Business

Amazon’s Stock Could Double Amid AI and Cloud Growth

SEATTLE, Wash. — Amazon‘s stock price has surged more than 150% from $85 in early 2023 to around $210 recently, raising questions about future growth prospects.

The primary drivers behind this growth are Amazon Web Services (AWS) and advancements in artificial intelligence (AI). AWS remains Amazon’s most profitable segment, contributing significantly to future stock possibilities with a revenue growth rate of 19% in 2024 and 17% in Q1 2025. Experts predict this trend to continue in the near term.

With rising demand for cloud services driven by AI ventures, Amazon’s leadership position is strengthened. The company is also set to invest approximately $75 billion in infrastructure improvements in 2024. CEO Andy Jassy noted that this amount may exceed $100 billion in 2025, largely due to the growing generations of AI technology.

Recent reports show AWS revenue hit $108 billion in 2024, accounting for about 17% of the company’s total revenue. This significant income is critical as AWS is expected to continue driving margins and profits for the company. In fact, approximately 40% of Amazon’s earnings before interest, taxes, depreciation, and amortization (EBITDA) in 2024 originated from AWS.

The company’s advertising segment has also emerged as a robust revenue source, generating $56.2 billion in 2024, marking a 20% annual increase. As Amazon continues to leverage its unique dual role as both a marketplace and a media platform, further revenue increases are anticipated.

For Amazon’s stock to possibly double, it will need to demonstrate consistent growth in its primary businesses, fueled by AWS’s AI developments and an expanding advertising revenue stream. Analysts suggest key benchmarks include maintaining AWS growth over 20% and achieving advertising revenues ranging from $80 to $90 billion within the next two to three years.

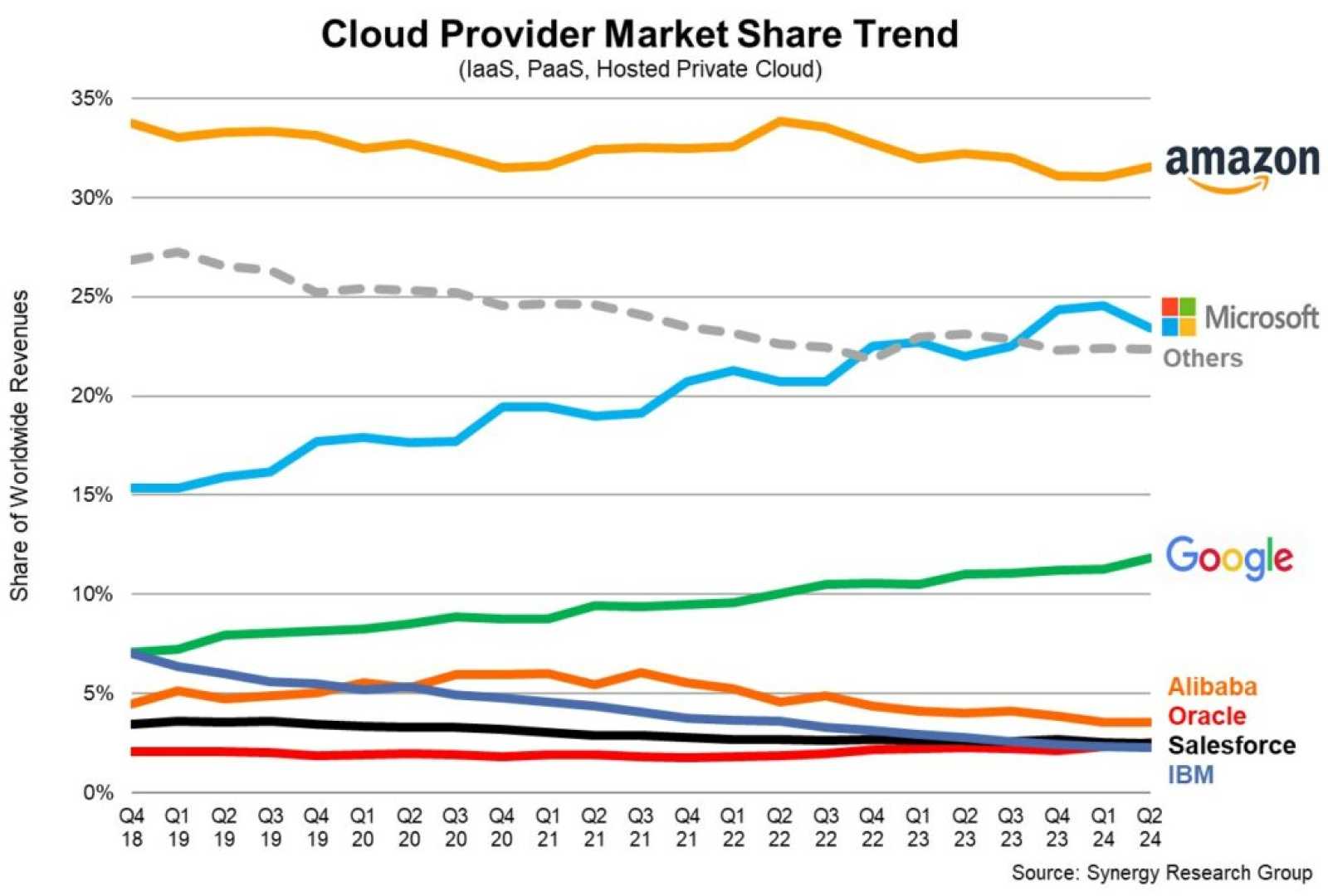

However, various risks could complicate this potential growth trajectory. Increasing competition from cloud rivals, especially Microsoft Azure, may challenge AWS’s market performance. Regulatory pressures against Amazon’s dominance could impact its operations, posing additional risks.

Investors must carefully consider these risk factors when looking at Amazon’s robust growth outlook. The company’s ability to convert ongoing AI investments into substantial returns remains crucial for sustaining stock performance at high valuation levels.