Business

Walmart’s Q3 Earnings Report: A Key Indicator of U.S. Consumer Health and Retail Sector Performance

Walmart Inc. (NYSE: WMT) is set to release its highly anticipated third-quarter earnings report on Tuesday, November 19, before the market opens. This report is expected to provide significant insights into the health of U.S. consumers and the broader retail landscape, particularly as the holiday shopping season begins.

The earnings report from Walmart, along with Target‘s report scheduled for Wednesday, will offer a snapshot of consumer spending habits and sentiment. Recent retail data indicates that Americans have been increasing their spending, especially in “fun” categories such as electronics and restaurants, ahead of the holiday season. This uptick in spending is partly attributed to lower energy prices, which have freed up more dollars for discretionary spending.

Walmart and Target collectively accounted for over $140 billion in U.S. sales in their latest quarters and are expected to generate more than $470 billion in revenue during the holiday quarter, according to Visible Alpha estimates. The reports will also update their outlooks for the holiday period, which is crucial given the current economic conditions.

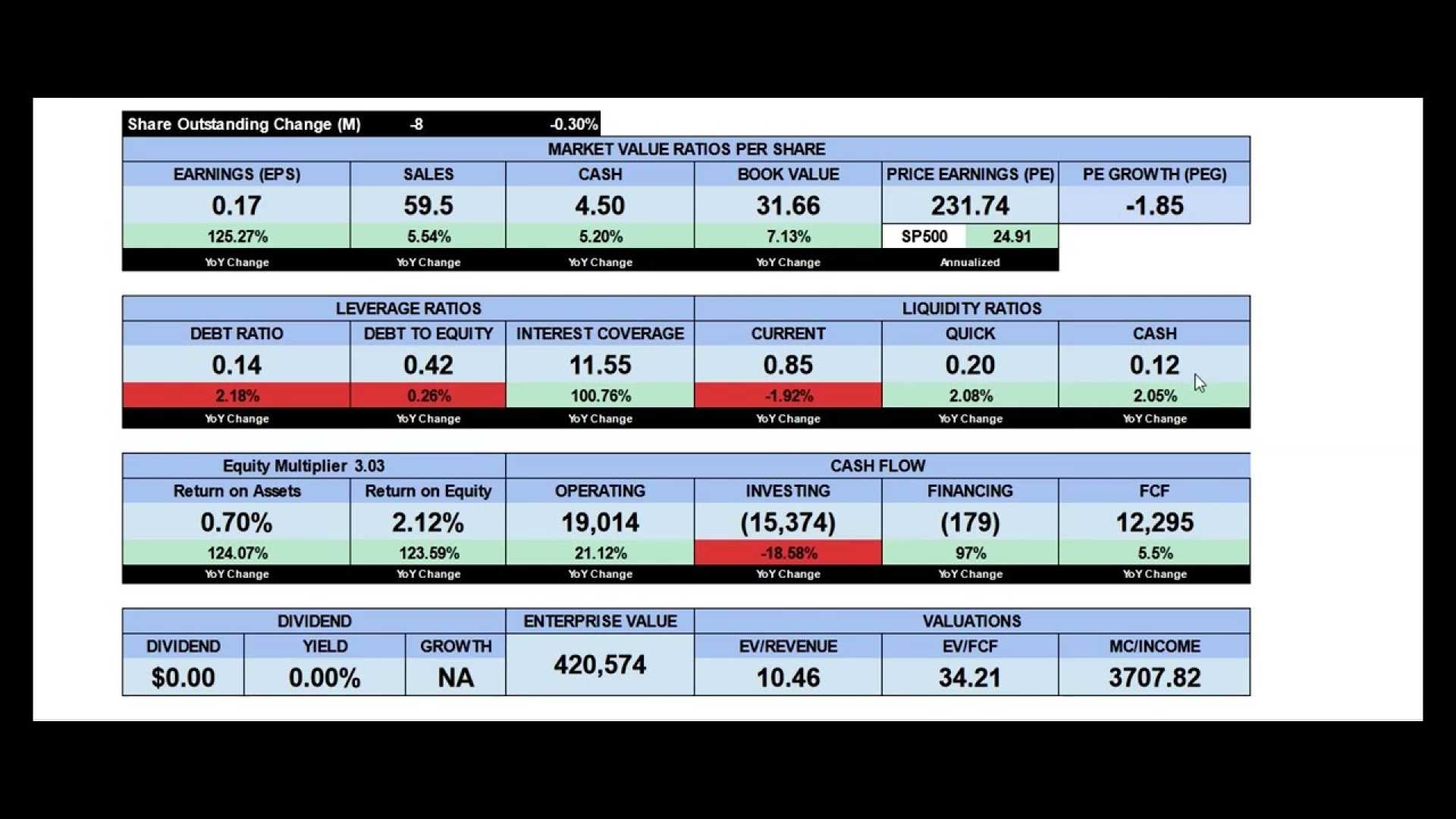

Walmart’s stock has been resilient, supported by its strong market positioning and diversified revenue streams. The company has seen a 64.52% rally in its share price over the past year, outperforming the S&P 500 Consumer Staples sector. Analysts have a strong buy consensus rating on WMT stock, with an average price target of $86.43 per share, indicating potential upside from current levels.

The company’s ability to attract both budget-conscious and higher-income consumers through its low-cost model and services like Walmart+ membership and delivery has been a key factor in its success. However, Walmart faces intense competition from Amazon, particularly in non-grocery categories, and must manage rising costs in logistics and labor to maintain its margins.

Investors will closely watch Walmart’s ability to manage expenses, its digital transformation efforts, and its healthcare expansion, including the rollout of same-day prescription delivery services. These factors are expected to drive long-term growth and influence the stock’s performance in the coming quarters.

As the holiday shopping season kicks off, Walmart has already begun its Black Friday promotions, which are expected to boost foot traffic and online sales. The company’s strategic focus on innovation, operational efficiency, and customer engagement positions it well for a strong Q4 outlook.