Business

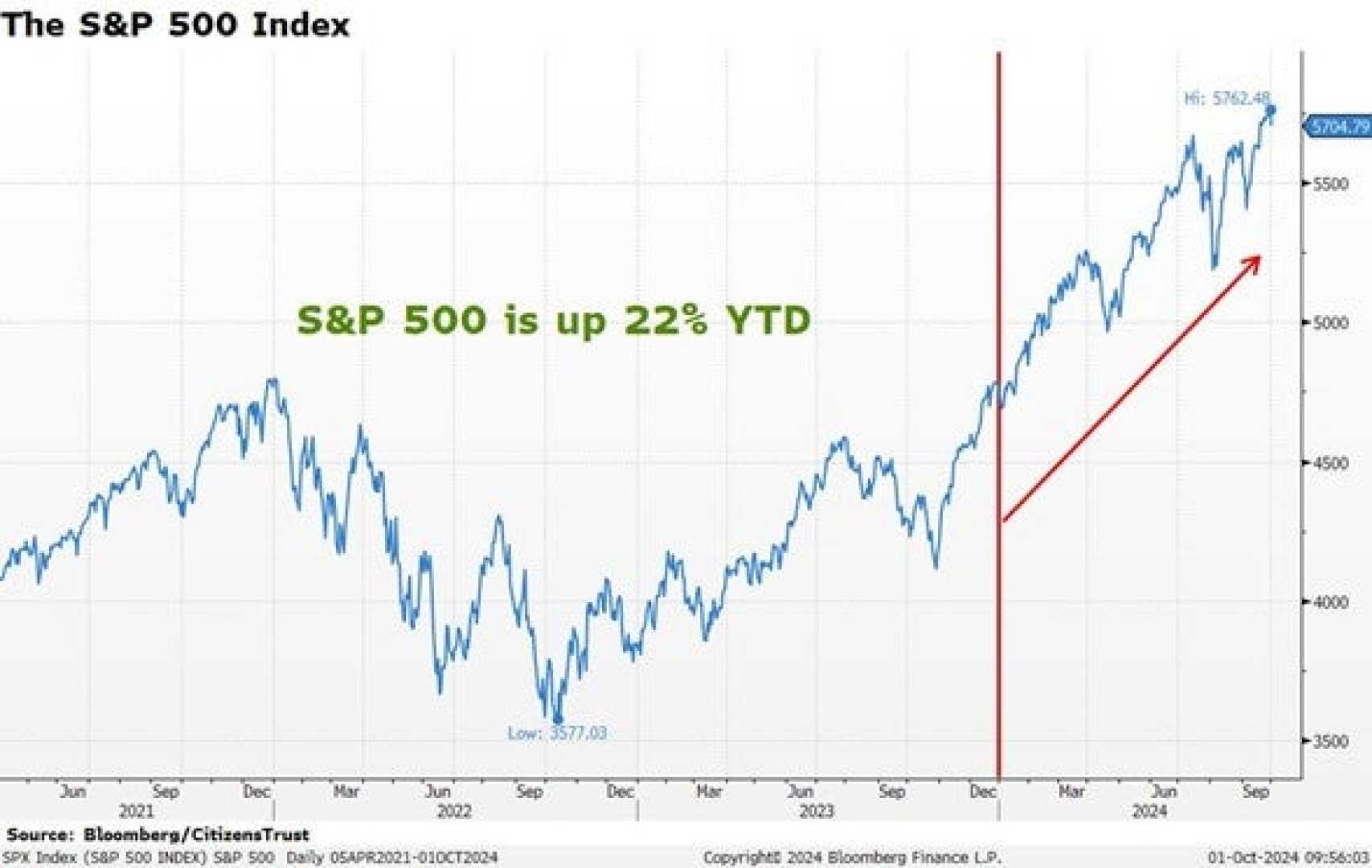

S&P 500 Surges to New Highs as Q3 Earnings Exceed Expectations

The S&P 500 has been making significant strides, reaching new record highs in recent trading sessions. Following the release of third-quarter earnings, the index has seen a strong rally, particularly from Monday’s low at 5,696, and is now trading above its mid-October peak of 5,882.

In the third quarter of 2024, S&P 500 companies outperformed earnings estimates, with 75 percent of the firms surpassing analysts’ expectations. This figure is in line with the 10-year average but slightly below the 5-year average of 77 percent. The Communication Services sector led the pack, with 92 percent of its companies reporting earnings above estimates, closely followed by the Consumer Staples sector at 87 percent.

However, revenue performance was less impressive. Only 60 percent of the S&P 500 companies topped revenue projections, falling short of both the 5-year average of 69 percent and the 10-year average of 64 percent. The IT and Healthcare sectors were among the leaders in revenue, with 84 percent and 78 percent of the firms’ revenue coming in above expectations, respectively.

Notable performers in the quarter included Uber and Southwest Airlines, which led the S&P 500’s top EPS surprises by exceeding expectations by 220 percent and 215 percent, respectively. Other strong performers were EQT Corporation and Pfizer, which beat expectations by 101 percent and 73 percent, respectively. On the other hand, Smurfit Westrock and Caesars Entertainment reported significant EPS shortfalls, missing estimates by 141 percent and 119 percent.

The market’s positive momentum is also influenced by broader economic and political factors, including the anticipation of a potential interest rate cut by the Federal Reserve and the ongoing US presidential election.