Politics

Bipartisan Senators to Expand Low-Income Housing Tax Credit This Week

Washington, D.C. — A bipartisan group of senators plans to reintroduce a measure this week aimed at expanding the low-income housing tax credit. Senators Todd Young, R-Ind., and Maria Cantwell, D-Wash., are promoting this legislation to address the growing housing shortage in the United States.

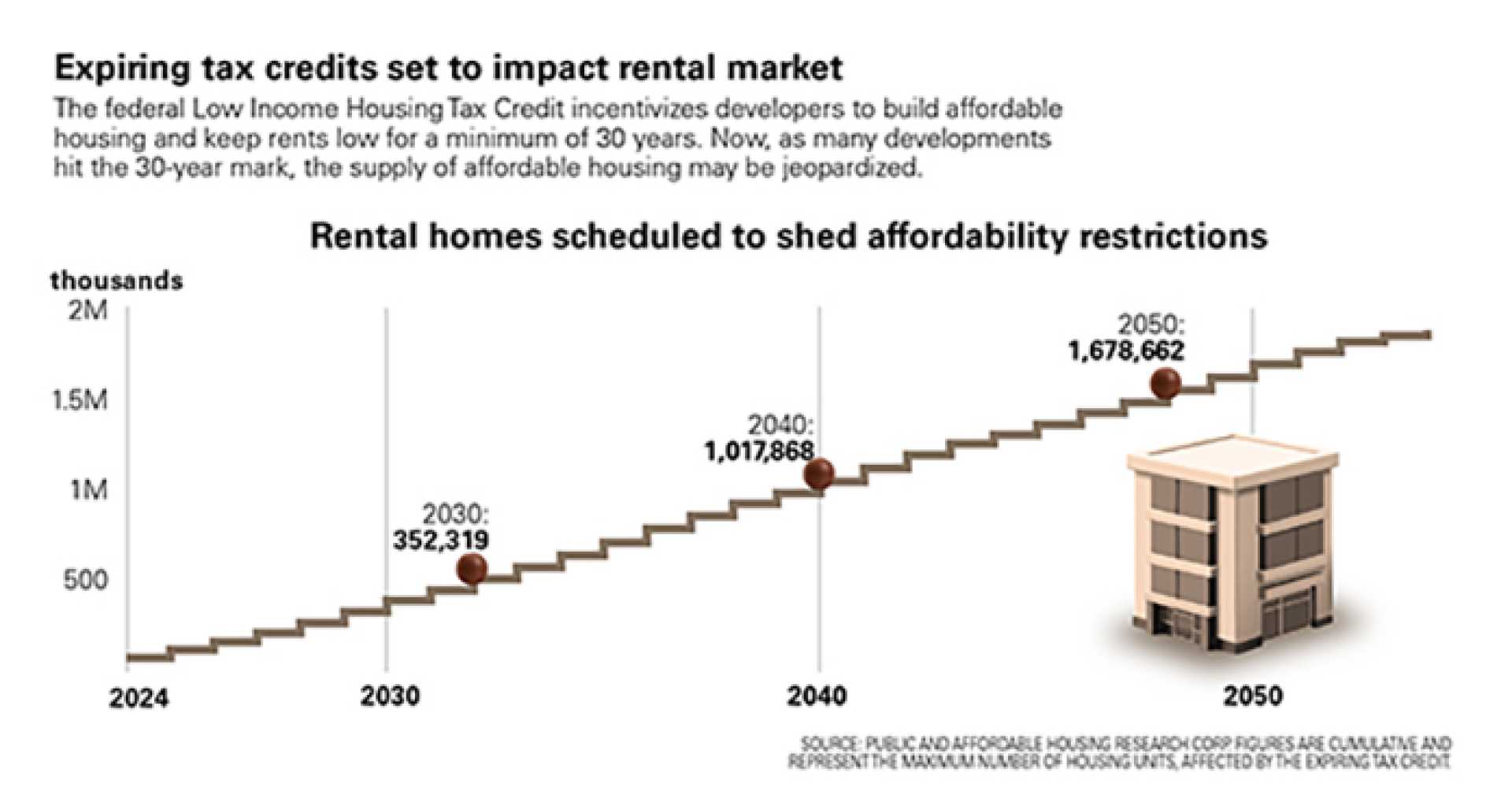

The proposed bill would allow states to allocate more tax credits for the construction of affordable housing, potentially leading to the creation of up to 1.6 million homes over the next decade. This expansion includes easing public financing requirements for housing developments.

Senator Young stated, “Our bill tackles the housing affordability crisis head on to help Hoosier families and strengthen our communities.” He believes it will incentivize private sector investment in affordable housing.

Cantwell highlighted the urgency of the situation, citing a 4% increase in housing inflation across the nation. She stated, “We need to do more to lower housing costs for everyone” and emphasized that expanding the housing credit will facilitate building homes and reducing rents.

The low-income housing tax credit has historically had bipartisan support, but it faces competition amid various tax priorities as Republicans prepare their budget reconciliation package for this year. Senator Michael D. Crapo, R-Idaho, noted that he has received over 200 proposals from Republican members regarding tax policies.

The House version of the bill, sponsored by Representatives Darin LaHood, R-Ill., and Suzan DelBene, D-Wash., has gained significant traction, attracting 130 co-sponsors. In the Senate, Young and Cantwell are joined by bipartisan supporters, including Ron Wyden, D-Ore., and Marsha Blackburn, R-Tenn.

Organizations such as the ACTION Campaign and the Affordable Housing Tax Credit Coalition support the legislation, indicating a broad coalition advocating for expanded housing initiatives.

The proposed bill would not only increase tax credits but also simplify regulations governing their use. It aims to create more opportunities for rural, tribal, and other underserved communities to benefit from affordable housing initiatives.

As the debate over the bill continues, its sponsors estimate it could create 2.4 million jobs and generate nearly $94 billion in tax revenue over ten years.