People

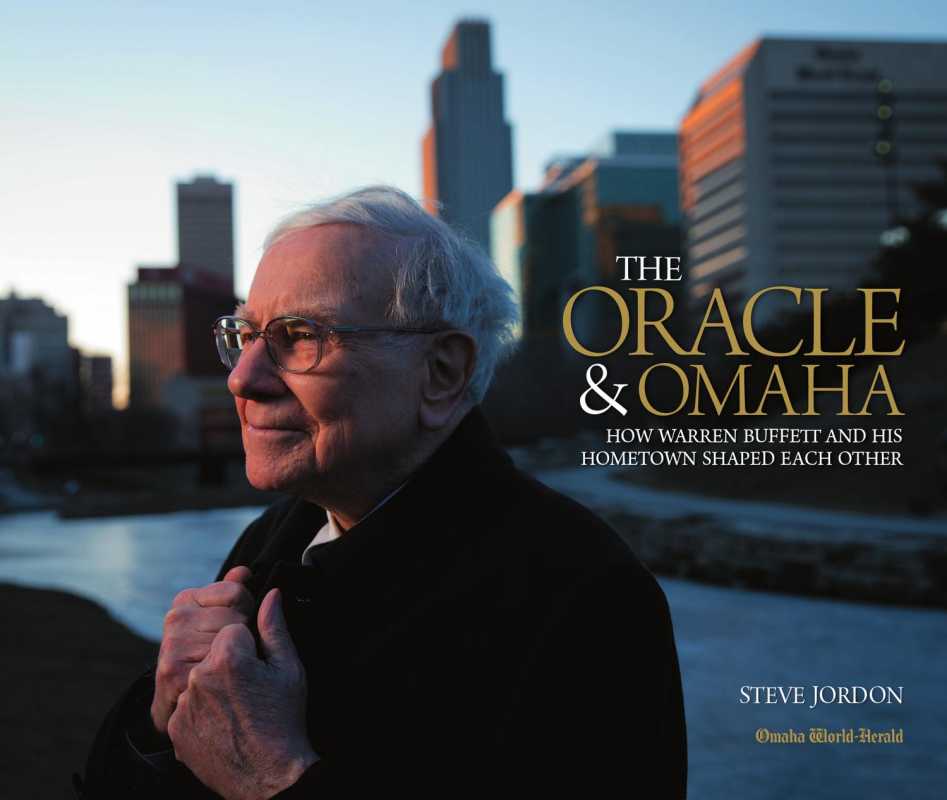

Warren Buffett: The Oracle of Omaha

Table of Contents

- Introduction

- Early Life and Education

- Investment Genius and Strategy

- Philanthropy

- Key Takeaways

- Interesting Facts about Warren Buffett

- Frequently Asked Questions

Introduction

Warren Buffett is widely known as one of the most successful investors in the world, often referred to as the Oracle of Omaha. Born on August 30, 1930, in Omaha, Nebraska, Buffett has built an immense fortune through his intelligent investment decisions and disciplined approach to value investing.

Early Life and Education

Buffett developed an early interest in business and investing. He started his first business at the age of 13, delivering newspapers. He displayed an entrepreneurial spirit throughout his childhood, and his knack for numbers became evident at an early age.

Buffett graduated from the University of Nebraska-Lincoln with a Bachelor of Science degree in Business Administration. He then went on to pursue a Master’s degree in Economics from Columbia Business School. It was during his time at Columbia that he studied under the legendary investor Benjamin Graham, whose investment philosophy greatly influenced Buffett’s approach.

Investment Genius and Strategy

Buffett’s investment strategy revolves around value investing, which involves seeking out undervalued companies with strong fundamentals and long-term growth potential. He looks for businesses with sustainable competitive advantages and stable cash flows.

For many years, Buffett served as the chairman and CEO of Berkshire Hathaway, a multinational conglomerate holding company. Under his leadership, Berkshire Hathaway has become one of the most successful and valuable companies globally. Buffett’s ability to spot lucrative investment opportunities, such as Coca-Cola, American Express, and Apple, has cemented his reputation as a true investment genius.

Buffett is known for his long-term perspective, often holding onto stocks for decades. He believes in the power of compounding and advises against frequent trading, emphasizing the importance of patience and sound decision-making in the investing world.

Philanthropy

Warren Buffett has shown a tremendous commitment to philanthropy throughout his career. In 2006, he pledged to donate the majority of his wealth to charity, primarily through the Bill and Melinda Gates Foundation. This incredible act of generosity has inspired other billionaires to follow suit and contribute their wealth for the greater good.

Buffett’s philanthropic efforts have focused on causes such as healthcare, poverty alleviation, and education. His dedication to giving back has helped make a significant impact on global issues and has earned him admiration and respect worldwide.

Key Takeaways

- Value Investing: Warren Buffett is a proponent of value investing, which involves finding undervalued companies with strong fundamentals.

- Long-Term Perspective: Buffett believes in holding onto investments for the long term to benefit from the power of compounding.

- Philanthropy: He has pledged to donate a significant portion of his wealth to charitable causes, setting an example for others.

Interesting Facts about Warren Buffett

Here are some fascinating facts about Warren Buffett:

| Nickname | The Oracle of Omaha |

| Net Worth | As of 2021, his net worth is estimated to be over $100 billion. |

| Annual Letters | Buffett writes an annual letter to Berkshire Hathaway shareholders, sharing his insights and thoughts on the economy and investments. |

| Favorite Drink | He enjoys drinking Cherry Coke, a brand owned by his investment company, Berkshire Hathaway. |

Frequently Asked Questions

1. How did Warren Buffett become so successful?

Warren Buffett became successful through his disciplined value investing approach, keen investment insights, and long-term perspective. He has focused on identifying undervalued companies with strong fundamentals and holding onto them for the long term.

2. What is Warren Buffett’s net worth?

As of 2021, Warren Buffett’s net worth is estimated to be over $100 billion, making him one of the wealthiest individuals in the world.

3. How does Warren Buffett select his investments?

Warren Buffett looks for businesses with sustainable competitive advantages, strong cash flows, and long-term growth prospects. He prefers undervalued companies with a margin of safety and a management team that he trusts.

4. What is Warren Buffett’s investment philosophy?

Warren Buffett’s investment philosophy revolves around value investing and adopting a long-term perspective. He believes in buying quality assets at reasonable prices and allowing time and compounding to work their magic.

5. How does Warren Buffett approach philanthropy?

Warren Buffett is a committed philanthropist and has pledged to donate the majority of his wealth to charity. He primarily channels his philanthropic efforts through the Bill and Melinda Gates Foundation and focuses on causes such as healthcare, poverty alleviation, and education.

In conclusion, Warren Buffett’s remarkable success as an investor, coupled with his dedication to philanthropy, has made him an influential figure in both the financial and philanthropic sectors. His investment genius, disciplined approach, and long-term perspective continue to inspire aspiring investors worldwide.