Business

Zscaler Shares Surge After Upgraded Earnings Guidance Amid Cybersecurity Demand

San Jose, California – Zscaler, Inc. (NASDAQ: ZS) shares jumped 6% in after-hours trading Wednesday after the cybersecurity firm raised its earnings forecast for the full fiscal year, following a stronger-than-expected second quarter.

For fiscal year 2025, Zscaler now anticipates earnings between $3.04 and $3.09 per share on an adjusted basis, up from previous estimates. This increase comes as Zscaler continues to face a rising tide of cyber threats, driven by technological shifts toward cloud computing and artificial intelligence.

“The demand for our Zero Trust Exchange platform indicates a strong market need, particularly as organizations adapt to new digital threats,” said Chief Executive Officer Jay Chaudhry. Zscaler’s platform has gained traction due to growing concerns about cybersecurity.

Despite this positive outlook, Zscaler’s stock has seen a 17% decline over the past year, although it has rebounded approximately 9% since the start of 2025. The company is scheduled to announce its Q2 fiscal 2025 results on March 5, where analysts expect a revenue growth of about 21%, totaling approximately $634.4 million.

Stifel analyst Adam Borg remains optimistic, maintaining a ‘Buy’ rating with a price target of $235. “We are anticipating upside based on our recent checks, particularly in the wake of a back-end loaded year and improved sales productivity,” he noted.

Wall Street analysts currently hold a Strong Buy consensus rating for Zscaler, with 20 Buy and seven Hold ratings, suggesting an average upside potential of 17.5% based on a price of $230.64.

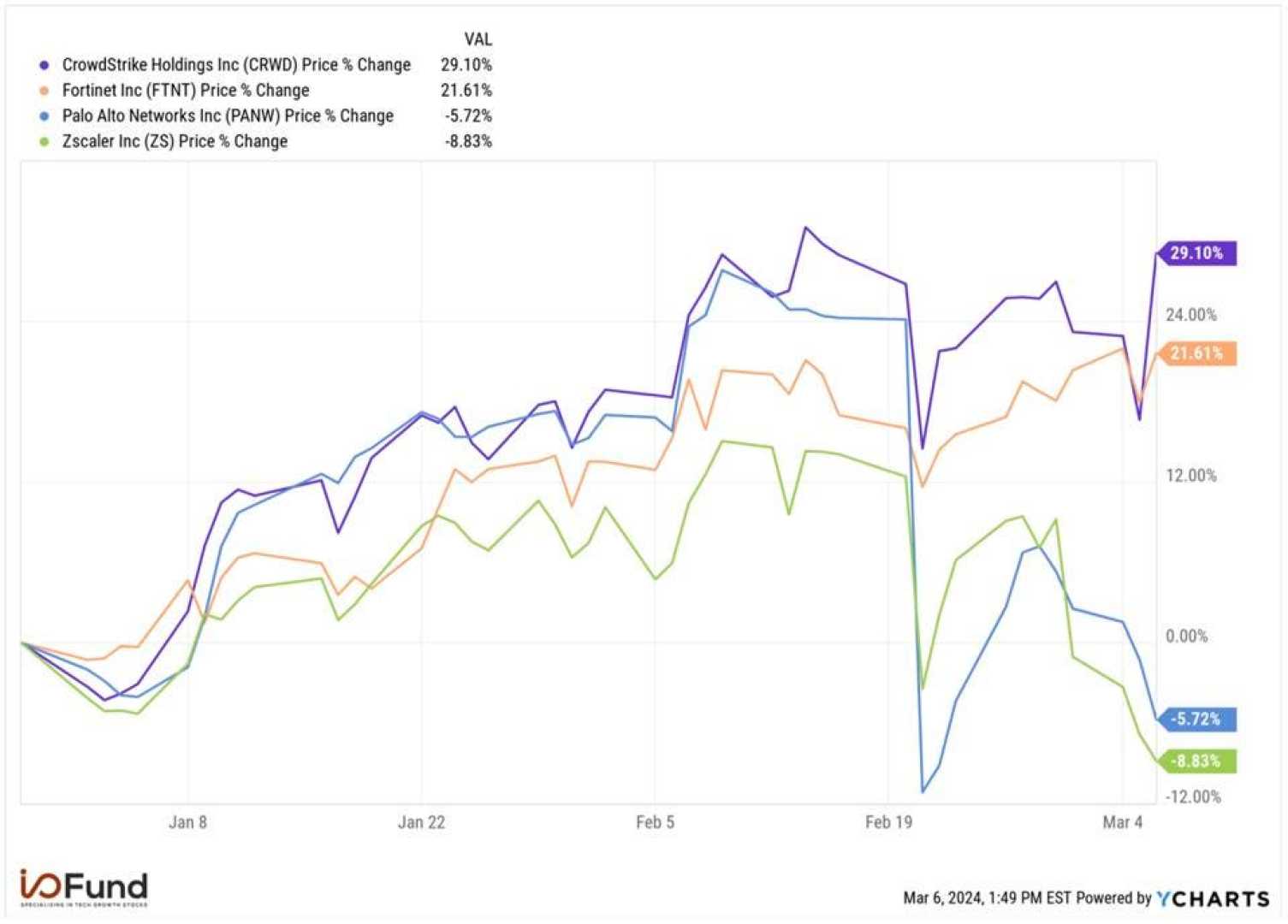

Other cybersecurity firms, such as CrowdStrike and CyberArk, have also witnessed stock performance variations amidst rising cybersecurity threats. CrowdStrike has increased 21% over the past year and is set to release its Q4 fiscal 2025 results on March 4, with expectations of a revenue increase despite a recent service outage that temporarily impacted customer trust.

Similarly, CyberArk has reported a 30% rise in annual recurring revenue and is focusing on expanding its identity security offerings amidst an evolving market landscape. Analyst Shaul Eyal reiterated a ‘Buy’ rating for CyberArk with a target price of $450, highlighting the firm’s robust outlook due to significant acquisitions.

As the cybersecurity sector grows more competitive, Zscaler’s management continues to innovate, aiming to retain and expand its market share through enhanced strategies and technology.