Business

30-Year Mortgage Rates Drop Below 7% for First Time in Years

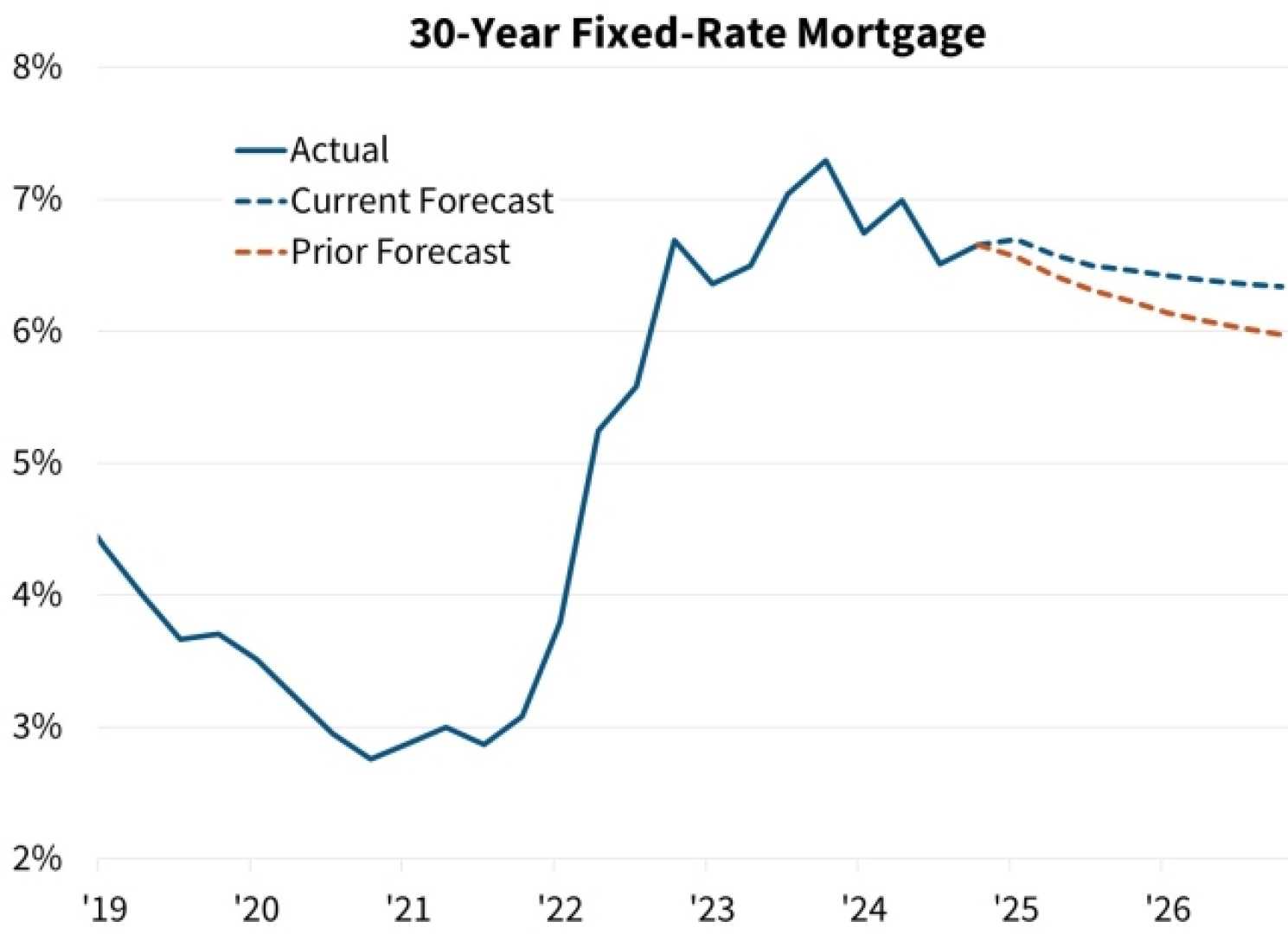

WASHINGTON, D.C. — The average interest rate for a 30-year, fixed-rate mortgage loan in the U.S. has dropped to 6.244%, according to data from mortgage data company Optimal Blue. This marks a roughly 1 basis point rise from the previous week, but a noteworthy decrease compared to the same time last year.

As of November 20, 2025, the current average rate reflects home loans locked in as of November 19. Mortgage rates have remained a hot topic as many expected them to ease following the Federal Reserve’s cuts to the federal funds rate last year.

January of this year saw the average 30-year fixed-rate mortgage exceed 7% for the first time since May, a significant jump from the historic low of 2.65% recorded in January 2021. Experts suggest that barring another major economic disruption, rates in the 2% to 3% range may never return.

President Donald Trump‘s economic policies, including tariffs, have prompted concerns about inflation and the labor market. Nonetheless, homebuyers have found strategies to cope with high mortgage rates, such as negotiating rate buydowns when purchasing newly constructed homes.

In late August and early September of 2025, mortgage rates began to trend downward, following the Fed’s September announcement of a quarter percentage point rate cut. A second similar cut followed in October, with more expected meetings scheduled.

While external economic conditions are unpredictable, an individual’s financial profile substantially affects the rate offered by lenders. High rates result from a comparison to previous low rates and a complex interplay of economic conditions.

Historical context illustrates that rates around 7% are not unusual. Data from the St. Louis Federal Reserve highlights that rates were commonplace throughout the 1970s and 80s. In fact, rates exceeded 18% during certain months in 1981.

The pandemic has led to what some homeowners refer to as ‘golden handcuffs,’ where low rates keep them from moving. Current economic conditions are the most significant drivers of mortgage rates, influenced by inflation fears and national debt, among other factors.

While shopping around can help homebuyers and homeowners secure lower rates, Freddie Mac research indicates that applying with multiple lenders may save buyers between $600 and $1,200 annually.

The latest trends suggest that now may be an opportune time for potential buyers, as mortgage rates are showing encouraging signs of stability.