Business

Warner Bros. Discovery Faces Bidding War Amid Strategic Split Plans

Los Angeles, CA — Warner Bros. Discovery (WBD) is currently navigating a competitive bidding process for its assets, drawing interest from several high-profile buyers.

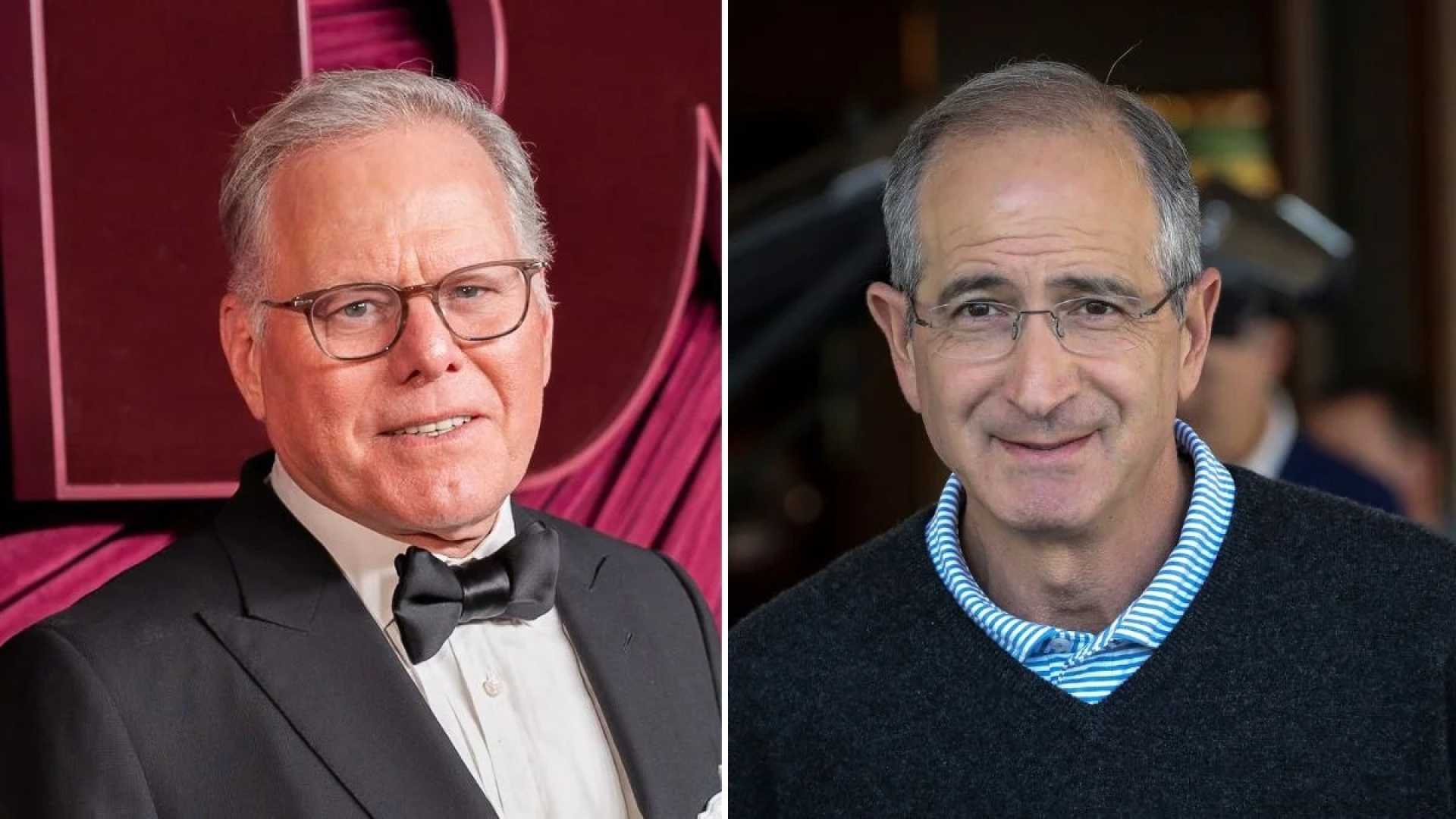

A major shareholder and former director of WBD, who has been a mentor to CEO David Zaslav, compared the bidding situation to the parable of The Blind Men and the Elephant. “We have three or four aggressive bidders. They each are seeing a different elephant,” he told CNBC on November 13, 2025. He emphasized that different companies see unique opportunities in WBD, whether it’s for social media, streaming, or film production.

WBD is reportedly fielding offers from Netflix and Comcast, who have enlisted investment banks to assess potential bids for the studio and its streaming division. Additionally, Amazon-MGM is exploring its options. Zaslav has acknowledged multiple parties interested in different segments of the company, asserting that there is “an active process underway.”

The only formal offer publicly noted has come from Paramount. The unnamed shareholder expressed that if Netflix acquires WBD, it would likely lead to increased activity in Hollywood rather than disruptions. “You’d have essentially more activity than less,” he stated.

Discussion over regulatory hurdles adds a layer of complexity. “Regulatory outcomes are very hard to handicap because there is a political element in it,” he explained, noting the differing international and domestic regulations.

WBD, which has faced a significant debt load following its merger of Discovery and WarnerMedia, is also pursuing plans to split its operations into streaming and studios, and global linear networks. “David and his team did a wonderful job of getting the company organized so that it could split,” the shareholder remarked.

He noted that the unexpected offers, particularly from Paramount, have complicated the previously straightforward process of re-organizing WBD’s balance sheet. This strategic split aims to address financial challenges while refining the company’s focus.

Amid these developments, the shareholder has not shied away from critiquing CNN, attributing a liberal bias to the network and inciting backlash from its staff.