Business

Analysts Bullish on Netflix’s Growth Potential Amid Market Expansion

NEW YORK, NY — MoffettNathanson has upgraded Netflix’s stock rating from neutral to buy, citing significant opportunities for profit expansion as the streaming giant pulls ahead of its competitors. The firm also raised its price target for Netflix shares from $850 to $1,100, suggesting a potential upside of around 20% based on Friday’s close.

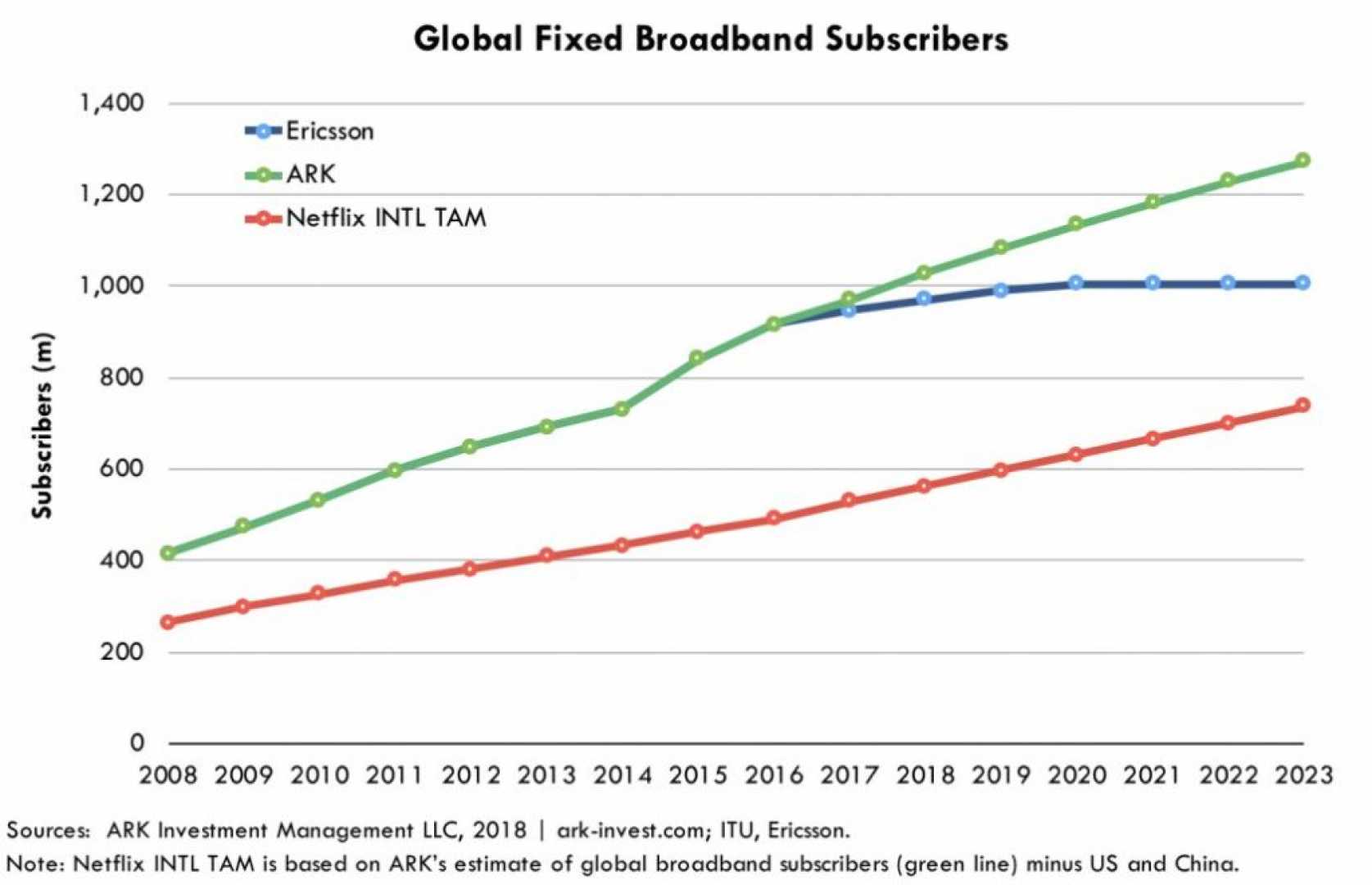

Analyst Robert Fishman indicated confidence in Netflix’s margin expansion story, asserting that the company has emerged victorious in the ongoing “streaming wars.” He noted that despite its already large user base, Netflix has further growth prospects.

“We believe Netflix’s engagement will allow the company to better monetize and unlock greater profits in the years ahead,” Fishman stated in a release. He also emphasized the untapped revenue potential from the existing subscriber base and opportunities for growth through advertising.

According to Fishman, Netflix has room to enhance its revenue per hour viewed, asserting that it remains “underearning” relative to the engagement metrics it generates. He projected continuous growth in subscription revenues complemented by an increase in advertising, which is expected to drive annual margin expansion of at least 200 basis points, reaching 40% by 2030.

Market sentiment appears optimistic, with most analysts agreeing on a positive outlook for Netflix. Data compiled by LSEG shows that 34 of 47 analysts recommend buying or strongly buying the stock, with the average price targets indicating more than 16% upside potential.

In related market activity, shares of Norwegian Cruise Line also saw an upgrade from JPMorgan, which shifted its rating to overweight, forecasting a price target of $30, signifying over 56% upside from previous levels. Analyst Matthew Boss reported confidence stemming from meetings with company executives, despite broader concerns about consumer spending.

“The definitive message from management was zero detectable change in demand behavior to date despite ‘noise’ in the macro backdrop,” Boss explained, addressing the recent challenges the cruise industry has faced this year, including a drop of over 25% in stock value.

In the past few hours, other significant upgrades across Wall Street have included Seaport upgrading Formula One to buy from neutral, Deutsche Bank advising to buy Sprouts, and Wells Fargo enhancing Genesis Energy to overweight.