Business

Why Bitcoin May Be Grossly Undervalued at Current Prices

Despite its current value of around $60,000, Bitcoin is being considered significantly undervalued by many analysts. Several factors are cited as potential drivers for its future appreciation. One key aspect is the anticipated transfer of wealth from older generations to younger ones, such as millennials and Gen Z, who are more inclined to invest in decentralized digital currencies like Bitcoin. This demographic shift could lead to a significant surge in demand for Bitcoin.

The increasing integration of technology and the transformation of societal perceptions of money also play crucial roles. Unlike conventional financial systems, which are often centralized and sluggish, Bitcoin offers a decentralized and secure solution that aligns with the digital era. This decentralized nature, operating on the most expansive and secure network without any single controlling entity, makes Bitcoin a unique asset for value preservation.

The escalating government debt and inflation are also highlighted as critical factors. Governments are accumulating unprecedented levels of debt and are increasingly resorting to inflation as a strategy to manage these financial burdens. This dynamic could position Bitcoin as a preferred asset for safeguarding wealth, given its limited supply of 21 million coins and its resistance to external manipulation or mismanagement.

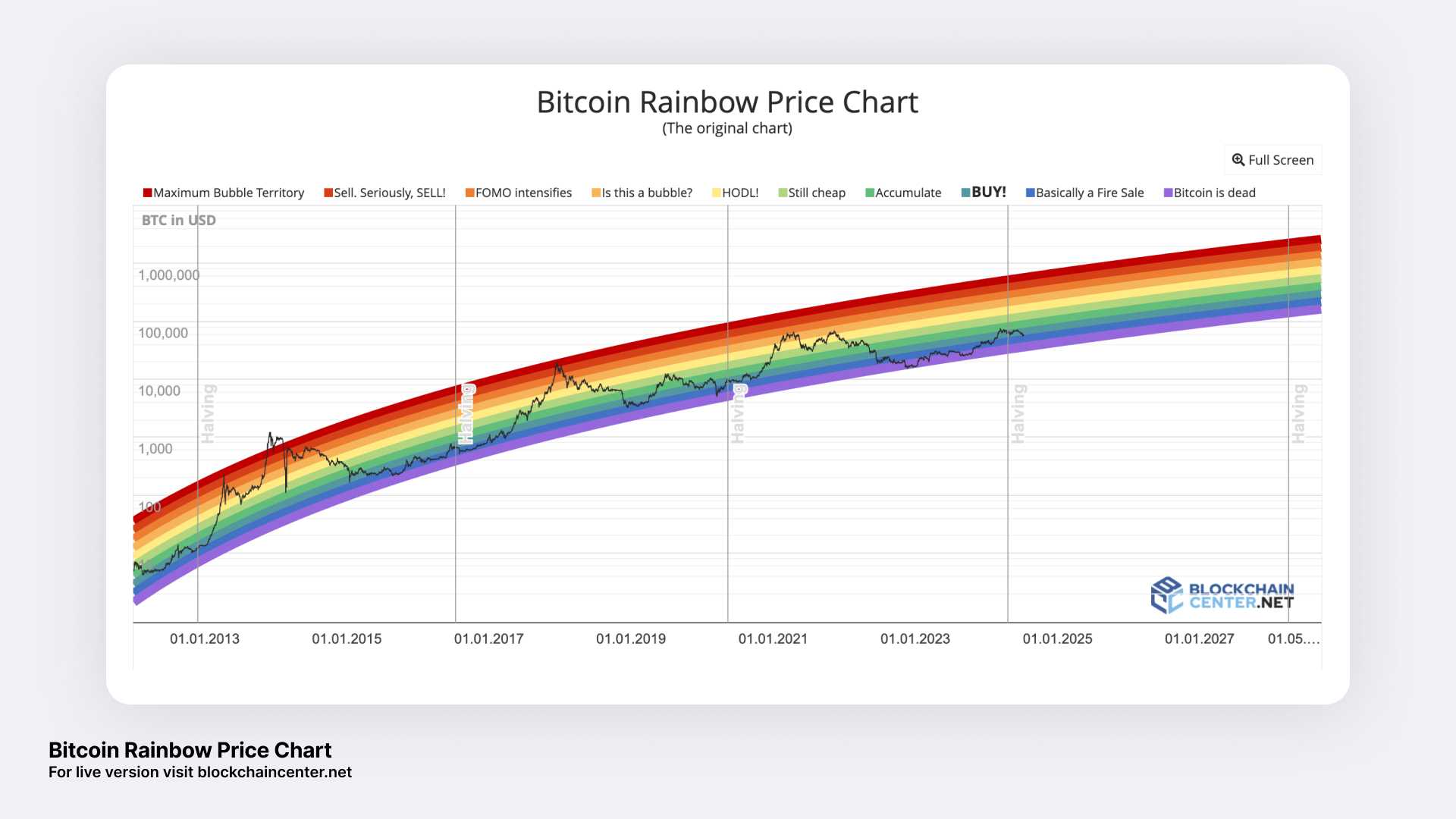

Proponents of Bitcoin, such as Michael Saylor, CEO of MicroStrategy, believe that the cryptocurrency will continue to ascend in value over time. Saylor’s firm has converted its cash reserves into Bitcoin, reflecting a strong belief in its long-term potential. Given Bitcoin’s performance over the last 15 years, this viewpoint suggests that the current price of around $60,000 may be an opportune moment to invest before it potentially rises further.

In summary, the combination of demographic shifts, technological advancements, and economic factors such as government debt and inflation make a strong case for why Bitcoin could be undervalued at its current price.