Business

Gen Z Revolutionizes Personal Finance with New Trends in Saving and Investing

New York, NY — Gen Z, the first digital-native generation, is transforming personal finance with its unique approaches to saving and investing. With an average retirement savings start age of just 24, this demographic shows a remarkable confidence that is juxtaposed with their relatively modest savings rates.

A recent study indicates that while 76% of employed Gen Zers contribute to retirement plans like 401(k)s, only 20% actively save for retirement. Many cite a lack of knowledge on how to begin as a primary barrier, compounded by rising housing costs and significant student debt. However, an impressive 63% express confidence in their retirement preparedness, highlighting a disparity between their perceptions and actual saving behaviors.

Financial experts note that Gen Z’s priorities—like debt repayment, emergency funds, and environmentally-conscious investments—are driving their demand for financial technology (fintech) solutions. Tools that simplify investing and savings are gaining traction among this group, as they seek user-friendly platforms that align with their values.

Platforms like Betterment and Wealthfront are developing automated financial tools that cater to Gen Z’s financial literacy gap. These companies offer low-cost, AI-driven solutions that help users with retirement planning and integrate ESG criteria to appeal to this generation’s values.

Furthermore, as 60% of Gen Z emphasizes impact investing, ESG-focused funds are becoming mainstream. Not just larger firms like BlackRock and Vanguard are seizing this opportunity; smaller companies like Calvert Investments are also making inroads, signaling a broader shift in investment preferences.

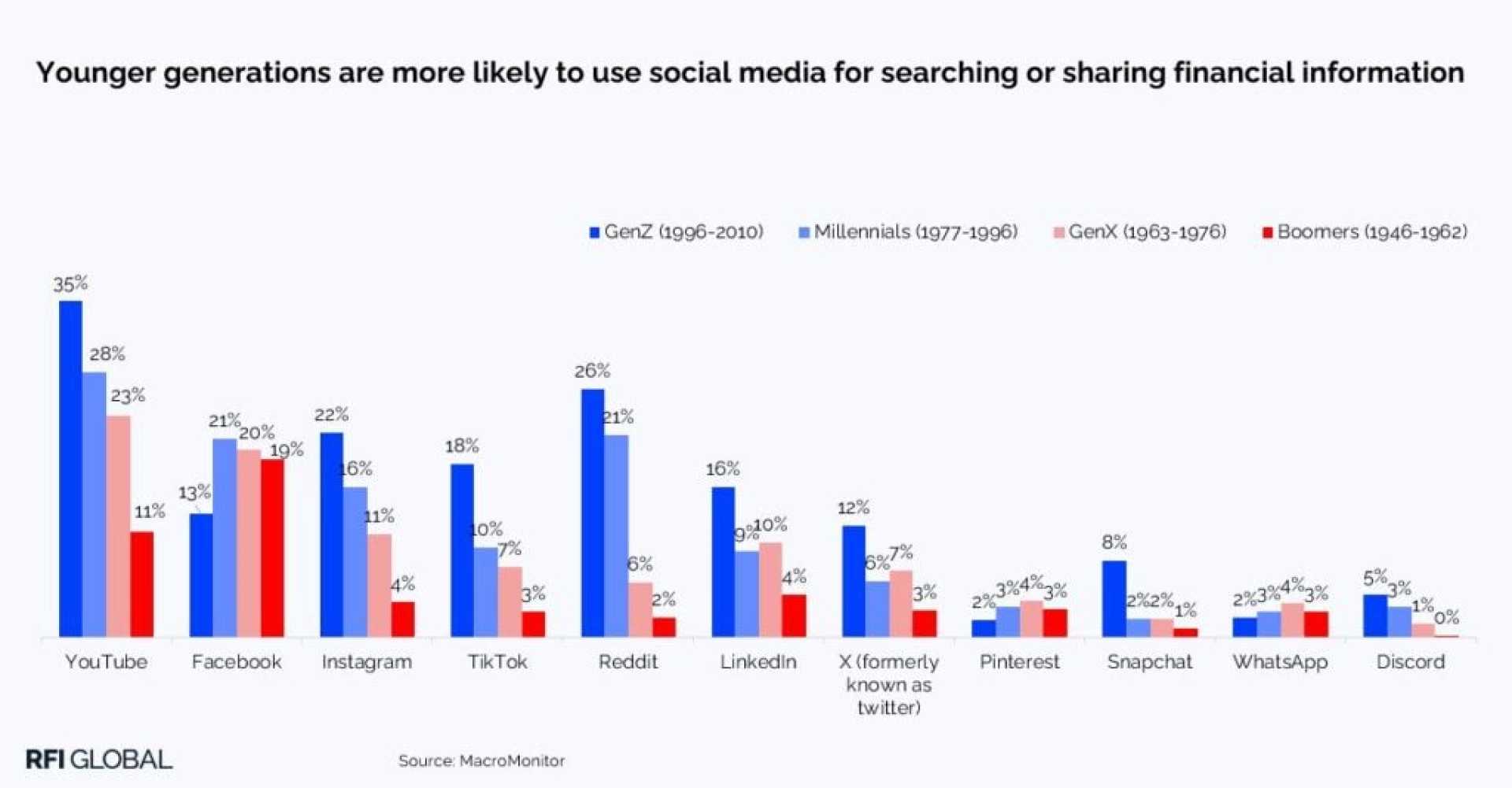

With social media playing a crucial role in their lives, Gen Z also favors apps that gamify investment. Platforms such as Acorns and Stash leverage rewards systems and challenges to make investing engaging. Even traditional banks are adapting, with firms like Chase introducing innovative financial dashboards.

A new study from J.P. Morgan Asset Management reveals that over 80% of retirement plan sponsors recognize their role in employee financial wellness and are enhancing benefits to address these needs. However, programs like emergency savings and student loan assistance often remain under-utilized, particularly in smaller companies.

Overall, the trend indicates that Gen Z will significantly influence the financial landscape, with projections that they will control $14 trillion in spending power by 2030. Investors and financial services can leverage this generational shift by simplifying access to retirement and aligning with values that matter to Gen Z.