Tech

Agentic AI Transforms Financial Services Landscape

BENGALURU, India — The financial services sector is on the brink of transformation as agentic artificial intelligence (AI) begins to emerge from the shadows of generative AI. This evolution marks a shift from automation to autonomy, significantly impacting consulting, accounting, and auditing sectors.

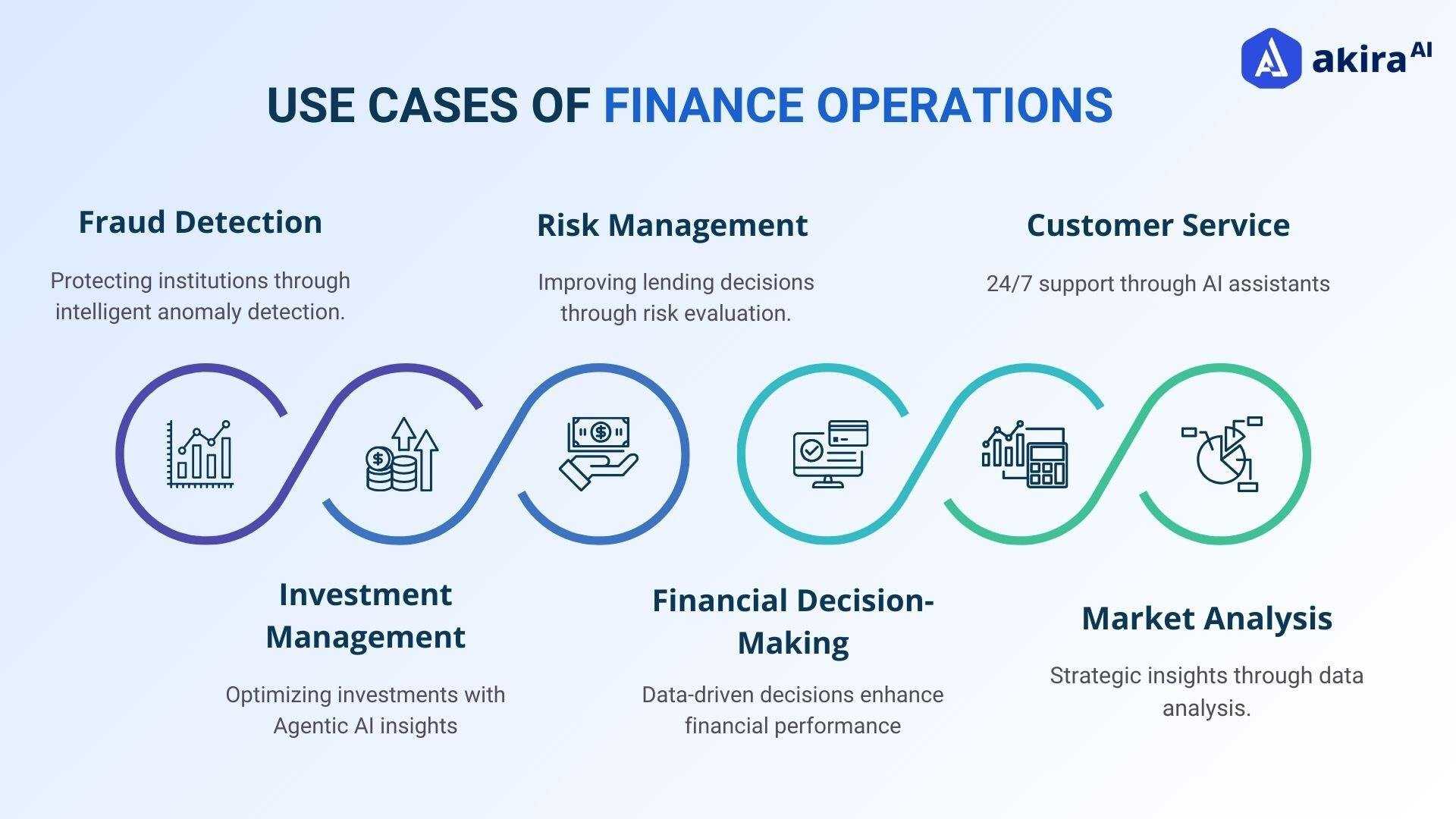

For decades, advancements in machine learning have powered financial services, refining risk models and enhancing fraud detection. While generative AI has recently allowed for the creation of coherent text, images, and videos with human prompts, it lacks the ability to autonomously plan or execute actions. However, agentic AI introduces a new paradigm. It integrates with various tools, enabling it to perceive, learn, and make decisions with minimal human intervention.

According to Bryan Zhang, co-founder of the Cambridge Centre for Alternative Finance, “The distinct feature of agentic AI is its capability to orchestrate multiple agents using large language models as a collective brain to tackle complex, multi-step problems autonomously.” As agentic tools develop, they promise to significantly impact sectors that historically relied on human analysts.

The first industries likely to feel the impact of agentic AI include consulting, accounting, and auditing. Consulting firms, typically reliant on analysis-heavy models, are particularly vulnerable. Tools like OpenAI‘s Deep Research can independently gather extensive datasets, identify trends, and generate reports enriched with analytical insights.

Auditing is similarly positioned for a revolution. Rather than manually reviewing transactions, agentic systems can automatically scan financial statements, validate them against compliance regulations, and identify discrepancies in real time.

While this advancement will not eliminate auditors, it will reshape their roles, redirecting their focus from routine checks to providing strategic, high-value insights alongside AI support.

Banks are also poised for disruption as agentic AI enhances existing AI-driven customer interactions. The transition from scripted chatbots to intelligent virtual agents capable of executing transactions reflects the potential for significant operational shifts in the banking sector.

“Imagine a virtual agent that not only answers queries but also recommends optimal actions based on individual financial situations,” said Kieran Garvey, AI research lead at the CCAF.

This continuous assessment powered by agentic AI could enable banks to adjust lending models dynamically, improving risk assessments and speeding up approval processes.

However, with these innovations come critical ethical considerations. Concerns about bias and fairness in agentic AI-driven decisions underscore the importance of maintaining oversight. If training data reflects historical inequalities, the risk is that these biases could be amplified by autonomous systems.

“Institutions must find a balance between leveraging AI’s capabilities and ensuring transparency and fairness in decision-making,” advised Zhang.

The agentic AI landscape is expected to grow rapidly. A report by Capgemini forecasts the agentic AI market will increase from $5.1 billion to roughly $47.1 billion by the end of this decade, posing significant opportunities for investors. This growth rate reflects a compounded annual growth projection of 45 percent.

Some startups are already capitalizing on this wave of investment. CoRover.ai, for instance, utilizes agentic AI to streamline operations for clients like the Indian Railways and has attracted significant interest from venture capitalists.

As the technology matures, agentic AI is predicted to enhance trading and investment by making sophisticated autonomous strategies available to a broader audience. However, this autonomy could also lead to heightened market volatility, as AI agents might react uniformly to market signals, potentially causing systemic disruptions.

“Regulators will need to implement robust safeguards to manage these risks,” Garvey warned.

In summary, while agentic AI presents remarkable opportunities for improving efficiency and personalizing financial services, it also introduces challenges that demand careful consideration. The imperative for transparency, accountability, and ethical oversight will be paramount as the industry navigates this new frontier.