

Vertex Pharmaceuticals (VRTX) Stock Outlook: Analyst Forecasts and Recent Performance

As of the latest trading sessions, Vertex Pharmaceuticals Incorporated (VRTX) stock has been under scrutiny due to recent developments and analyst forecasts. The stock closed at $469.22 on December 16, 2024, which is near its 52-week high of $519.88, indicating potential for further appreciation depending on market conditions.

Analyst consensus ratings suggest a “Moderate Buy” for VRTX, with 18 out of 31 analysts recommending a buy, one recommending a strong buy, nine recommending a hold, and three recommending a sell. The average price target from these analysts is $505.73, representing an 8.04% upside from the current price.

Vertex Pharmaceuticals has recently reported strong quarterly earnings, with earnings per share of $4.38, surpassing the consensus estimate by $0.77. The company also saw a year-over-year revenue increase of 11.6%, reaching $2.77 billion, which highlights its growing market presence and successful product offerings. Additionally, the company maintains a low debt-to-equity ratio of 0.01, indicating a strong balance sheet and reduced financial risk.

However, there are also bearish sentiments. The company has a negative return on equity of 1.91% and a negative net margin of 4.52%, indicating challenges in profitability. The PE ratio of -233.23 suggests that the company is currently not generating profits relative to its stock price, making it a riskier investment. Despite recent revenue growth, the company is projected to post an EPS of -1.83 for the current fiscal year, which may signal ongoing financial difficulties.

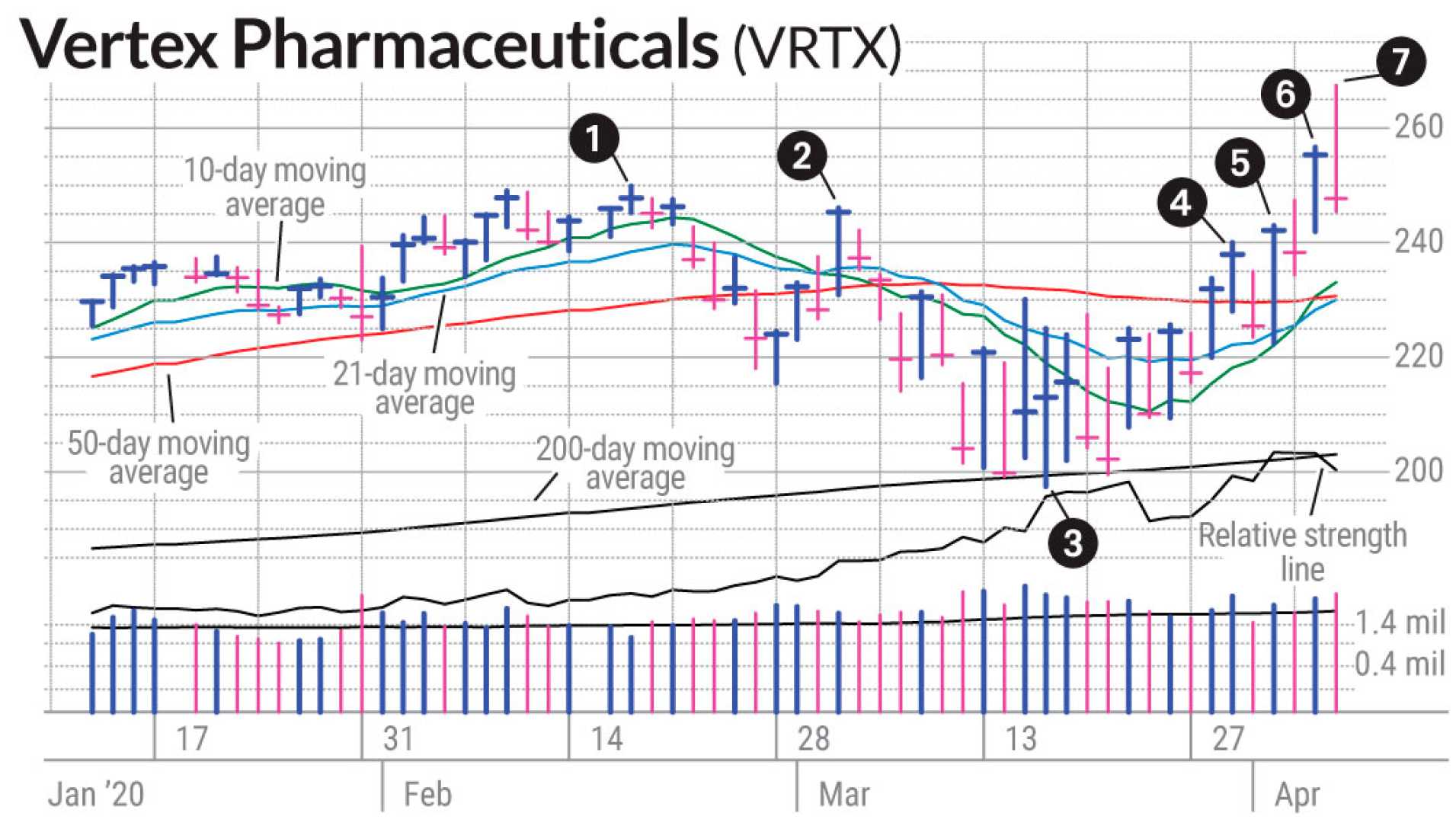

In terms of technical analysis, the stock is expected to rise within a strong rising trend in the short term. There is a general buy signal from the relation between the short-term and long-term moving averages, and the stock is expected to rise by 23.64% over the next three months with a 90% probability of holding a price between $560.90 and $625.40 at the end of this period.

Recent volatility has been noted, with the stock experiencing daily movements of up to 2.38%. The recommended stop-loss level is at $453.87, which is a 4.25% drop from the current price. This volatility, combined with mixed analyst sentiments, underscores the need for careful consideration by potential investors).