Business

Warren Buffett-Backed Apple Inc Receives Strong Ratings Based on Guru Investment Strategy

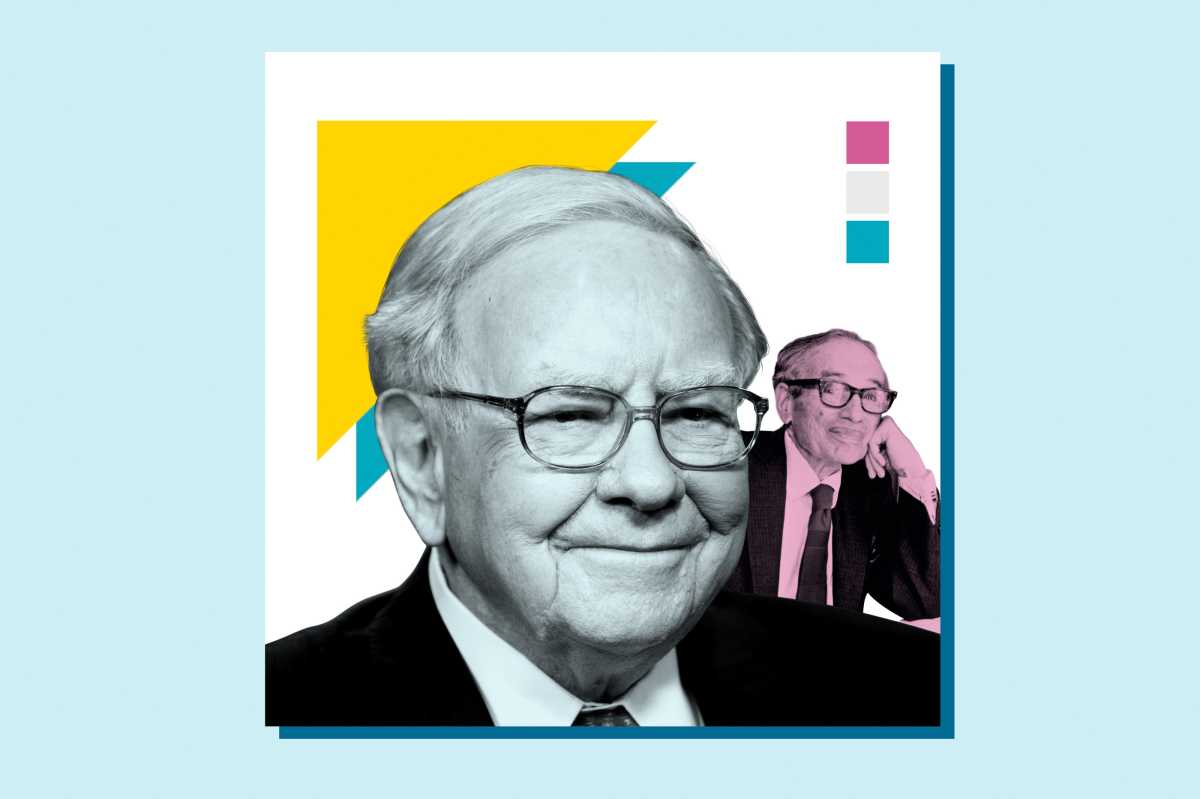

Renowned investor Warren Buffett‘s Berkshire Hathaway has long been associated with successful investments and outperforming the market. One of the key investments in the Berkshire portfolio is technology giant Apple Inc, which has recently received strong ratings based on a guru investment strategy.

Apple Inc, a leading player in the Communications Equipment industry, has stood out in terms of long-term profitability, low debt levels, and reasonable valuations, aligning with the criteria set by the investment strategy.

With a score of 100%, Apple Inc has demonstrated predictability in earnings, efficient debt service, strong return on equity and total capital, healthy free cash flow, and strategic use of retained earnings and share repurchase.

Warren Buffett, who is known for his modest lifestyle and long-term investment approach, has built a reputation as one of the greatest investors of all time. His fortune, estimated by Forbes at $37 billion, reflects his consistent ability to outperform the market.

Despite his wealth, Buffett’s primary residence remains a humble home in Nebraska, which he bought for $31,500 nearly five decades ago. His down-to-earth demeanor and simple pleasures like cherry Coke, good burgers, and a good book have endeared him to many.