Business

D-Wave Quantum Stock Faces Potential Correction Amid Overstretched Enthusiasm

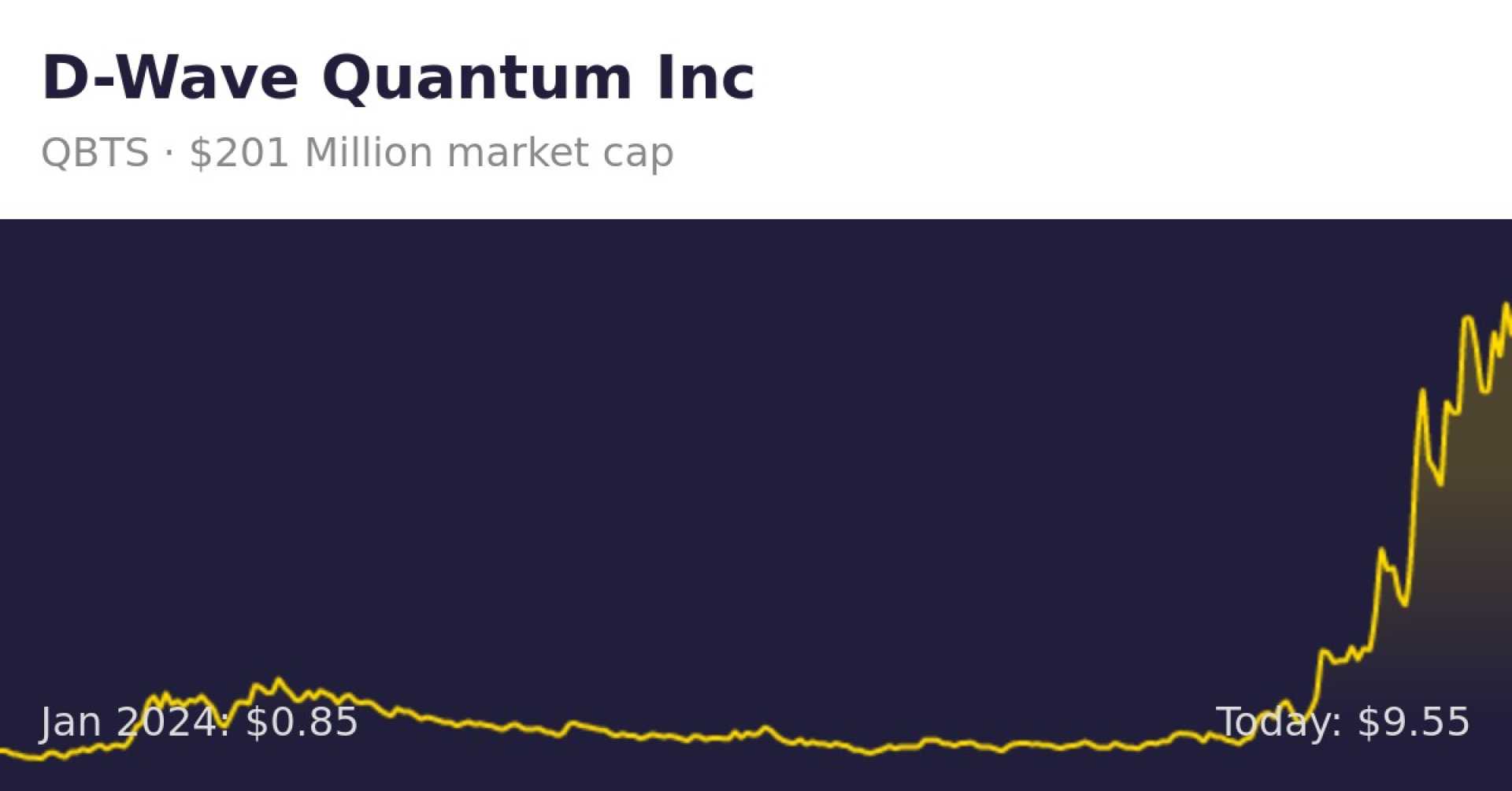

D-Wave Quantum Inc. (QBTS), a leader in quantum computing, has seen its stock surge dramatically in recent months, driven by investor enthusiasm for the transformative potential of quantum technology. However, analysts are warning that the stock’s rapid ascent may be overstretched, with a potential correction on the horizon.

Quantum computing, which leverages the principles of quantum mechanics to perform complex calculations far beyond the capabilities of traditional supercomputers, has captured the imagination of investors. D-Wave Quantum, along with other players in the sector, has benefited from this optimism. Google‘s recent unveiling of its Willow quantum chips has further fueled interest in the industry.

Despite the excitement, D-Wave’s financials tell a different story. In 2022, the company reported revenue of $7.17 million, which grew to $8.76 million in 2023, a modest 22.2% increase. Over the trailing 12 months, revenue stood at $9.42 million, reflecting a growth rate of just 7.53%. In the third quarter of 2024, revenue declined by nearly 27% year-over-year to $1.87 million, raising concerns about the company’s near-term prospects.

Technical indicators also suggest caution. While D-Wave’s stock has seen a parabolic rise, with a 228.15% return over four weeks in late 2024, such rapid gains are often followed by corrections. Historical data shows that similar surges in QBTS stock have typically been followed by pullbacks, making a near-term downturn likely.

Analysts recommend a Bear Put Spread strategy for investors looking to hedge against a potential correction. This involves buying a Put option at a higher strike price and selling a Put at a lower strike price, limiting downside risk while positioning for a decline. For QBTS, the 10/8 Bear Put Spread for options expiring on January 31, 2025, is seen as a viable strategy, given the stock’s repeated failure to break past the $10 level and its support at $8.

Wall Street remains cautiously optimistic, with a Strong Buy consensus rating for QBTS based on five Buy recommendations and no Sell ratings. However, the average price target of $4.19 implies a 56.13% downside risk, highlighting the disparity between the stock’s current valuation and its fundamentals.

While the long-term potential of quantum computing remains undeniable, the near-term outlook for D-Wave Quantum suggests that a correction may be overdue. Investors are advised to tread carefully, balancing their enthusiasm for the sector’s promise with a realistic assessment of market dynamics.