Business

Palantir Technologies: Gaining Popularity Amid Rising AI Sector

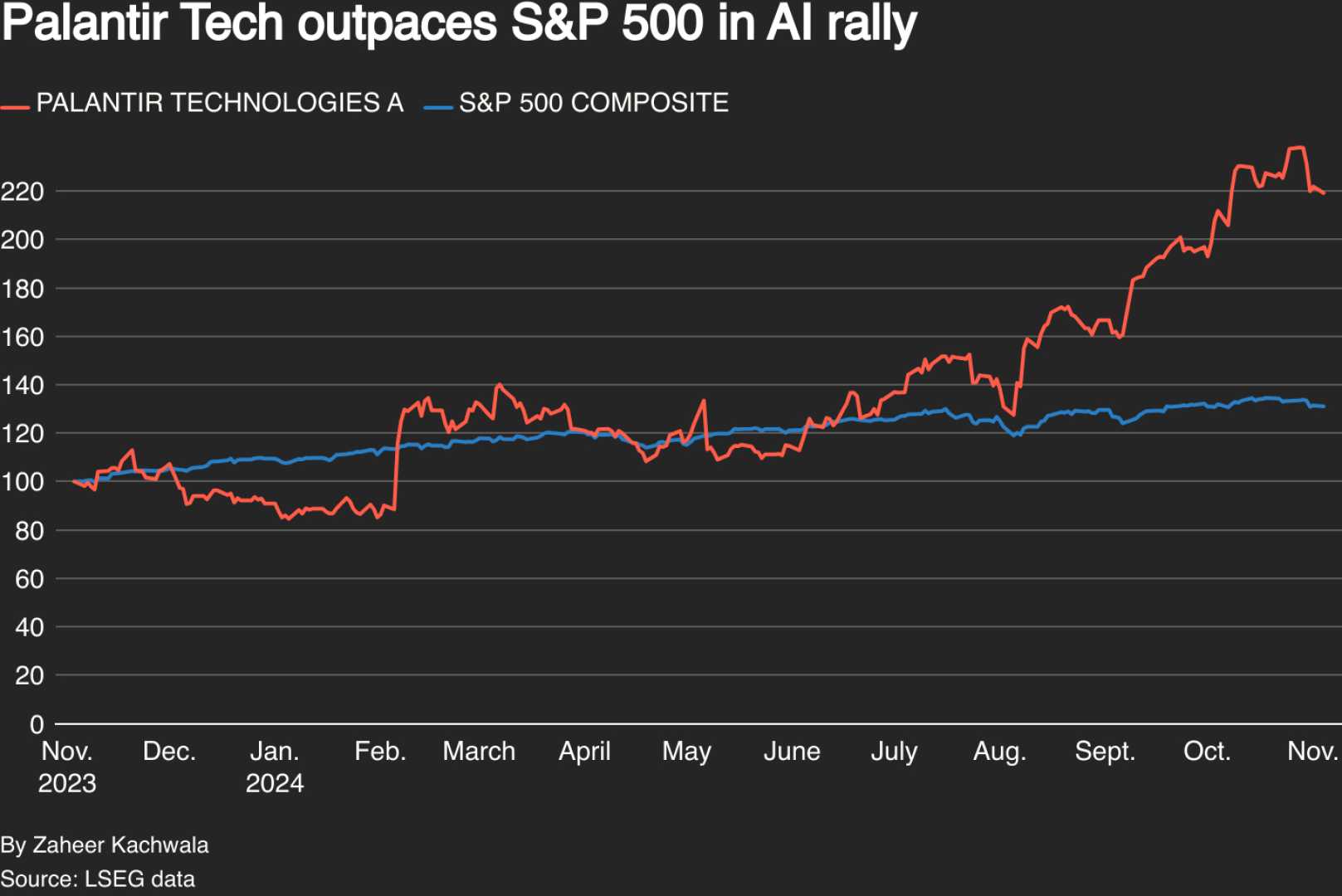

NEW YORK, NY — Investors have shown substantial interest in Palantir Technologies (NASDAQ: PLTR), with the company’s stock price surging over 110% this year and experiencing a staggering increase of nearly 1,500% over the past three years. This growth persists despite a high valuation of 660 times earnings, raising questions about the sustainability of its ascent.

Palantir specializes in data analytics and artificial intelligence (AI), connecting disparate datasets to streamline complex operations. Initially created for government clients, the firm has expanded its offerings to commercial markets, contributing to its swift growth.

In the first quarter of 2025, Palantir reported revenues of $884 million, a 39% year-over-year increase, largely driven by its U.S. commercial segment, which grew 71%. The company has also seen its customer count rise by 39% to 769, signaling strong demand for its services.

Ryan Taylor, a spokesperson for Palantir, highlighted the ongoing need for its AI Platform (AIP), which facilitates decision-making by consolidating different data systems into one interface. He expressed optimism about the company’s future, as management has increased its full-year revenue forecast by 36%.

Palantir’s significant government contracts provide a safety net by ensuring recurring revenue, while its commercial business continues to expand rapidly. The International Data Corporation recognized Palantir as a leader in decision-intelligence platforms, further cementing its position in the growing AI landscape.

However, some analysts warn that the stock’s significant valuation poses a risk. With a price currently at $154.46, Palantir is deemed the most expensive stock in the S&P 500. Many industry experts recommend caution, believing that potential investors should wait for a more favorable entry point.

While Palantir’s future appears bright, volatility in its stock price has led to varied analyst opinions. Of 25 analysts surveyed, 16 have advised maintaining a ‘hold’ on the stock, with only four recommending it as a ‘buy.’

In contrast, industry giant Amazon also reported impressive earnings growth, prompting analysts to favor it over Palantir based on its more reasonable valuation. Amazon’s earnings increased by 62% in the second quarter, solidifying its status as a market leader in e-commerce and cloud computing.

The contrasting views on Palantir’s stock underscore the complex dynamics of the AI sector—a space filled with both potential risks and opportunities. As investors weigh these elements, the discussion around Palantir Technologies will likely continue to unfold.