Business

The Platinum Card® from American Express: Worth the Price?

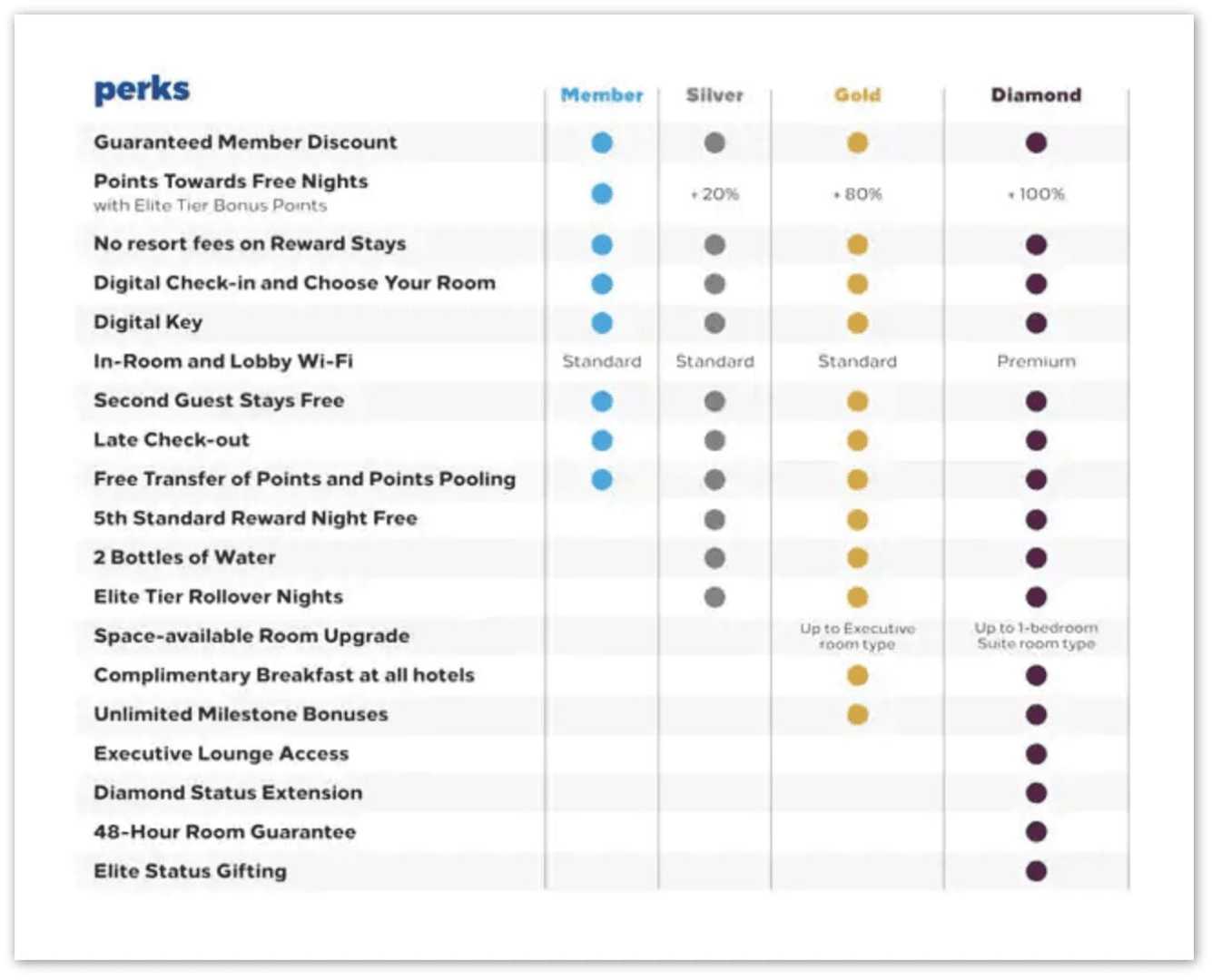

NEW YORK, NY — The Platinum Card® from American Express is recognized as a leading premium credit card that offers numerous luxury benefits, including travel credits, hotel elite status, and access to exclusive airport lounges. With an $895 annual fee, potential cardholders are encouraged to consider whether they will effectively utilize its offerings.

The card includes over $2,500 in statement credits each year, but cardholders need to maximize these credits to offset the high fee. Many credits are based on monthly usage, with some only valid a few times a year. A strategic approach to applying could help users make the most of the perks available.

American Express also provides a significant welcome offer for new applicants, with potential bonuses as high as 175,000 Membership Rewards® Points after spending $8,000 within the first six months. However, current or former cardholders are ineligible for this bonus.

To qualify for The Platinum Card®, applicants typically need a good to excellent credit score—at least 690. Yet, a strong score does not guarantee approval, as banks evaluate additional factors before granting credit.

Cardholders can enrich their experience through the addition of authorized users, who can enjoy benefits like complimentary lounge access. However, adding these users incurs an extra cost of $195 per card for up to three additional Platinum cards.

Among its benefits, The Platinum Card® allows a significant value increase through membership in the American Express Global Lounge Collection, which includes Centurion Lounges, among others. Notably, cardholders can also earn Uber Cash, dining credits, and statement credits for various services.

Despite the high annual fee, many find the card justifies the cost through its extensive range of benefits tailored to frequent travelers and luxury seekers. As new features are added, those considering the application are encouraged to carefully assess their spending patterns to ensure they receive the card’s full value.