Business

DTE Energy Faces Mixed Analyst Signals Amid Price Fluctuations

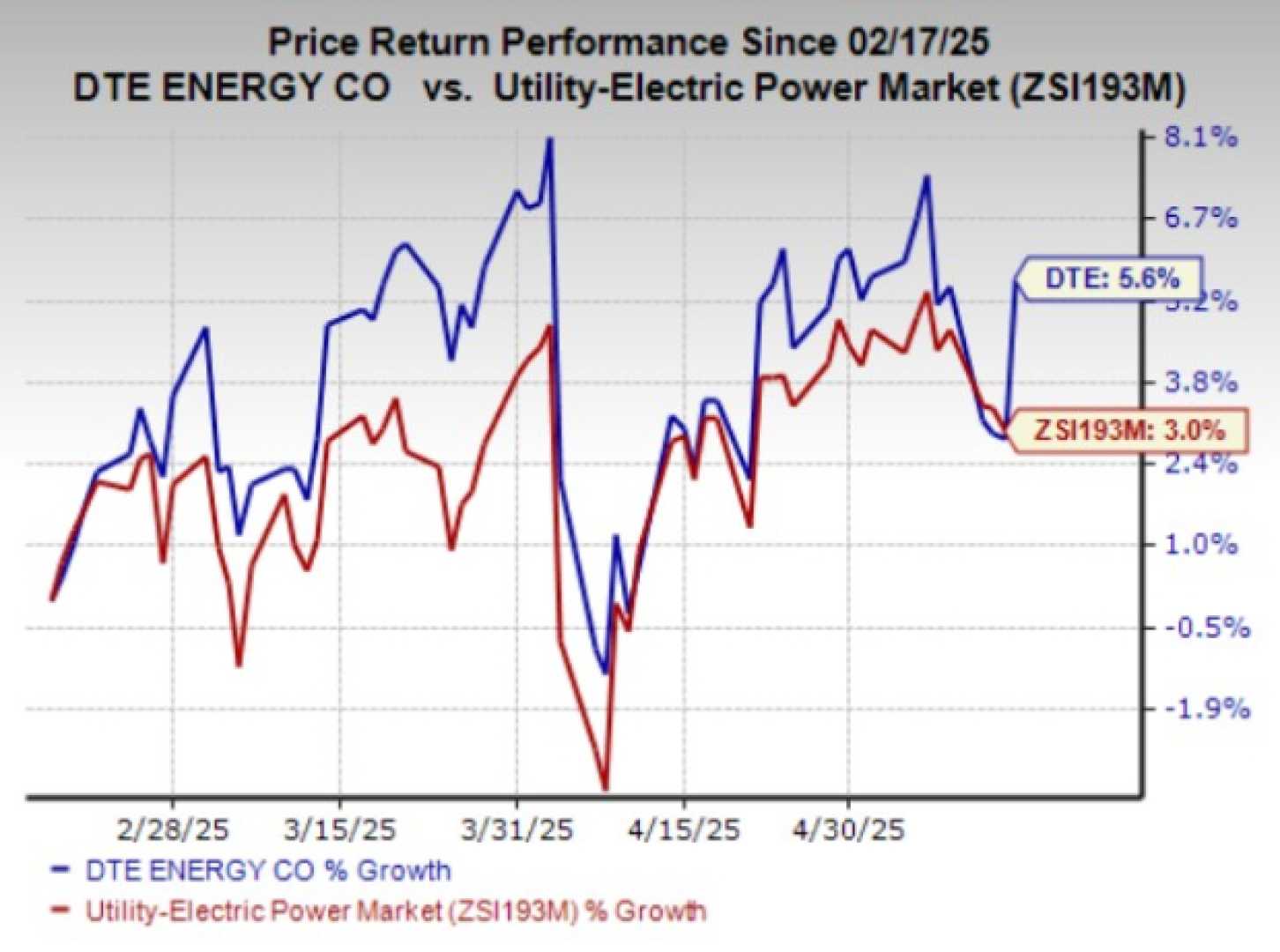

DETROIT, Mich. — DTE Energy is currently in a technical neutrality phase as its stock price has seen a slight decline of 1.34%. Analysts are sending mixed signals, indicating a cautious atmosphere for investors.

Despite the recent dip, large institutional investors have shown confidence, reporting a 50.25% inflow ratio. In contrast, retail investor sentiment remains bearish, highlighting a divergence in market behavior. Analysts have suggested that investors should adopt a wait-and-see stance as the market navigates these conflicting signals.

Recent technical indicators present a challenging landscape. Although some bullish patterns have emerged, such as engulfing and marubozu patterns, bearish trends like the Hanging Man signal have raised concerns. These mixed indicators imply a lack of clear momentum.

Broader market trends may also be influencing DTE Energy’s performance. Innovations in robotics from companies like Tesla and Nvidia, along with significant investments in infrastructure, highlight a shift within the energy sector that could have long-term impacts on DTE.

Analysts remain neutral in their outlook, with ratings averaging around 3.00. However, a stark contrast exists between the current upward price movement and analysts’ forecasts, suggesting that market expectations may diverge from professional assessments.

Investors are advised to monitor developments closely and consider waiting for clearer signals before making significant investment moves. Overall, DTE Energy’s performance appears caught in a technical limbo, making cautious navigation essential for current and potential shareholders.