Business

Investors Bet Big on Nvidia Despite Market Fluctuations

SEATTLE, WA – On September 17, 2025, Nvidia‘s stock price saw a decline of 2.62%, closing at $170.29, despite being one of the top stocks to buy over recent years. With a current market cap of $4.1 trillion, Nvidia remains a key player in the technology sector, especially in artificial intelligence (AI).

Recently, hedge fund manager Daniel Loeb of Third Point invested $442 million in Nvidia shares, marking a significant strategy shift after previously holding no shares at the beginning of the year. This move represents approximately 6% of his fund, indicating strong confidence in Nvidia’s future potential.

Nvidia specializes in manufacturing graphics processing units (GPUs), essential components that drive today’s advanced AI models. These GPUs excel at processing multiple calculations simultaneously, making them vital for AI training and data inference.

The demand for GPUs has surged as AI technology evolves, and Nvidia projects that global data center spending could reach between $3 trillion and $4 trillion by 2030. If these expectations hold true, Nvidia could significantly enhance its profitability and growth.

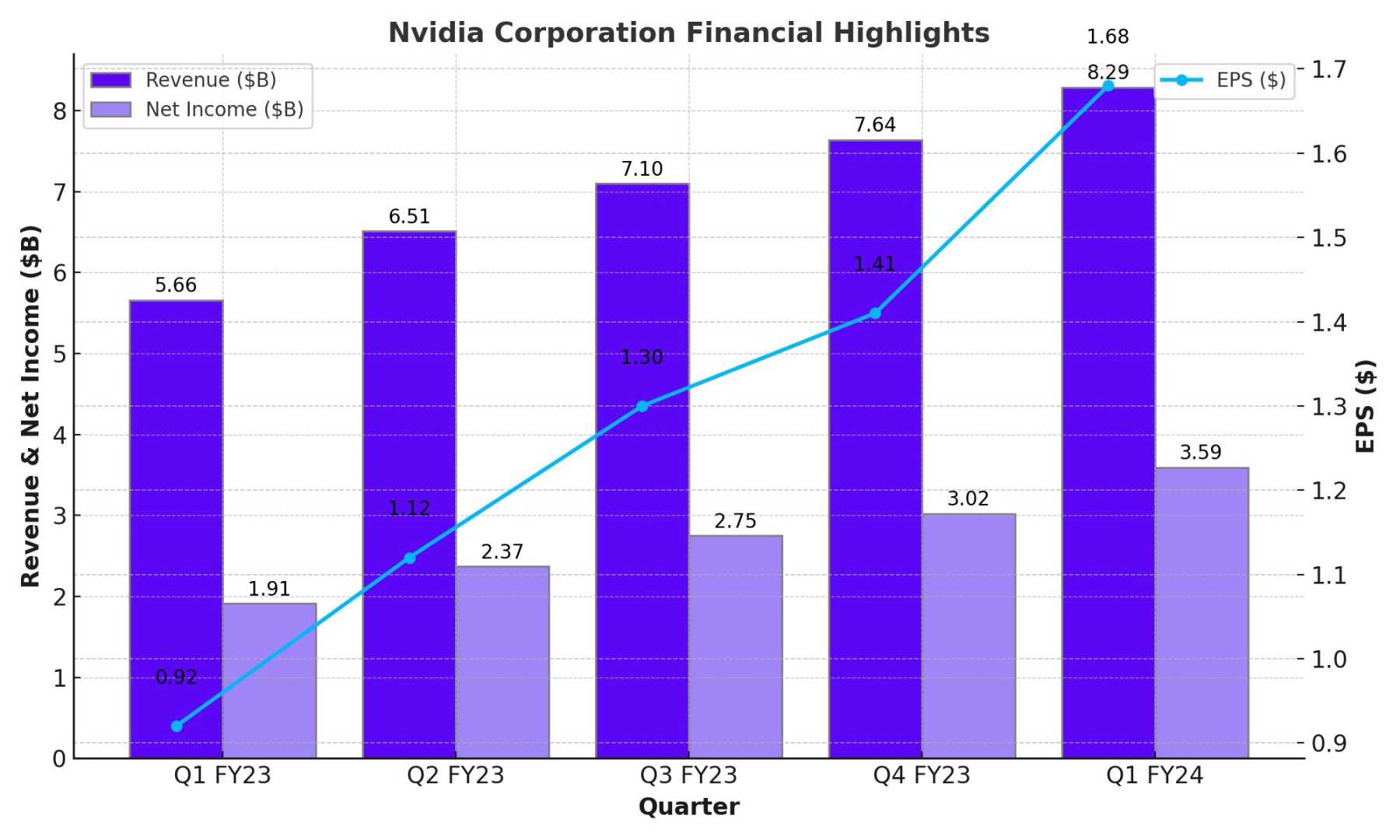

Historically, Nvidia has captured roughly one-third of total revenue from data center capital expenditures. If the demand increases as anticipated, Nvidia could generate as much as $1 trillion in revenue by 2030, translating to profits of $500 billion if the company’s profit margins remain steady.

For perspective, Alphabet currently leads as the most profitable company, with nearly $116 billion in profits over the last year. Nvidia’s growth projections seem ambitious, yet CEO Jensen Huang and his team are optimistic about the company’s trajectory.

If the market applies a price-to-earnings ratio of 30 to Nvidia’s projected profits, the company could reach a market valuation of $15 trillion, tripling its current value.

The potential for significant returns has attracted not only institutional investors like Loeb but also retail investors eager to capitalize on Nvidia’s possible ascent post-2030.

Industry experts suggest that Nvidia remains a lucrative buy, citing the ongoing AI arms race as a driving force for future stock performance. Analysts encourage investors to consider this opportunity as Nvidia continues to play a crucial role in the tech landscape.