Business

30-Year Mortgage Rates Surpass 7% Amid U.S. Credit Rating Concerns

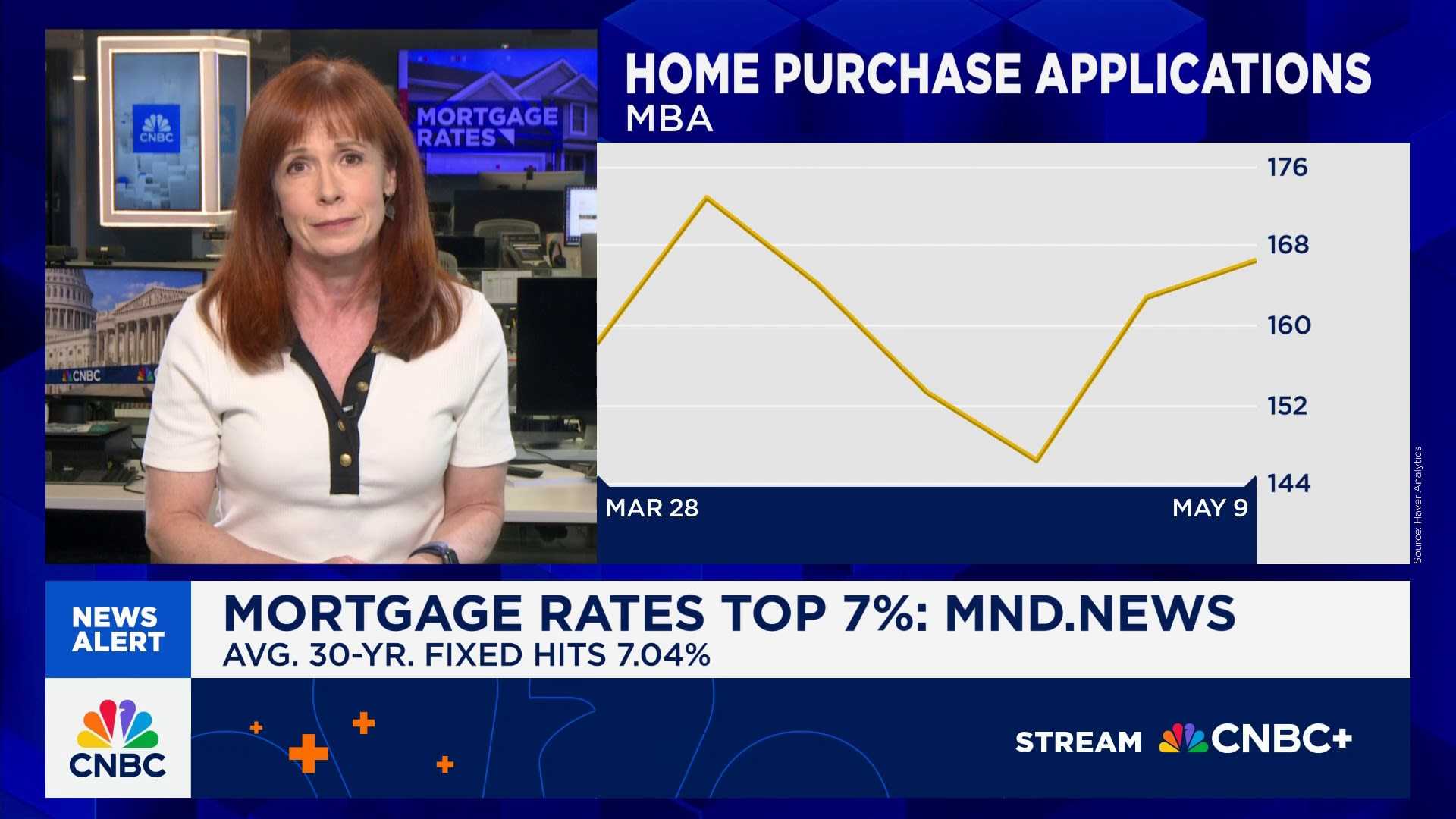

NEW YORK, NY — The average interest rate for a 30-year mortgage climbed above 7% on Monday, driven by concerns over rising U.S. debt levels following Moody's credit rating downgrade on Friday. This marks the first time since April 11 that mortgage rates have exceeded 7%, according to Mortgage News Daily.

Despite a slight easing later in the day that brought rates to approximately 6.99%, this spike reflects ongoing volatility in the housing market as borrowing costs remain near a 25-year high. Analysts note that mortgage rates track the 10-year Treasury bond, which recently surged above 5% due to growing economic anxiety.

Brian Rehling, head of global fixed income strategy at Wells Fargo Investment Institute, stated that investors had largely anticipated the downgrade, leading to limited market impact beyond the initial response. However, elevated mortgage rates are expected to persist, compounding challenges for hopeful homebuyers who face a limited supply of affordable real estate.

Data from the National Association of Realtors indicates that only 20% of listed homes in March were within reach for households earning $75,000 annually, a significant drop from about half of all listings before the pandemic. Senior economist Nadia Evangelou remarked that homebuying typically picks up when mortgage rates dip below 6.7%.

The recent increase in mortgage rates has already begun to affect home sales. Pending sales of existing homes fell 3.2% in April compared to a year earlier, as higher borrowing costs deter buyers during the critical spring season. Homebuilder sentiment has also taken a hit, with reports of decreased demand.

On the morning of May 19, the average 30-year fixed-rate mortgage was reported at 7.04%. Matthew Graham, COO at Mortgage News Daily, explained that lenders had to adjust for the market’s fluctuations following Moody’s announcement, resulting in a notable day-over-day increase.

As housing sales continue to stagnate, the real estate market braces for continued uncertainty with potential fluctuations in interest rates as the Federal Reserve weighs future policy responses amidst these economic challenges.