Business

Vertiv Sees Surge in Revenue as AI Demand Boosts Growth

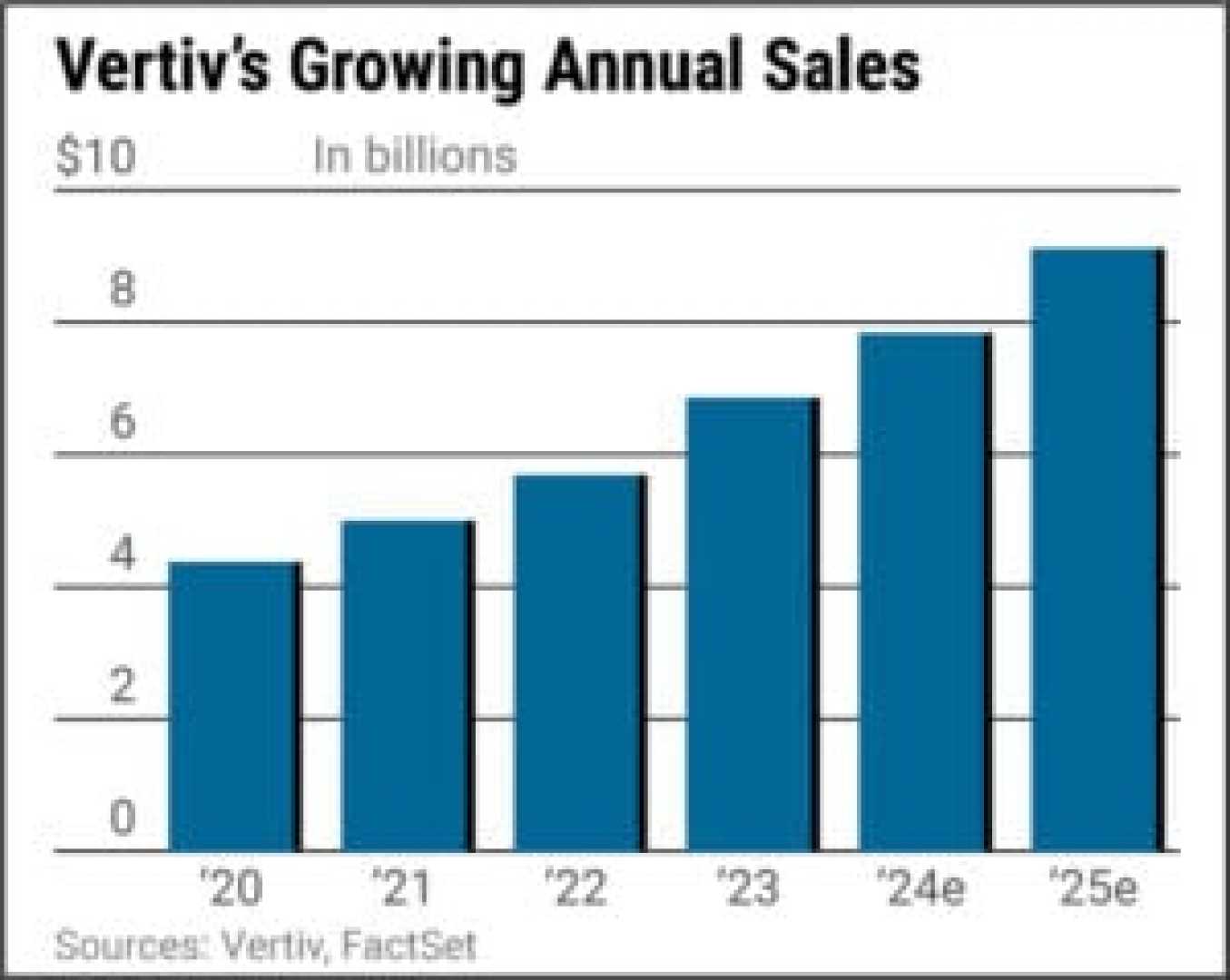

Columbus, Ohio – Vertiv Holdings Co reported a remarkable third quarter, posting a 29% increase in revenue to $2.67 billion, driven largely by unprecedented demand for AI-ready data center infrastructure.

The company’s success comes amidst a global surge in AI investments, significantly enhancing expenditures in data centers. Vertiv’s adjusted earnings per share surged 63% to $1.24, far exceeding analyst predictions. Organic orders also jumped 60% compared to the previous year, indicating strong market confidence.

Growth was particularly evident in the Americas, with revenues rising 43%, while the Asia-Pacific region recorded a healthy 20% increase. Vertiv’s efforts to streamline operations have led to improved profit margins, prompting the company to raise its earnings outlook for 2025 to a range of $4.13 per share.

Analysts remain optimistic about Vertiv’s future, with 22 of 27 rating the stock as a ‘buy’ or ‘strong buy.’ This positive sentiment comes despite the company’s shares currently trading at a higher price-to-earnings ratio of 38, up from 32 last quarter.

The demand for AI infrastructure has not only benefited Vertiv but also has kept tech stocks in the spotlight. The company’s expansion and strong quarterly results reflect broader optimism in the technology sector, as global digital transformation accelerates.

Vertiv’s upcoming third-quarter earnings report on October 22, 2025, is anticipated to show further growth, with projections indicating revenues between $2.51 billion and $2.59 billion.