Business

Mortgage Rates Hold Steady Amid Economic Uncertainty

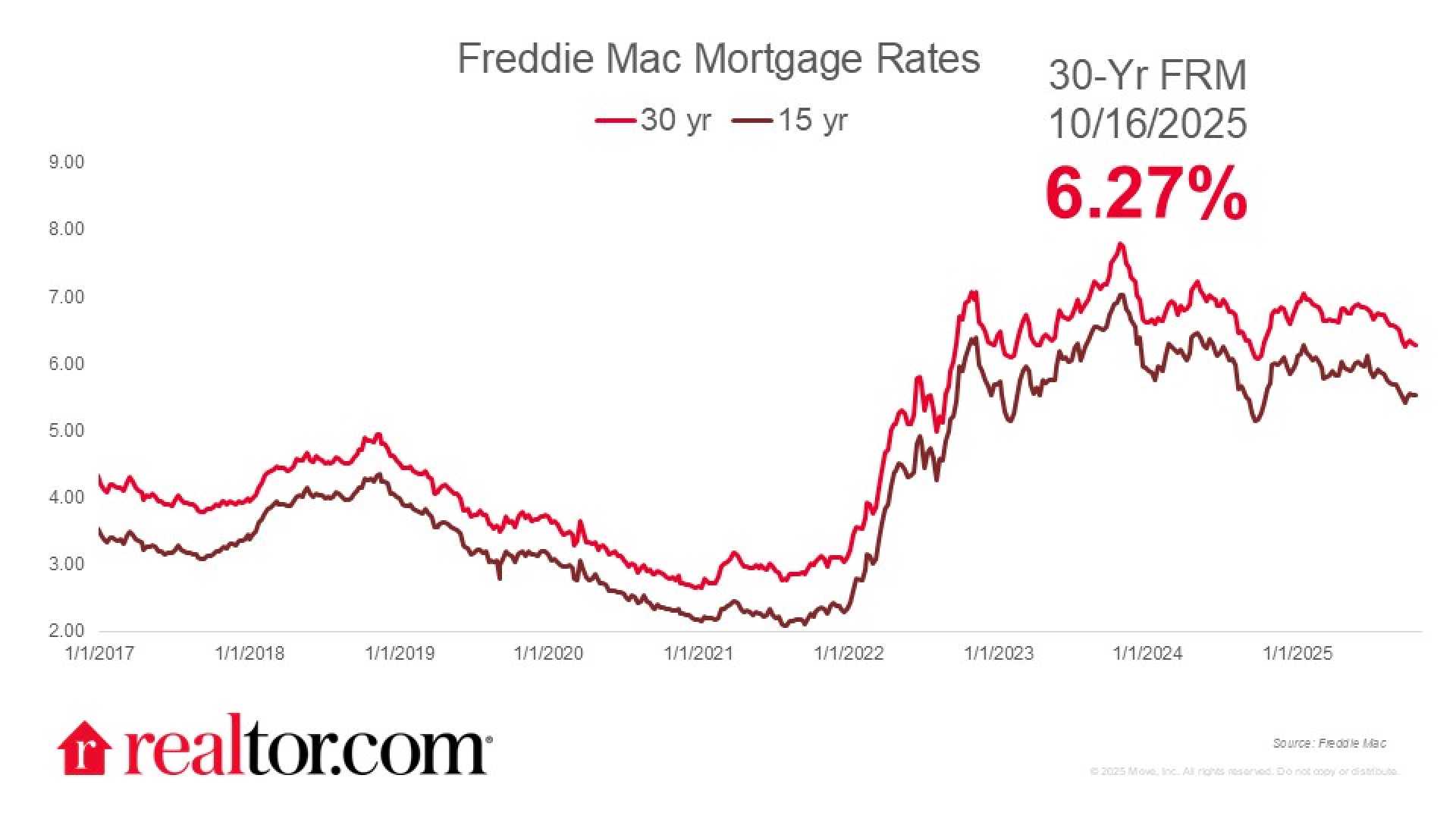

New York, NY — Experts are divided on the future of mortgage rates as economic uncertainty looms. In a recent survey, 42% of participants believe rates will remain stable, 33% predict a decrease, and 25% project an increase. As of October 15, the average mortgage rate stood at 6.35%, a slight drop from the previous week’s 6.39%, according to Bankrate.

The current economic climate remains influenced by a government shutdown, resulting in a lack of significant market data. Bonds showed some improvement last week, contributing to slightly lower mortgage rates. Analysts note that easing trade tensions and Federal Reserve speakers advocating for rate cuts amid labor market softness are key factors.

Michael Becker, from Union Home Mortgage, commented, “While there’s potential for rates to rally further, we are lacking supporting economic data.” Conversely, Dan Green, President of a mortgage company in Cincinnati, foresees increasing rates, stating, “The dollar is declining, leading mortgage rates to rise.”

Heather Devoto, a Vice President in McLean, believes rates will rise modestly in the coming week as ongoing trade issues continue to affect market dynamics. Similarly, economist Joel Naroff highlighted that although inflation concerns persist, signs of a steady job market could have future implications for mortgage trends.

Several mortgage planners, including James Sahnger and Nicole Rueth, suggested that buyers should act now, as rates may edge higher soon. Sahnger remarked on Jerome Powell‘s recent comments regarding controlled inflation, predicting lower rates later this year.

The housing market continues to adjust, with the median sale price nationally reaching $436,000, which is 1.7% higher than a year ago. Despite lower mortgage rates, many prospective buyers remain hesitant due to high prices and economic volatility. Additionally, the government shutdown has delayed many economic reports, creating further uncertainty.

Experts warn that buyers should carefully consider personal financial readiness despite attractive mortgage rates. Those planning to enter the housing market are encouraged to consult local agents and assess their financial stability before making decisions.