Business

Cisco Systems Earnings Preview: Analysts Anticipate Significant Stock Movement

Cisco Systems, Inc. (NASDAQ:CSCO) is set to release its third-quarter earnings after the market close on Wednesday, November 13, 2024. The market is anticipating a significant reaction to the earnings report, with several key indicators and analyst forecasts suggesting potential stock movement.

Pre-earnings options volume in Cisco is notably high, with activity 2.5 times the normal level and calls leading puts by a 2:1 ratio. Implied volatility suggests the market is expecting a move of around 5.1%, or $2.98, following the earnings release. Historically, the median move over the past eight quarters has been 4.1%.

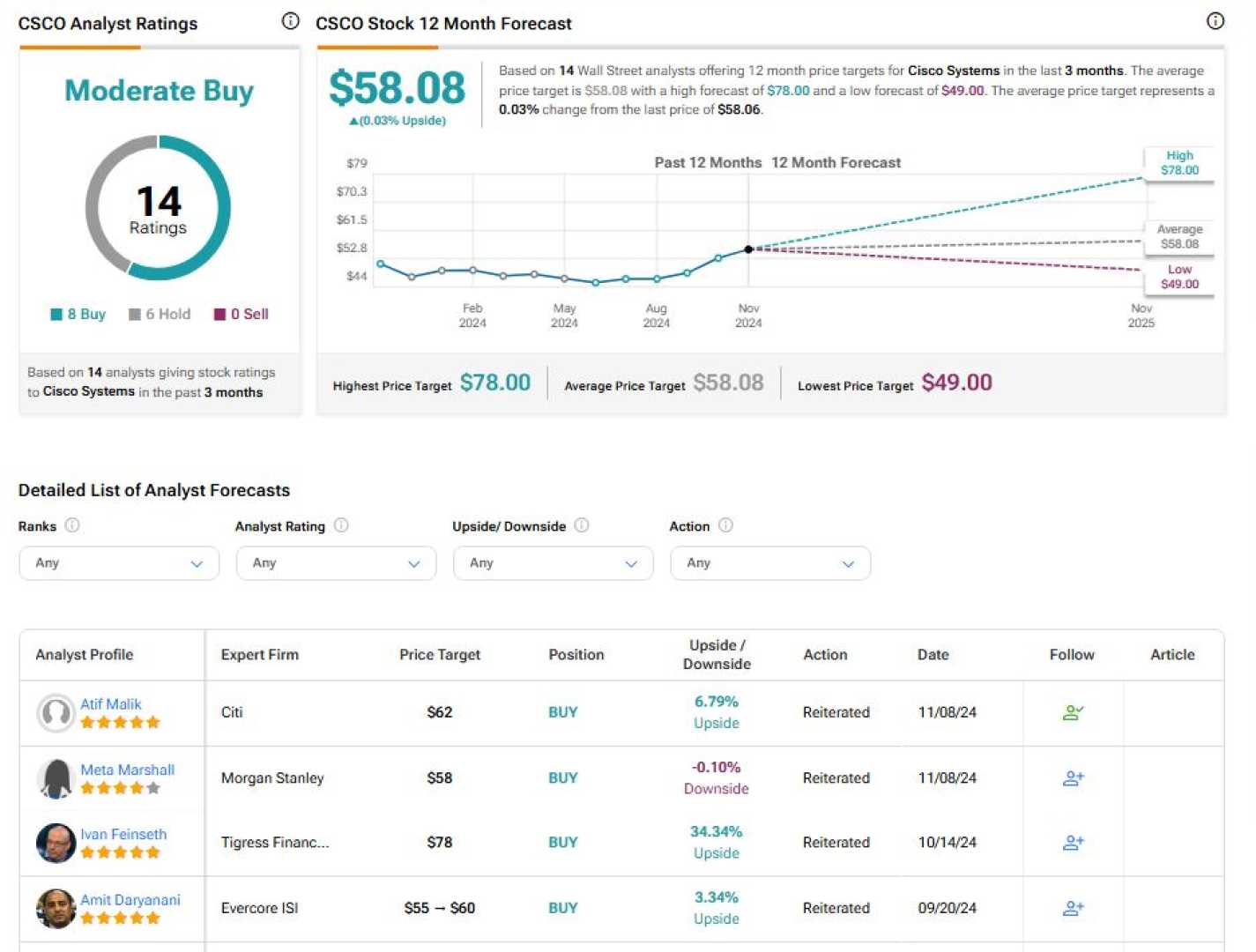

Analysts have been revising their forecasts ahead of the earnings call. JP Morgan analyst Samik Chatterjee upgraded the stock from Neutral to Overweight and raised the price target from $55 to $66, citing strong enterprise networking demand. Other analysts, such as Citigroup‘s Atif Malik and Tigress Financial’s Ivan Feinseth, have also upgraded their ratings and price targets, reflecting optimism about Cisco’s performance.

From a technical analysis perspective, Cisco’s stock has penetrated a symmetrical triangle formation, indicating a potential rally. The stock is expected to rise to the 62.50 to 64 level in the short term, provided the 54/53 support level remains intact post-earnings. Long-term targets suggest the stock could reach between 80 and 85 in the next few months.

Cisco’s earnings report will also be scrutinized for signs of recovery in the enterprise and service provider networking markets, as well as updates on AI orders, the integration of Splunk, and security transformation initiatives. The company’s subscription revenues, which now make up more than half of its total revenues, will also be a focus area for investors.