Business

U.S. Home Prices Expected to Rise Amid Mortgage Rate Concerns

BENGALURU, India (Reuters) — U.S. home prices are projected to rise steadily in the coming years as mortgage rates are expected to decline, according to a recent Reuters survey of property experts. Nearly all analysts shared the view that President Donald Trump‘s tariffs could impede affordable home construction.

The survey findings were consistent with earlier predictions that led to optimism about market affordability. Analysts believe that conditions would improve should the Federal Reserve resume cutting interest rates after a year of stasis. However, following Congress’s passage of a substantial tax cut and spending bill, apprehensions grew about escalating debt, currently at $36.2 trillion, as noted by the Committee for a Responsible Federal Budget.

James Egan, a housing strategist at Morgan Stanley, expressed caution regarding mortgage rates. “Looking forward into 2026, we don’t anticipate mortgage rates to drop significantly, particularly through the third quarter of 2025,” Egan stated. He indicated that persistent affordability pressures are likely to remain.

The S&P CoreLogic Case-Shiller composite index predicts an annual increase of 3.5% in home prices through 2027. Should these forecasts materialize, it would mark the slowest growth rate for home prices since 2011. Currently, average home prices exceed 50% of their 2019 levels prior to the pandemic.

Thomas Ryan, an economist at Capital Economics, commented on the current housing market, stating, “The market is in a cooler phase as sellers adjust to less intense competition following the pandemic.”

Despite anticipated interest rate cuts by the Fed, 30-year mortgage rates are only expected to marginally ease to an average of 6.73% this year, slightly down from the current 6.98%. Predictions show rates falling further to approximately 6.33% next year and 6.29% in 2027, still nearly double the rates available during earlier pandemic years.

Lawrence Yun, chief economist at the National Association of Realtors, noted that a significant drop in mortgage rates could spur increased buying activity. “For buying activity to surge, we need rates to drop meaningfully,” Yun remarked, emphasizing the need for lower rates.

The survey also revealed concerns regarding the tariffs imposed by the Trump administration. Almost 90% of respondents anticipated that these tariffs would lead to fewer homes being constructed. Egan from Morgan Stanley raised concerns about the ramifications of these tariffs, indicating they would likely inflate construction costs, resulting in fewer homes being built overall.

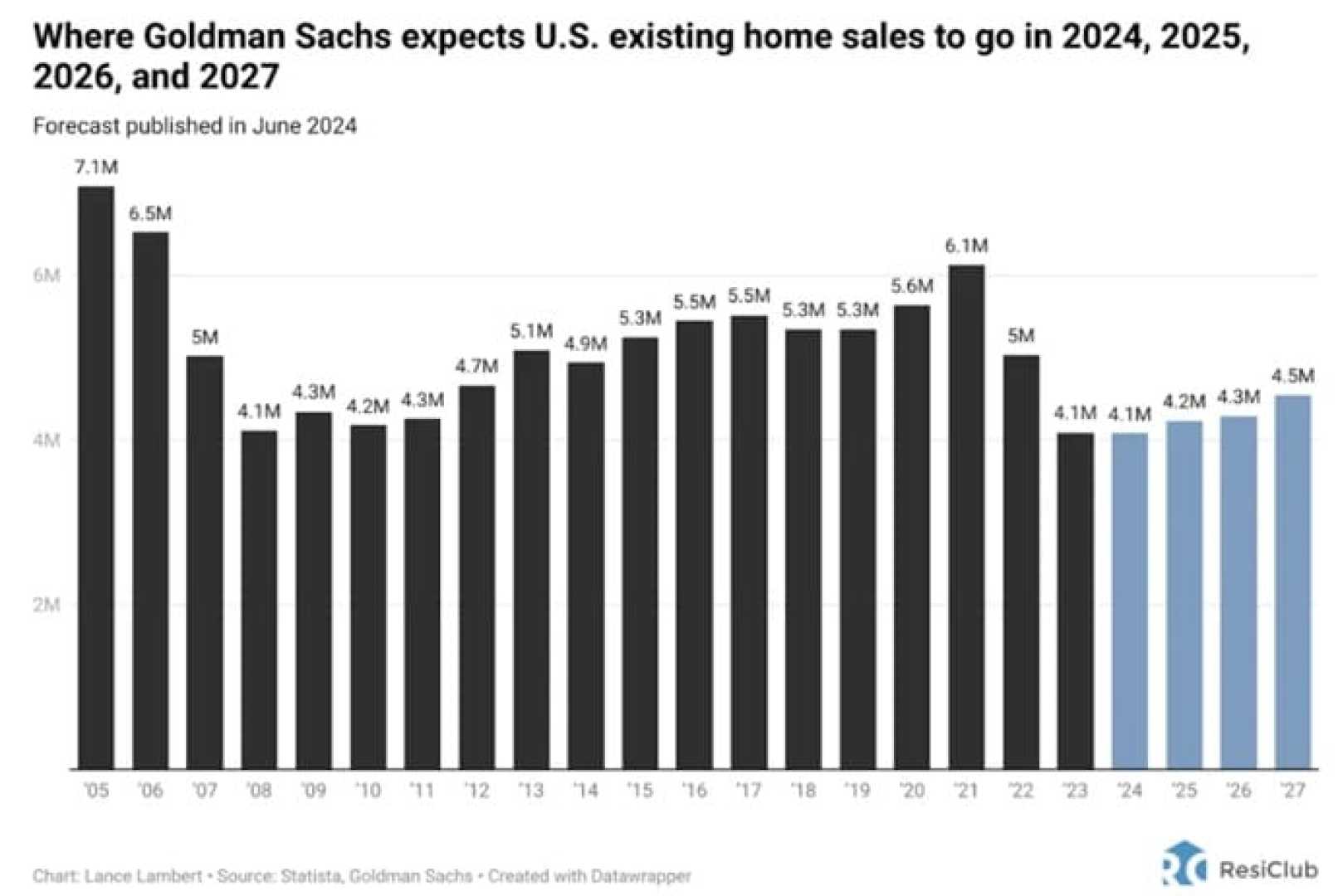

As for the future, only half of the analysts surveyed believed that purchasing affordability for first-time buyers would improve in the coming year, a notable decline from 62% in a previous survey conducted in February. The expected existing home sales are likely to hover around the current rates of 4 million units annually, rising gradually to 4.1 million by the end of the year, significantly lower than the nearly 15-year high of 6.6 million observed in early 2021.