Business

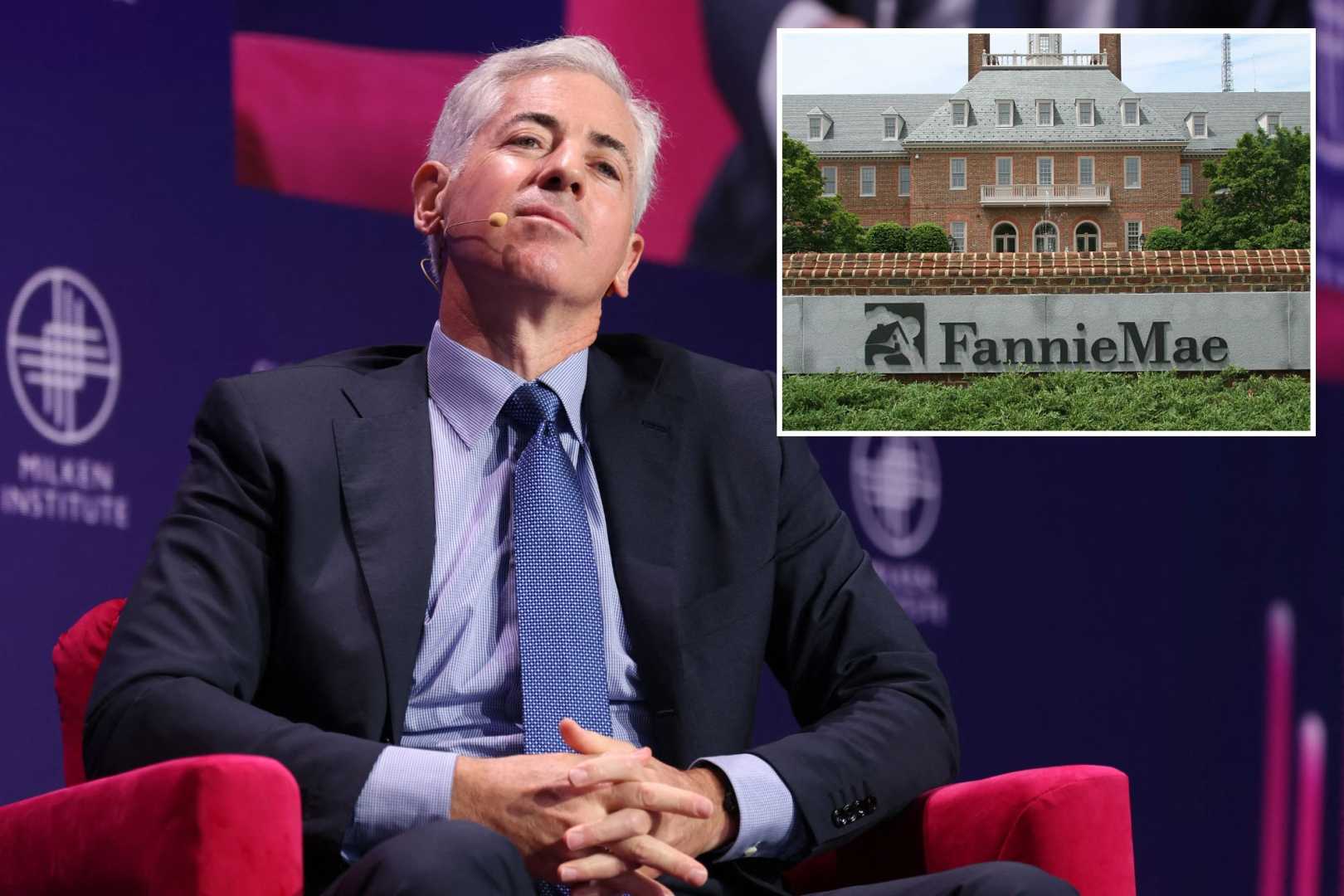

Bill Ackman Proposes Overhaul for Fannie Mae and Freddie Mac

NEW YORK, NY — Billionaire investor Bill Ackman outlined a three-step plan to reform Fannie Mae and Freddie Mac during an interview on ‘Mornings with Maria’ on Tuesday, November 19, 2025. The founder and CEO of Pershing Square Capital Management believes the plan could return $300 billion to U.S. taxpayers.

Fannie Mae (Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Mortgage Corporation) have remained under government control since the 2008 financial crisis. Ackman’s plan aims to alleviate the Trump administration‘s concerns regarding housing affordability and provide a pathway for both companies to return to the stock market.

Ackman highlighted that Fannie Mae and Freddie Mac have sent billions in profits to the U.S. Treasury, exceeding the money they received during their rescue. He proposed that the Treasury and the Federal Housing Finance Agency (FHFA) should officially recognize that taxpayers have been repaid and make them the majority owners by exercising existing warrants for company stock.

In his proposal, Ackman called for the two firms to be relisted on the New York Stock Exchange, where they were removed during the federal conservatorship. He contended that they currently meet all necessary requirements for this move, allowing investors to trade shares once more.

By executing these steps, Ackman explained that taxpayers would effectively hold a 79.9% stake in both companies, estimated to be worth over $300 billion. This plan emerges as the Trump administration seeks solutions to enhance housing affordability, including the controversial proposal of a 50-year mortgage.

Whether Ackman’s plan will gain traction with policymakers remains to be seen, as the nation navigates the complexities of the housing market and related financial risks.