Business

XRP Struggles Amid 2025 Market Turbulence: Future Uncertain

NEW YORK, NY — Ripple‘s XRP token is facing volatile market conditions as 2025 unfolds, prompting questions about its future potential. As of February 28, 2025, XRP is valued at $2.02, down 9.51% for the day, with a market capitalization of $202 billion.

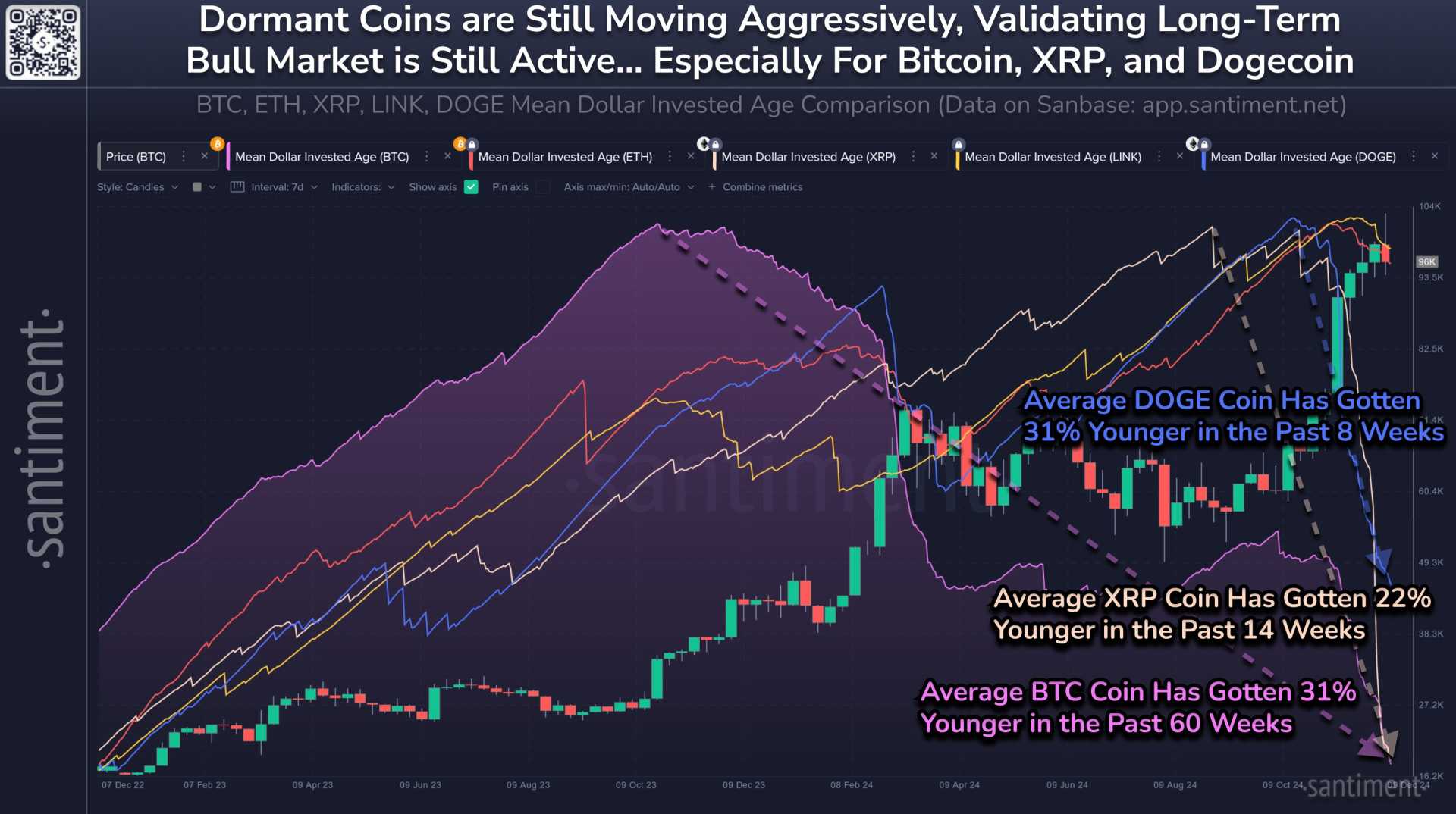

Last year saw a significant surge in the cryptocurrency sector, highlighted by the Securities and Exchange Commission’s (SEC) approval of various digital assets and Bitcoin exceeding the $100,000 mark for the first time. While XRP enjoyed a remarkable rise of over 400% since February 2024, peaking at approximately $3.30, it has since retraced to its current price.

As a centralized token issued by Ripple, XRP aims to streamline cross-border monetary transfers between financial institutions. Designed to be fast and cost-efficient, it provides banks with a mechanism to bypass traditional, slower systems that often incur high fees. Ripple’s technology allows for nearly instantaneous transactions, which is a significant competitive advantage in the banking sector.

“The need for reliable and efficient money transfers across borders has never been greater,” said a Ripple spokesperson. “XRP is positioned to change the landscape of financial transactions.”

Ripple’s journey has not been without challenges. In 2020, the SEC sued the company over allegations that XRP is a security and that Ripple failed to register it properly. Although a recent court ruling favored Ripple by confirming that XRP was not a security in all cases, the SEC has appealed, prolonging uncertainty for investors.

Following Donald Trump’s election victory, which was marked by promises of pro-cryptocurrency policies, many market analysts speculated this could bring a more favorable regulatory environment for XRP. Trump’s appointment of new SEC leadership is anticipated to influence the ongoing litigation, potentially providing clarity within the year.

Despite these developments, experts urge caution regarding XRP’s valuation. Currently, its market cap stands in line with that of Citigroup, which raises questions about its sustainability. “The banking industry spends hundreds of billions annually on transaction fees. Even if XRP gained a significant foothold, the total cost of banking transactions facilitated by XRP would likely reach only millions,” noted a financial analyst.

Market observers also cite the importance of proven reliability and security in banking decisions, arguing that established financial systems have a decades-long track record that XRP must match to gain widespread acceptance.

Looking further into 2025, traders are curious if XRP can reclaim its former highs. Predictions indicate XRP might rally to $4, driven by greater adoption and potential resolution of ongoing legal issues. However, some experts remain skeptical. “While XRP may experience short-term fluctuations, I’m concerned about its long-term viability as a major investment option,” said an industry analyst.

Simultaneously, competitors are entering the space. Other cryptocurrencies, like Bitcoin and Dogecoin, also captured headlines recently due to their inherent market activities, but XRP’s unique value proposition continues to differentiate it.

The burgeoning cryptocurrency landscape makes predictions challenging, and while XRP has the potential to bounce back, future outcomes remain highly speculative. Sudden shifts in regulatory stances and market dynamics could lead to either significant gains or losses in the coming months.