Business

Workday Reports Robust Revenue Growth as Fiscal 2026 Begins

PLEASANTON, Calif., May 22, 2025 /PRNewswire/ — Workday, Inc. (NASDAQ: WDAY), a leader in AI-driven enterprise solutions, announced significant financial results for the first quarter of fiscal 2026, ending April 30, 2025. The company reported a total revenue of $2.240 billion, reflecting a 12.6% increase compared to the same period last year.

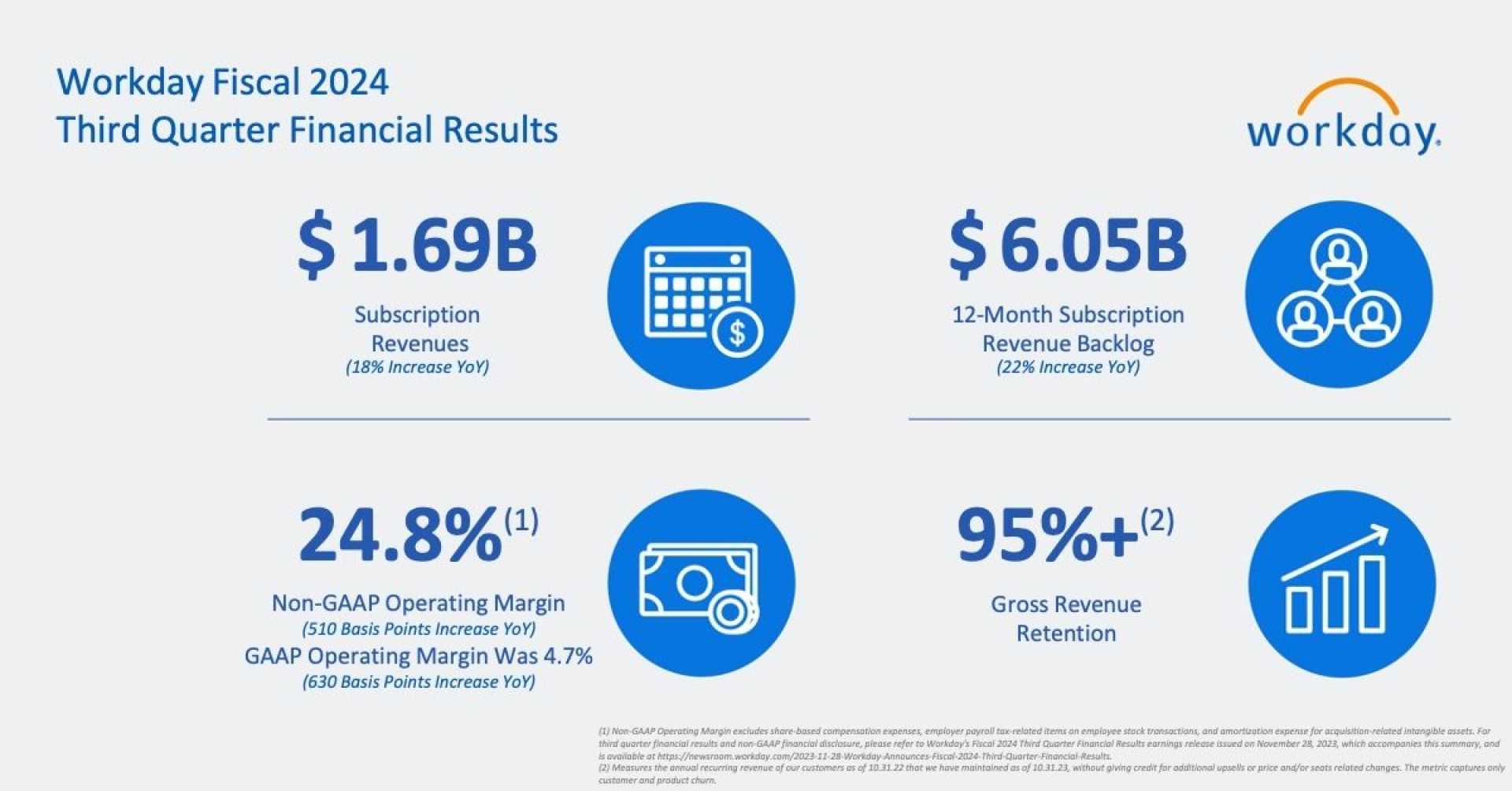

Subscription revenues reached $2.059 billion, marking a 13.4% growth year-over-year, underscoring the strong demand for Workday’s innovative AI platform. Despite this growth, the company’s operating income fell to $39 million, or 1.8% of total revenues, primarily due to restructuring expenses amounting to $166 million.

Workday’s non-GAAP operating income, which factors out certain costs, improved significantly to $677 million, equating to a 30.2% margin, an increase from last year’s 25.9%. This indicates enhanced profitability and operational efficiencies amidst a dynamic market.

The company also highlighted a substantial subscription revenue backlog of $7.63 billion, an increase of 15.6% from the prior year. Total subscription backlog rose by 19.1%, reaching $24.62 billion, reflecting robust future growth potential.

Workday’s Chief Executive Officer Carl Eschenbach attributed the results to the resilience of the company’s platform and its ability to meet growing customer needs for efficiency and growth. He expressed confidence in Workday’s ongoing strategic initiatives and emphasis on operational improvements.

In addition to the quarterly results, Workday announced a $1 billion share repurchase program, having bought back approximately 1.3 million shares for $293 million. This move signals the company’s commitment to returning value to shareholders.

Looking ahead, Workday continues to aim for $8.8 billion in subscription revenue for fiscal 2026, reflecting a target growth rate of 14%. The company has also revised its non-GAAP operating margin guidance to approximately 28.5%. This strategic outlook was bolstered by recent successes, including new client acquisitions from major corporations like United Airlines and mutual of Omaha.

Workday’s commitment to innovation and customer success remains steadfast as it navigates a competitive landscape, emphasizing its goal of driving business forward through enhanced AI capabilities.