Business

Berkshire Hathaway Anticipates Earnings Surge as Analysts Boost Stock Target

Omaha, Nebraska — Wall Street is placing its bets on Berkshire Hathaway ahead of the company’s first-quarter earnings release scheduled for May 2. UBS analyst Brian Meredith has significantly increased his outlook on the company’s Class B stock, also known as “Baby Berkshire.”

In a CNBC report on Monday, Meredith reiterated his buy rating, adjusting the 12-month price target to $606 per share, up from $557. This represents a projected increase of about 14% from Monday’s closing price of $530.96.

Meredith also raised his first-quarter earnings estimate to $4.89 per share from $4.81, citing improved loss ratios at Geico, a key subsidiary within Warren Buffett’s portfolio. Shares of Berkshire’s Class B stock have already surged nearly 18% this year.

Despite economic uncertainties, including tariffs, Meredith expressed confidence in Geico’s capacity to manage potential increases in claims costs. “We expect tariffs to potentially increase claims costs by 3% – 4% at Geico; however, current profitability suggests Geico may absorb these costs without raising prices,” he commented.

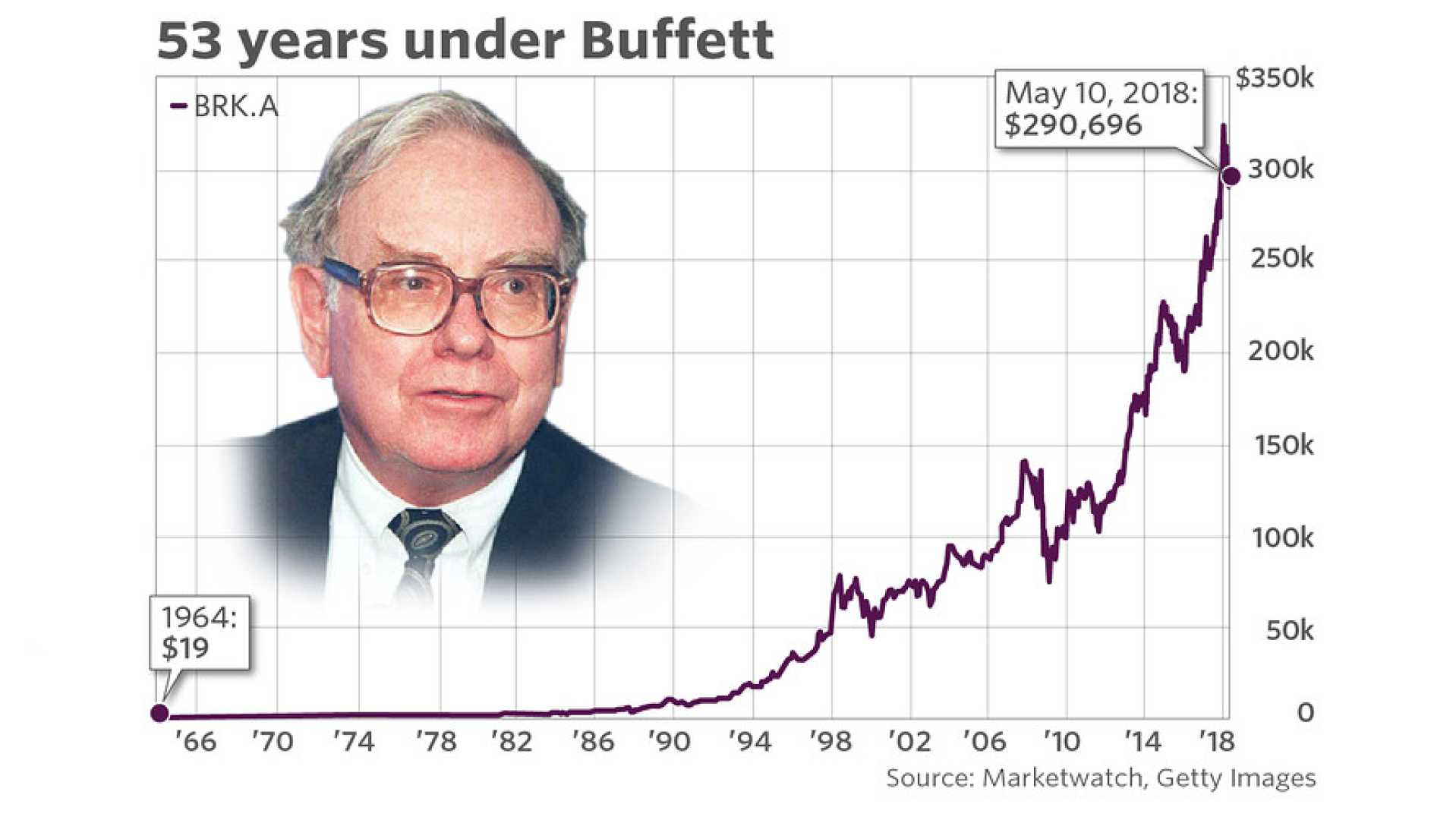

Analysts polled by FactSet are projecting first-quarter earnings per share of $4.72 with total revenue reaching $90.8 billion. As Warren Buffett, now 94 years old, continues to oversee the company, his fortune has also seen significant growth, jumping by $23.7 billion this year to reach an estimated $166 billion, according to the Bloomberg Billionaire Index.

This increase translates to a 16.7% gain year-to-date, driven primarily by the strong performance of Berkshire’s Class B shares, which closed at $534.29, up 19% this year. Buffett’s fortune is overwhelmingly tied to Berkshire, with approximately 99.5% of his wealth coming from his holdings in the company.

Despite a slight dip in his overall financial standing, Buffett’s assets remain robust. Recent filings indicate he owns about 37.4% of Berkshire’s Class A shares, while his Class B shares hold minimal weight in comparison. His non-Berkshire investments have not changed substantially over the past decade, as he has previously stated that they are negligible in relation to his main holdings.

Berkshire Hathaway’s stable strategies have allowed Buffett to navigate through various economic challenges, including inflation and market downturns. Analysts and investors alike are keenly watching how the company plans to utilize its significant cash reserves, currently totaling $334 billion, which is at a record high.

Berkshire Hathaway continues to stand as a beacon of stability, demonstrating Buffett’s longstanding reputation as one of the greatest investors in history.