Business

XRP Surges 500% Amid U.S. Crypto Policy Shift

NEW YORK, N.Y. — XRP, the cryptocurrency tied to Ripple Labs, has surged 500% over the past year, fueled by optimism that the U.S. government‘s pro-crypto stance could resolve its ongoing legal battles with the Securities and Exchange Commission (SEC). The token’s price rose to $2.91 as of Feb. 1, 2025, despite a 4.61% drop on the day.

The surge comes amid a broader shift in U.S. cryptocurrency policy. Recent executive orders and nominations for key financial regulatory positions have signaled a more favorable environment for digital assets. While Bitcoin has also benefited, XRP’s dramatic rise has captured investor attention, with its market cap reaching $179 billion, making it the third-largest cryptocurrency.

XRP is the native token of the Ripple ledger, a blockchain technology designed to facilitate cross-border payments. Unlike traditional international transfers, which can take hours or days through the SWIFT network, Ripple enables near-instant currency exchanges using XRP. This real-world utility has driven demand, even as the token faced legal challenges.

In 2020, the SEC sued Ripple Labs, alleging that the company violated securities laws by selling XRP tokens. Although Ripple won a partial victory in court, the ongoing appeals process created uncertainty, suppressing XRP’s price. With new SEC leadership and potential policy changes, investors are betting on a resolution that could further boost XRP’s adoption.

“The stars seem to have aligned for cryptocurrency investors,” said one market analyst. “The U.S. government’s shift toward a pro-crypto stance has given XRP a significant tailwind.”

Despite XRP’s momentum, Bitcoin remains the dominant cryptocurrency, with a market cap of $2 trillion—roughly five times that of Ethereum, the second-largest crypto. Recent executive actions, including a directive to explore a federal digital asset stockpile, suggest Bitcoin could play a central role in U.S. cryptocurrency strategy.

Ripple’s chief legal officer expressed optimism about XRP’s future, particularly in the banking sector. “As the legal clouds clear, U.S. banks might adopt XRP for cross-border payments,” he said. Such adoption could strengthen XRP’s case for inclusion in any potential federal digital asset reserve.

Investors, however, don’t have to choose between Bitcoin and XRP. The two cryptocurrencies serve different purposes, making them complementary holdings in a diversified portfolio. While XRP’s market cap is still less than 10% of Bitcoin’s, its real-world utility and growth potential make it a compelling option for long-term investors.

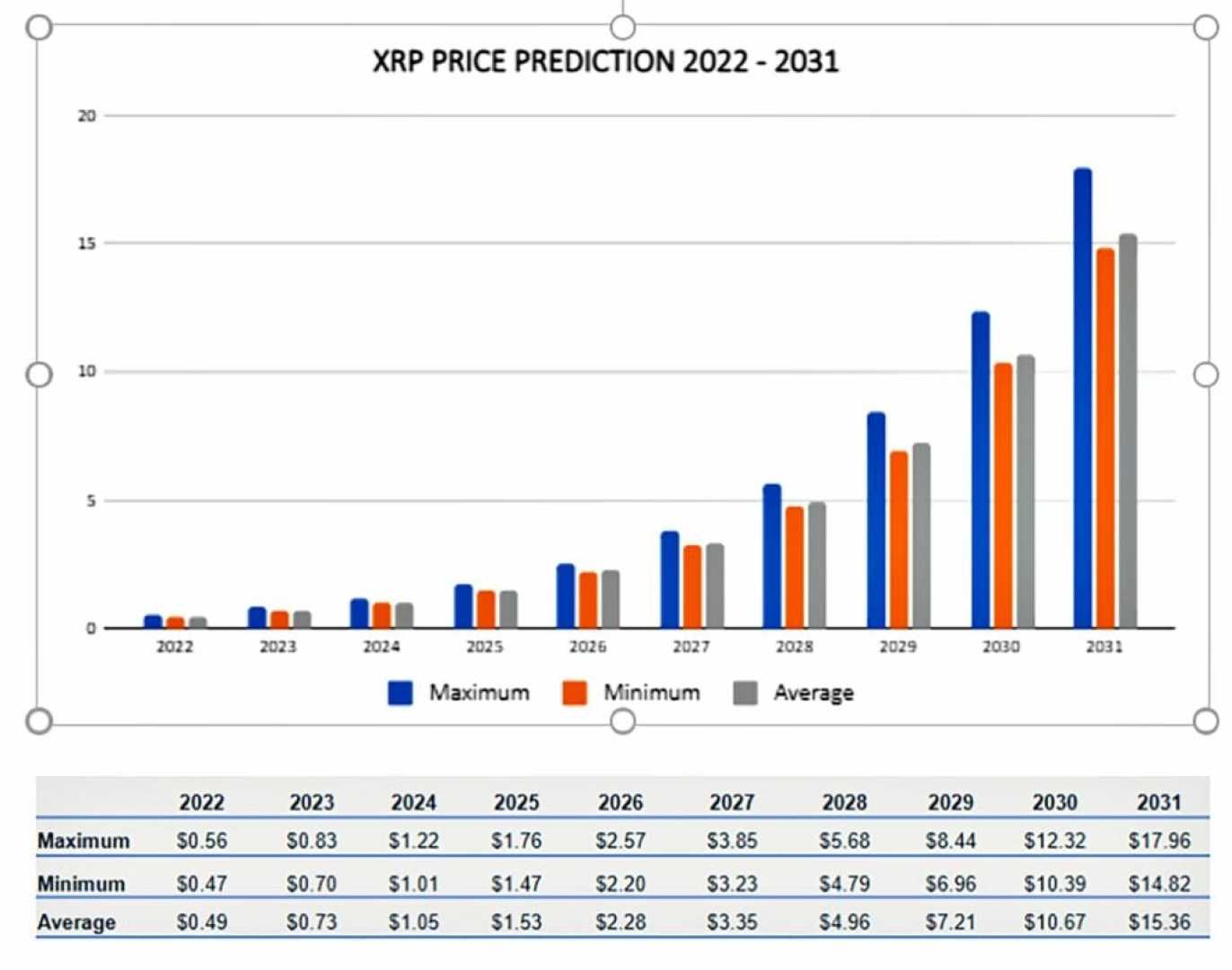

As the U.S. government continues to shape its cryptocurrency policies, the coming years could see increased adoption of digital assets like Bitcoin and XRP. For now, the market remains optimistic, with both tokens poised to benefit from a more favorable regulatory environment.