Business

XRP Volatility Surges After U.S. Digital Reserve Announcement

NEW YORK, NY — March 9, 2025 — XRP, a cryptocurrency known for its volatility, experienced significant fluctuations following President Donald Trump‘s announcement regarding the formation of a U.S. digital-asset reserve. On March 8, Trump revealed that XRP would be among the first cryptocurrencies included in the reserve, alongside Bitcoin, Ethereum, Cardano, and Solana. This news led to a brief surge in XRP prices, with the token rising to $2.90, but it later fell to $2.15, marking a daily decline of 7.93%.

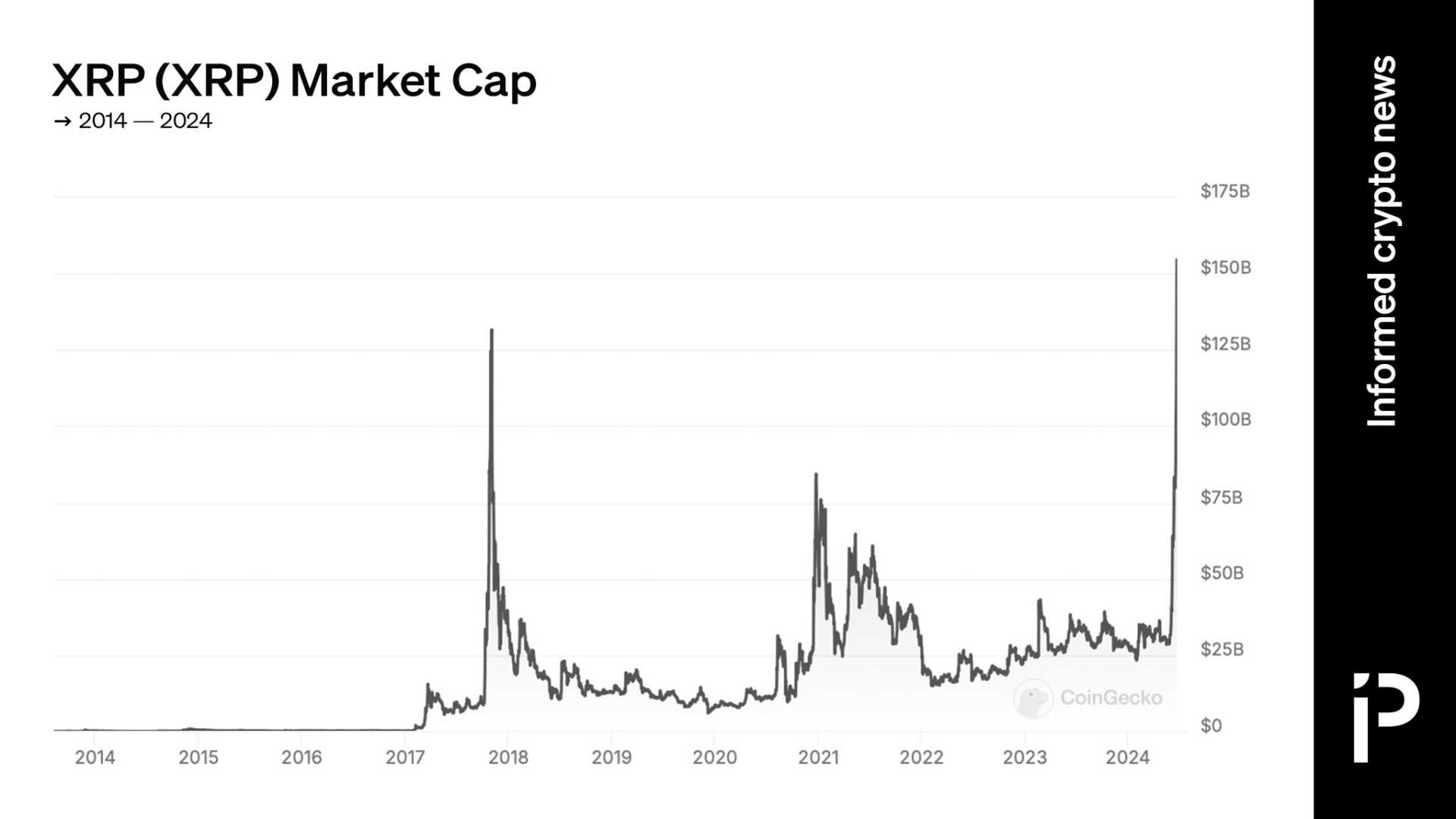

As of late Saturday, XRP had garnered a market capitalization of approximately $125 billion. Despite the recent decline, the token is still up approximately 6.7% over the past week. The market’s response to Trump’s announcement reflects both initial enthusiasm and caution from investors, some of whom are taking profits.

Trump’s executive order also signaled a stronger governmental interest in cryptocurrency, instructing the U.S. Treasury to utilize 200,000 Bitcoin held by the government from legal seizures as the reserve’s initial holdings. Although the executive order has potential long-term implications for the crypto industry, immediate market reactions have been mixed.

“We are witnessing substantial price swings, especially in reaction to regulatory announcements,” said Matthew Brienen, COO of CryptoCharged. “Investors are weighing their options carefully in light of broader economic conditions.”

XRP’s current performance is notable, considering its surge of approximately 278% over the past year. However, it has also faced a 28% pullback from its recent high of $3.40, underscoring the inherent risks in cryptocurrencies. Analysts are closely monitoring economic indicators such as inflation trends and interest rate forecasts, which are expected to influence XRP’s valuation.

In the wake of Trump’s announcement, other cryptocurrencies, including Bitcoin and Ethereum, also saw significant price increases. Bitcoin surged to more than $94,600, a jump of 10%, while Ethereum rose 15% to about $2,530. Experts cite regulatory clarity and institutional interest in the market as key factors driving these price movements.

“XRP’s potential is tied to the resolution of its legal issues with the SEC,” noted Andrew Forte, Head of Strategy at Unfungible. “A favorable ruling could trigger a strong rally for XRP, similar to what Bitcoin experienced after receiving ETF approvals.”

Ripple’s On-Demand Liquidity (ODL) solution, which aims to facilitate cross-border transactions, has reportedly been adopted by 80% of banks in Japan, amplifying XRP’s practical utility. This growing institutional adoption is another factor that investors are optimistic about.

Despite the current set of challenges, analysts believe that XRP’s enhancements and expansions could lead to a more stable valuation over time. Upgrades to the XRP Ledger and potential new partnerships are expected to boost XRP’s functionality as a digital payment solution.

Looking ahead, estimates for XRP’s future price vary widely. Some analysts believe that XRP could surge to $100 by the end of 2025, which would require a massive increase in demand and market capitalization. “Reaching $100 by 2025 is highly ambitious and would necessitate unprecedented growth,” warns the crypto strategist known as ‘The XRP Guy.’

Overall, the fluctuations of XRP prices in the wake of Trump’s announcement serve as a reminder of the volatile nature of cryptocurrencies. As market conditions and regulatory frameworks evolve, XRP’s potential continues to captivate investors’ interest.