Business

Lululemon Stock Faces Scrutiny Amid Market Changes

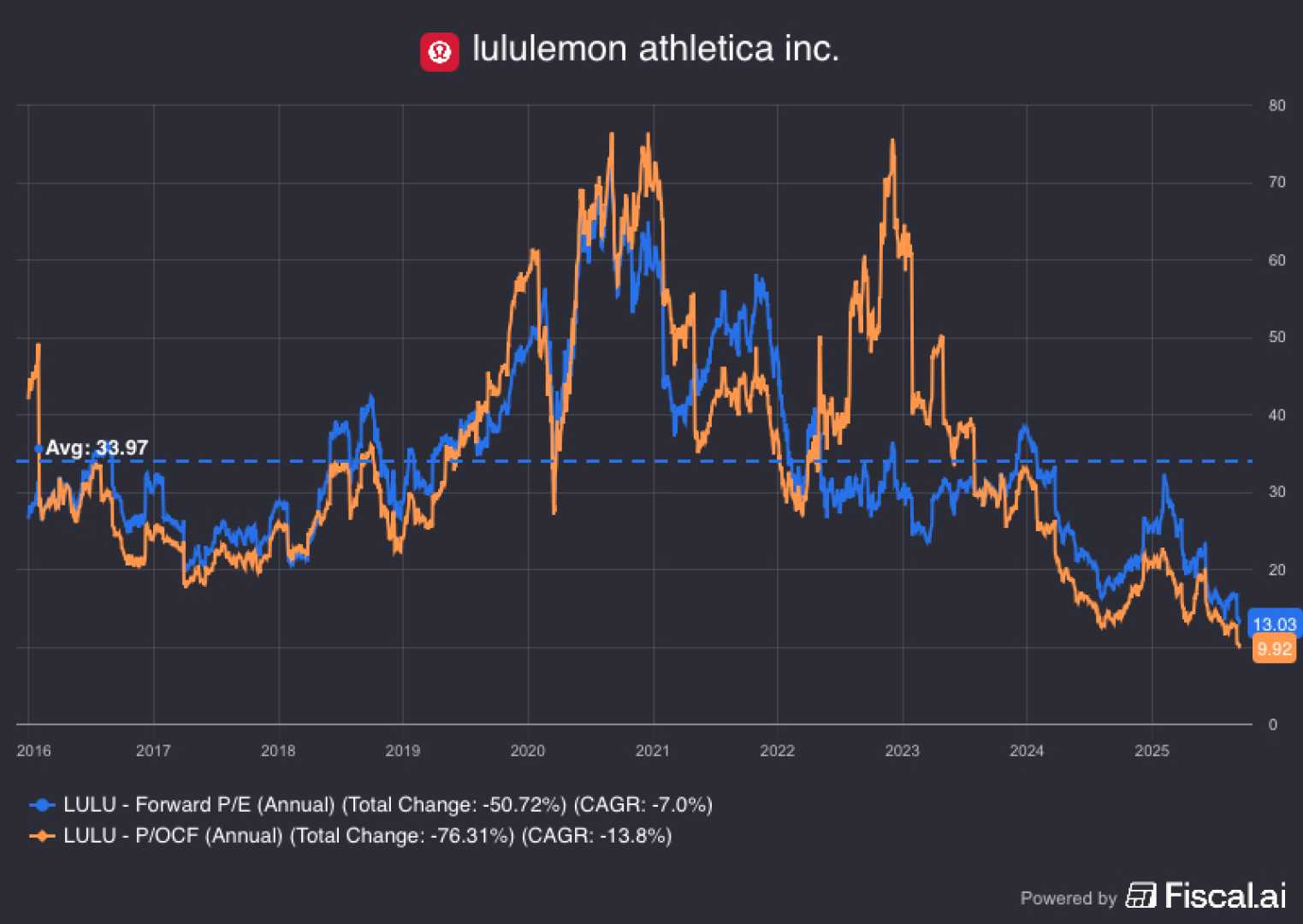

NEW YORK, NY — Lululemon Athletica Inc. (NASDAQ: LULU) is under fresh scrutiny as its stock has decreased by 57% this year. During a recent episode of his financial show, Jim Cramer discussed the recent performance of the athletic apparel company and shared his caution about investing in it.

A caller raised the question of whether now might be a good time to invest in Lululemon. Cramer responded, “I stopped liking them when I saw that they sued Costco for a really good product that Costco had.” He went on to recommend that investors consider Gap Inc. instead, indicating that he believes it is better positioned for a turnaround.

Despite its challenges, Cramer acknowledged the potential for younger investors to still take a chance on Lululemon. He stated, “It’s down so low, I would be willing to take a flier. Why? Because you’re young. You got your whole life ahead of you.” He advised a cautious approach, suggesting to buy just one share and to avoid becoming too invested.

In a broader context, the investment landscape is rapidly changing, particularly with the rise of artificial intelligence (AI). There is a growing belief among some analysts that AI stocks might offer higher returns than traditional retail stocks like Lululemon. These analysts are highlighting companies that own energy infrastructure as key players in the upcoming AI energy boom.

As Lululemon navigates through its stock decline, the conversation around investment choices continues to evolve. While some are skeptical about the brand’s direction, others are focusing on emerging technologies and the investments tied to them.

This ongoing shift indicates a potential future where companies linked to AI and energy may take precedence in investors’ portfolios, perhaps overshadowing previously dominant retail names like Lululemon.